Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What do you think of the role of arbitrage in future and forward markets? (Problems 5.18 of Chapter 5 on the Textbook.) Currency Forward

1. What do you think of the role of arbitrage in future and forward markets?

(Problems 5.18 of Chapter 5 on the Textbook.)

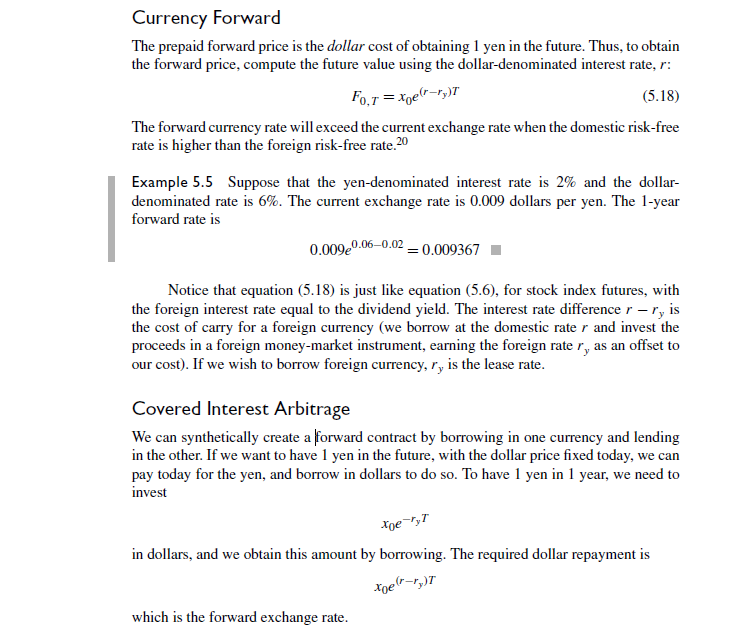

Currency Forward The prepaid forward price is the dollar cost of obtaining 1 yen in the future. Thus, to obtain the forward price, compute the future value using the dollar-denominated interest rate, r : F0,T=x0e(rry)T The forward currency rate will exceed the current exchange rate when the domestic risk-free rate is higher than the foreign risk-free rate. 20 Example 5.5 Suppose that the yen-denominated interest rate is 2% and the dollardenominated rate is 6%. The current exchange rate is 0.009 dollars per yen. The 1-year forward rate is 0.009e0.060.02=0.009367 Notice that equation (5.18) is just like equation (5.6), for stock index futures, with the foreign interest rate equal to the dividend yield. The interest rate difference rry is the cost of carry for a foreign currency (we borrow at the domestic rate r and invest the proceeds in a foreign money-market instrument, earning the foreign rate ry as an offset to our cost). If we wish to borrow foreign currency, ry is the lease rate. Covered Interest Arbitrage We can synthetically create a forward contract by borrowing in one currency and lending in the other. If we want to have 1 yen in the future, with the dollar price fixed today, we can pay today for the yen, and borrow in dollars to do so. To have 1 yen in 1 year, we need to invest x0eryT in dollars, and we obtain this amount by borrowing. The required dollar repayment is x0e(rry)T which is the forward exchange rate. Currency Forward The prepaid forward price is the dollar cost of obtaining 1 yen in the future. Thus, to obtain the forward price, compute the future value using the dollar-denominated interest rate, r : F0,T=x0e(rry)T The forward currency rate will exceed the current exchange rate when the domestic risk-free rate is higher than the foreign risk-free rate. 20 Example 5.5 Suppose that the yen-denominated interest rate is 2% and the dollardenominated rate is 6%. The current exchange rate is 0.009 dollars per yen. The 1-year forward rate is 0.009e0.060.02=0.009367 Notice that equation (5.18) is just like equation (5.6), for stock index futures, with the foreign interest rate equal to the dividend yield. The interest rate difference rry is the cost of carry for a foreign currency (we borrow at the domestic rate r and invest the proceeds in a foreign money-market instrument, earning the foreign rate ry as an offset to our cost). If we wish to borrow foreign currency, ry is the lease rate. Covered Interest Arbitrage We can synthetically create a forward contract by borrowing in one currency and lending in the other. If we want to have 1 yen in the future, with the dollar price fixed today, we can pay today for the yen, and borrow in dollars to do so. To have 1 yen in 1 year, we need to invest x0eryT in dollars, and we obtain this amount by borrowing. The required dollar repayment is x0e(rry)T which is the forward exchange rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started