Question

1. What are Tulley's total financing needs (that is, total assets) for the coming year? 2. Given the firm's projections and dividend payment plans, what

1. What are Tulley's total financing needs (that is, total assets) for the coming year?

2. Given the firm's projections and dividend payment plans, what are its discretionary financing needs?

3. Based on your projections, and assuming that the $103,000 expansion in fixed assets will occur, what is the largest increase in sales the firm can support without having to resort to the use of discretionary sources of financing?

I'm not sure what I'm missing here, but some of my answers are wrong, and it wouldn't show me which ones are incorrect unless I submit

submit

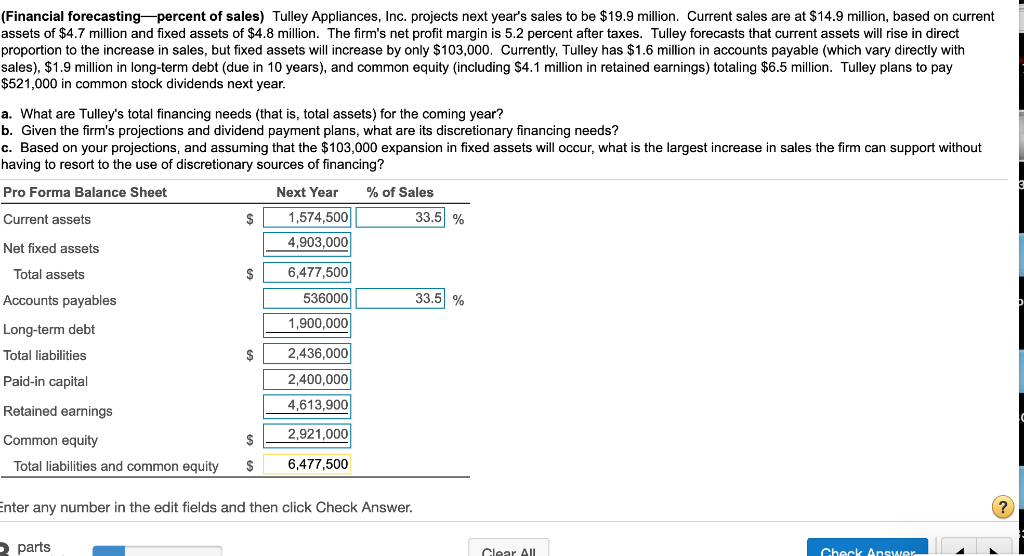

(Financial forecasting percent of sales) Tulley Appliances, Inc. projects next year's sales to be $19.9 million. Current sales are at $14.9 million, based on current assets of $4.7 million and fixed assets of $4.8 million. The firm's net profit margin is 5.2 percent after taxes. Tulley forecasts that current assets will rise in direct proportion to the increase in sales, but fixed assets will increase by only $103,000. Currently, Tulley has $1.6 million in accounts payable (which vary directly with sales), $1.9 million in long-term debt (due in 10 years), and common equity (including $4.1 million in retained earnings) totaling $6.5 million. Tulley plans to pay $521,000 in common stock dividends next year. a. What are Tulley's total financing needs (that is, total assets) for the coming year? b. Given the firm's projections and dividend payment plans, what are its discretionary financing needs? c. Based on your projections, and assuming that the $103,000 expansion in fixed assets will occur, what is the largest increase in sales the firm can support without having to resort to the use of discretionary sources of financing? Pro Forma Balance Sheet Next Year % of Sales Current assets $ 1,574,500 33.5 % Net fixed assets 4,903,000 Total assets 6,477,500 Accounts payables 536000 33.5 % Long-term debt 1,900,000 Total liabilities 2,436,000 Paid-in capital 2,400,000 Retained earnings 4,613,900 Common equity 2,921,000 Total liabilities and common equity $ 6,477,500 Enter any number in the edit fields and then click Check Answer. parts Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started