Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You borrowed a mortgage of $458000 to buy a new house 4 years ago with an APR of 4.84%. The loan had to be paid

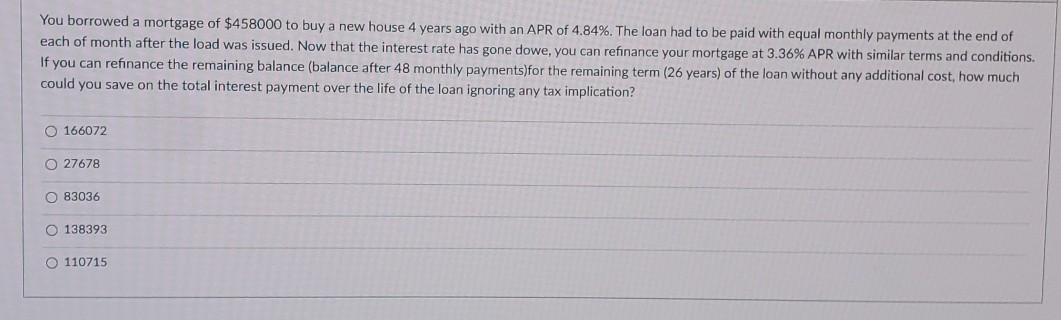

You borrowed a mortgage of $458000 to buy a new house 4 years ago with an APR of 4.84%. The loan had to be paid with equal monthly payments at the end of each of month after the load was issued. Now that the interest rate has gone dowe, you can refinance your mortgage at 3.36% APR with similar terms and conditions. If you can refinance the remaining balance (balance after 48 monthly payments for the remaining term (26 years) of the loan without any additional cost, how much could you save on the total interest payment over the life of the loan ignoring any tax implication? 166072 O 27678 O 83036 O 138393 110715

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started