Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What are the total deductions reported on Form 1120, line 27? a. $40,990 b. $ 42,740 c. $ 42,990 d. 44,740 2. what is

1. What are the total deductions reported on Form 1120, line 27?

a. $40,990 b. $ 42,740 c. $ 42,990 d. 44,740

2. what is the gross profit for the Beard Corporation?

a. $85,785 b. 86,210 c. $87,535 d. $87,785

3. what is the taxable income reported on Form 1120, line 30?

a. $43,045 b. $44,795 c. $47,295 d. $49,045

4. what is the total income reported on Form 1120, line 11?

a. $85,785 b. $87,535 c. $87,785 d. $89,535

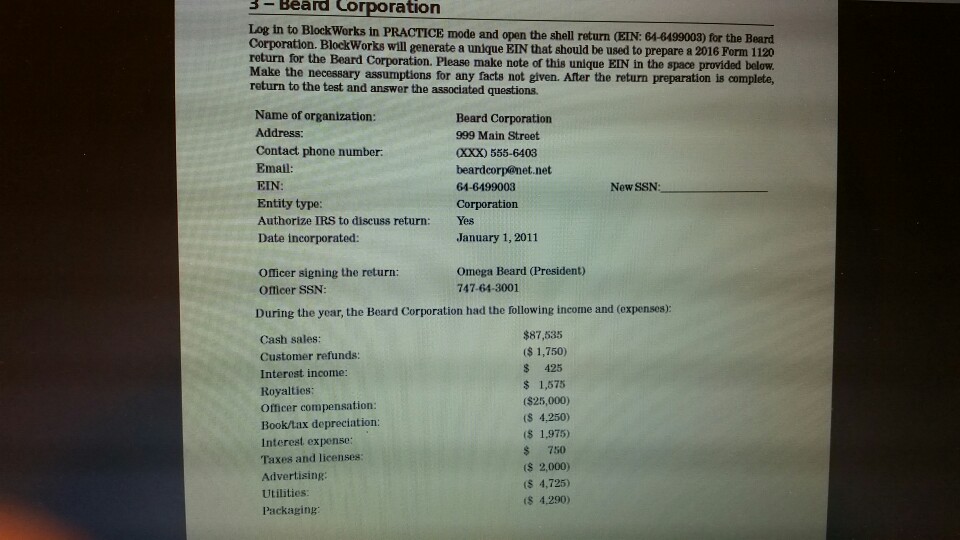

3-Beard Corporation Log in to Blockworks in PRACTICE mode and open the shell return ORE 64049003) for the Beard Corporation. BlockWorks will generate a unique EIN that should be used to prepare a 2016 Form 1120 rn for the Beard Corporation. Please make note of this unique EIN in the space provided below. the necessary assumptions for any facts not given. After the return preparation is complete, return to the test and answer the associated questions Name of organization Address: Contact phone number. Email: EIN Entity type Authorize IRS to discuss return: Date incorporated: Beard Corporation 999 Main Street Cxxx) 555-6403 beardcorp@net.net 64-6499003 New SSN Yes January 1, 2011 Omega Beard (President) 747-64-3001 Officer signing the return: Officer SSN During the year, the Beard Corporation had the following income and (expenses): Cash sales Customer refunds Interost income: Royalties Officer compensation: Bookhax depreciation: Interest expense Taxes and licenses: Advertising Utilities: Packaging $87,535 $ 1,750) $ 425 $ 1,575 ($25,000) (S 4,250) S 1,975) $ 750 S 2,000) (S 4,725) s 4.290)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started