Answered step by step

Verified Expert Solution

Question

1 Approved Answer

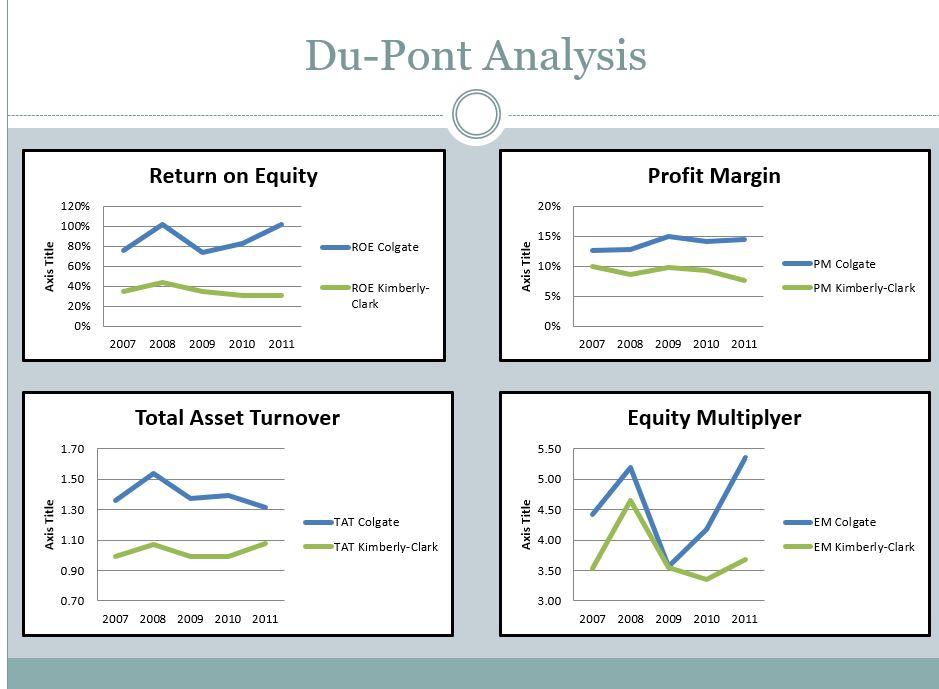

1. What does the ROE tell you about these companies? 2. For the company that has the highest ROE, what seems to be the main

1. What does the ROE tell you about these companies?

2. For the company that has the highest ROE, what seems to be the main thing driving that ROE (out of the three remaining ratios in the DuPont Model)?

3. For the companies in your group, is there anything you notice about the firms in your DuPont graphs that looks really good?

4. For the companies in your group, is there anything you notice about the firms in your DuPont graphs that looks really bad?

Du-Pont Analysis Return on Equity Profit Margin 120% 20% 100% 80% 15% ROE Colgate Axis Title 60% Axis Title 10% PM Colgate PM Kimberly-Clark 40% ROE Kimberly- Clark 5% 20% 0% 0% 2007 2008 2009 2010 2011 2007 2008 2009 2010 2011 Total Asset Turnover Equity Multiplyer 1.70 5.50 1.50 5.00 1.30 4.50 Axis Title TAT Colgate TAT Kimberly-Clark Axis Title N EM Colgate EM Kimberly-Clark 1.10 4.00 0.90 3.50 0.70 3.00 2007 2008 2009 2010 2011 2007 2008 2009 2010 2011Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started