Answered step by step

Verified Expert Solution

Question

1 Approved Answer

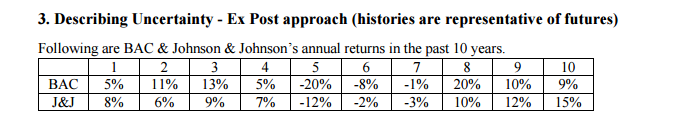

(1) What are these two stocks average yearly return? (2) What are these two stocks estimated standard deviation? (3) Assuming each stocks annual return follow

(1) What are these two stocks average yearly return?

(2) What are these two stocks estimated standard deviation?

(3) Assuming each stocks annual return follow normal distribution, please report the upper and lower limits of their returns that covers the 95% of possible outcomes respectively.

(4) What are these two stocks estimated Sharpe Ratios.

(5) What is the coefficient of correlation between these two stocks?

3. Describing Uncertainty Ex Post approach (histories are representative of futures Following are BAC & Johnson & Johnson's annual returns in the past 10 years 10 BAC 5% 11% 13% 5% -20% -8% -1% 20% 10% 9% J&J 8% 6% 9% 70% -12% -2% -3% 10% 12% 15%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started