Answered step by step

Verified Expert Solution

Question

1 Approved Answer

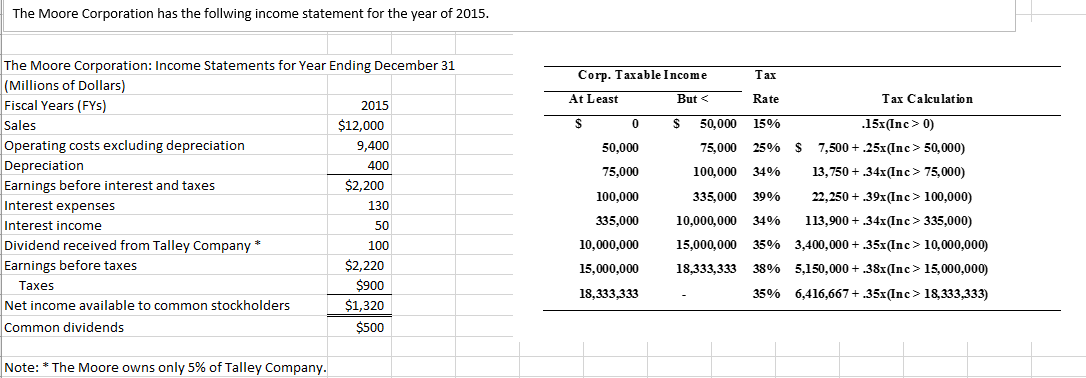

1. What are the Moore Corporation's income tax liability (federal corporate income tax) and its after-tax income? 2. 2. What are the Moore Corporation's marginal

1. What are the Moore Corporation's income tax liability (federal corporate income tax) and its after-tax income?

2. 2. What are the Moore Corporation's marginal and average tax rates on taxable income?

The Moore Corporation has the follwing income statement for the year of 2015 The Moore Corporation: Income Statements for Year Ending December 31 (Millions of Dollars Fiscal Years (FYS Sales Operating costs excluding depreciation Depreciation Earnings before interest and taxes Interest expenses Interest income Dividend received from Talley Company* Earnings before taxes Corp. Taxable Income ax At Least But 0) 50,000 75,000 100,000 335.000 10,000,000 15,000,000 18,333,333 75,000 25% $ 7,500 + ,25x(Inc > 50,000) 100,000 34%13,750 + .34x(Inc> 75,000) 335,000 39% 22,250 + .39x(Inc > 100,000) 10,000,000 15,000,000 18.333.333 34% 35% 3896 3596 113,900 + .34x(Inc > 335,000) 3,400,000 +35x(Inc>10,000,000) 5,150,000 + .38x(Inc>15,000,000) 6,416,667t .35x(Ine> 18.333.333) Taxes Net income available to common stockholders Common dividends Note: * T he Mo ore owns only 5% of Tall ey Company ey

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started