1. What internal resources does Campbell have that may give it a competitive advantage?

2. What do you think Campbell should do to counter the competition and remain in the top of

the soup business?

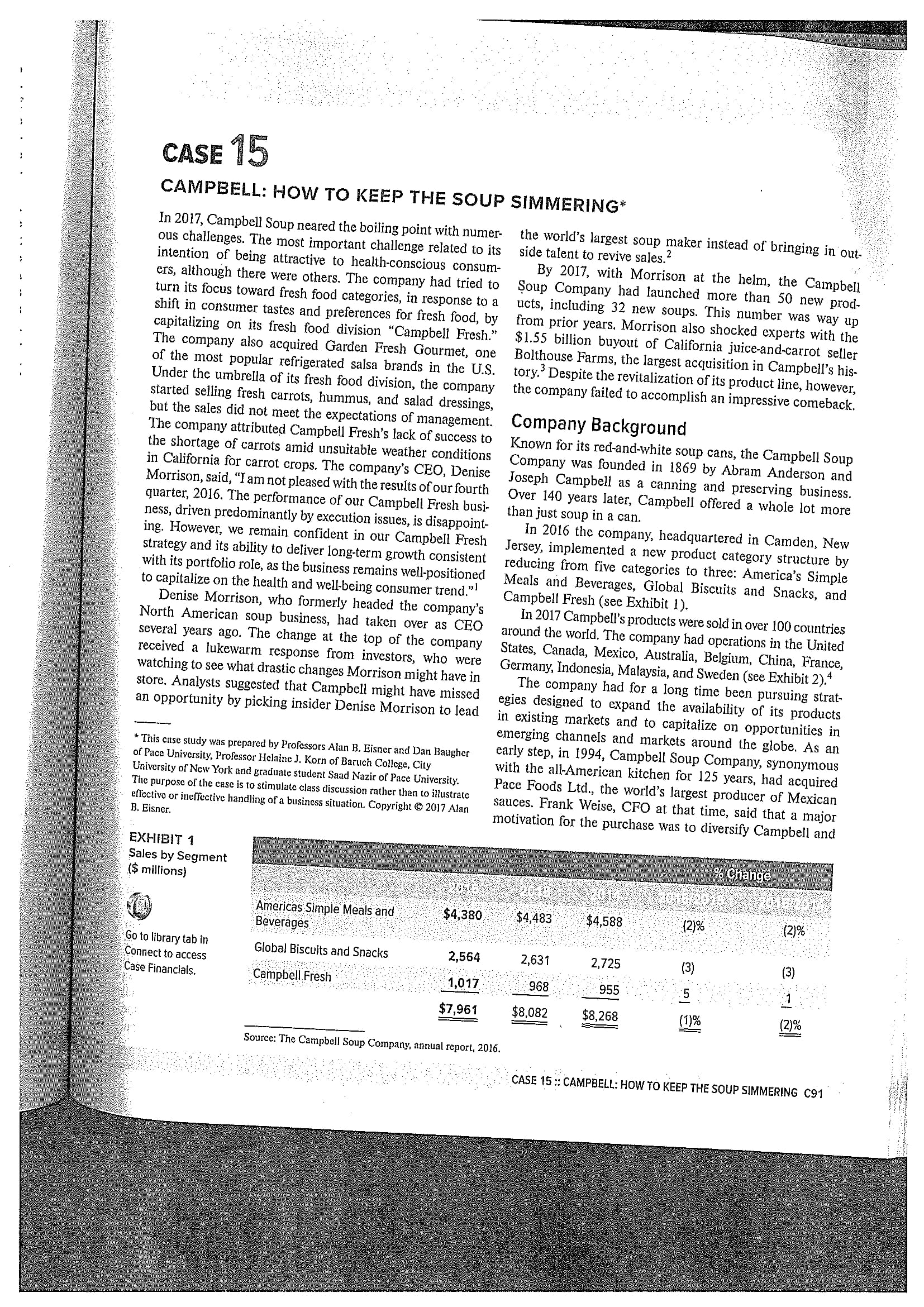

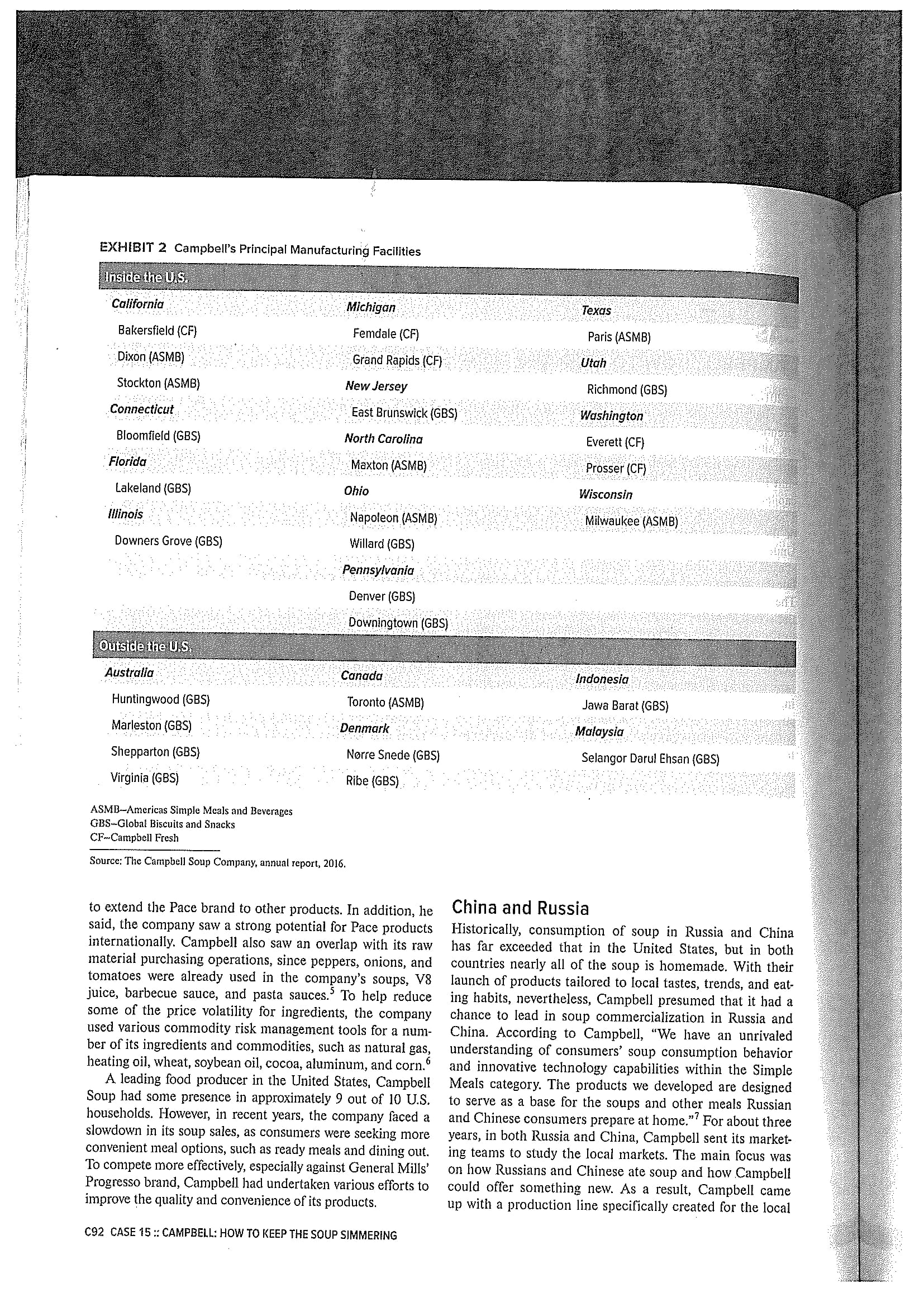

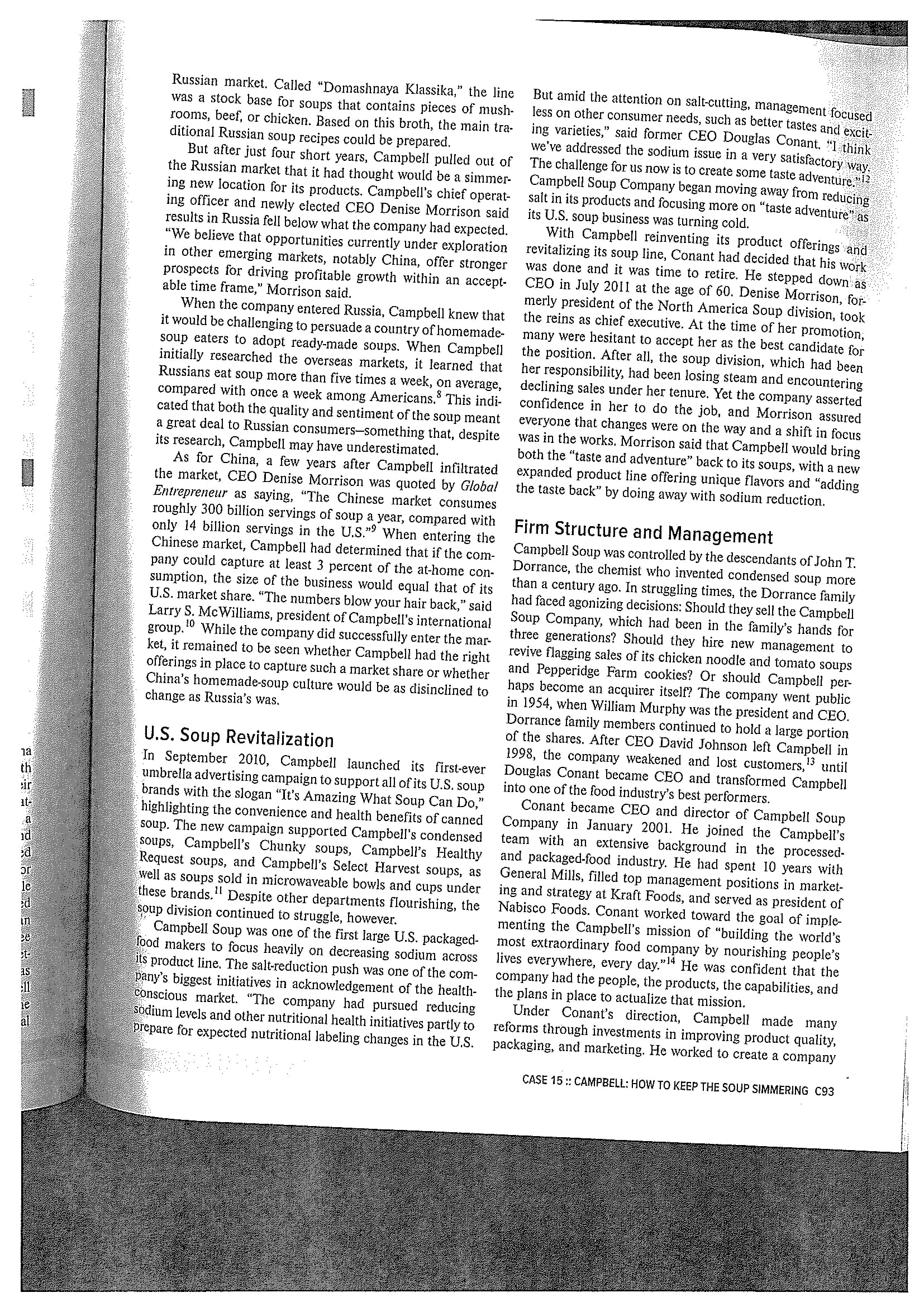

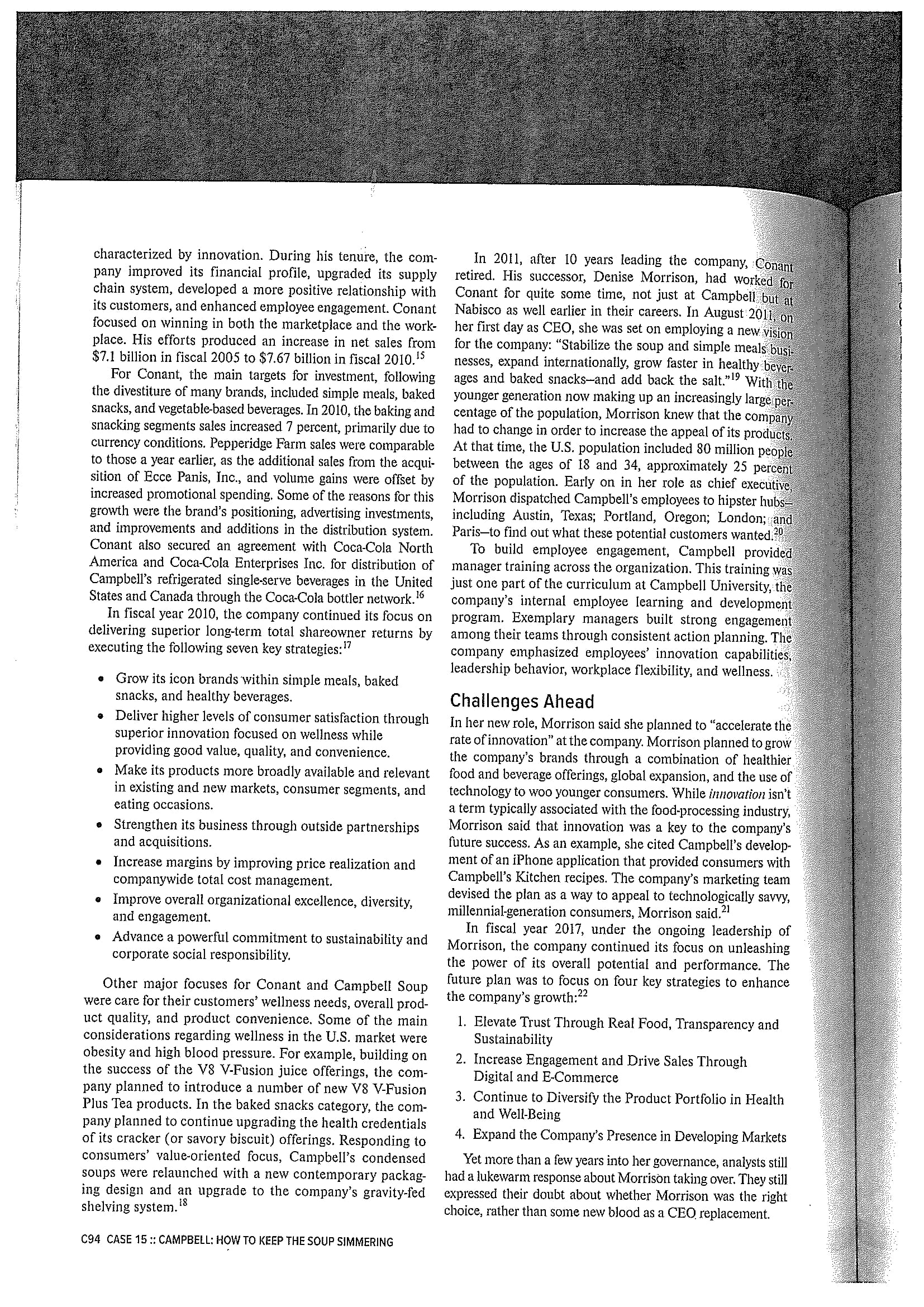

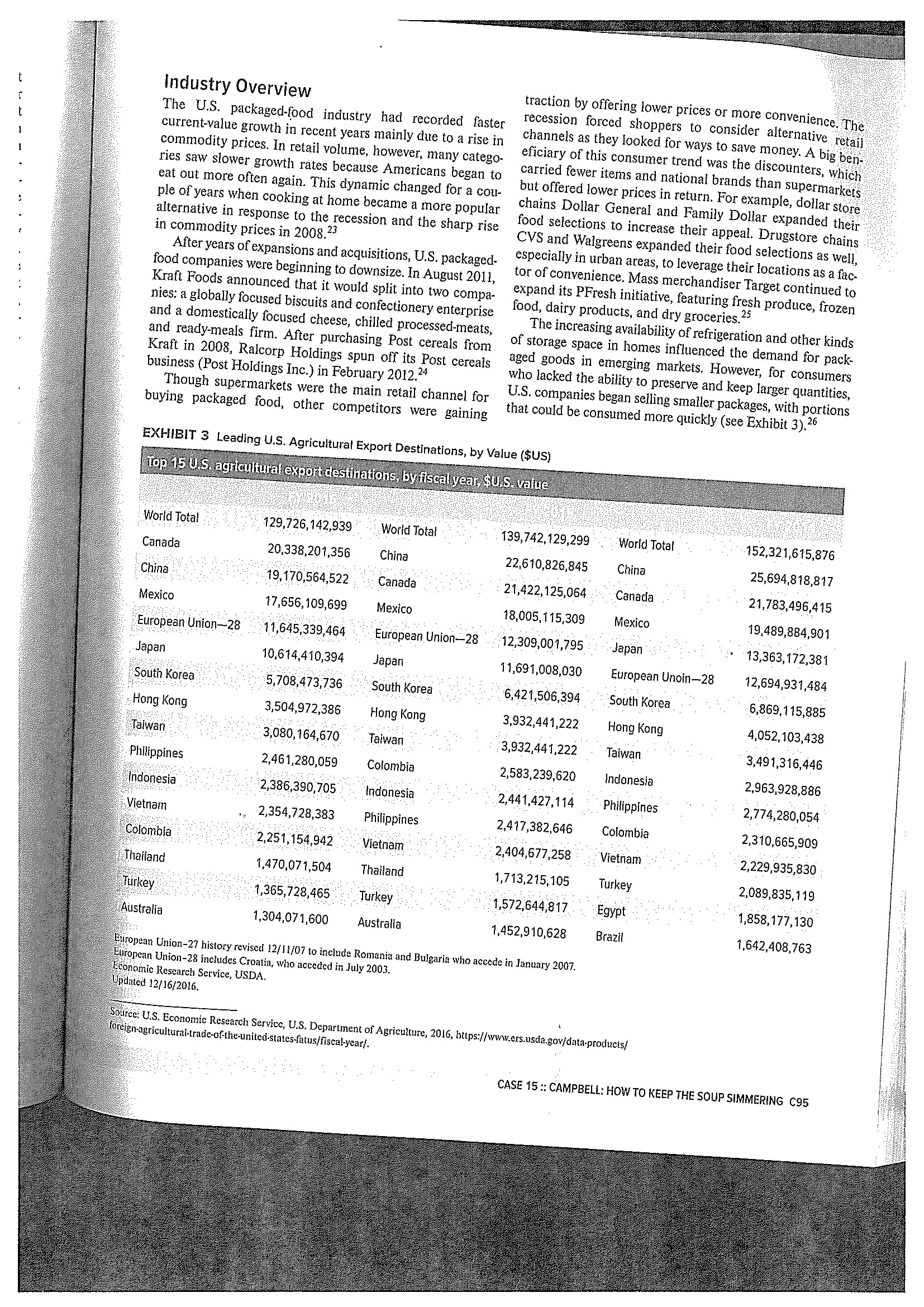

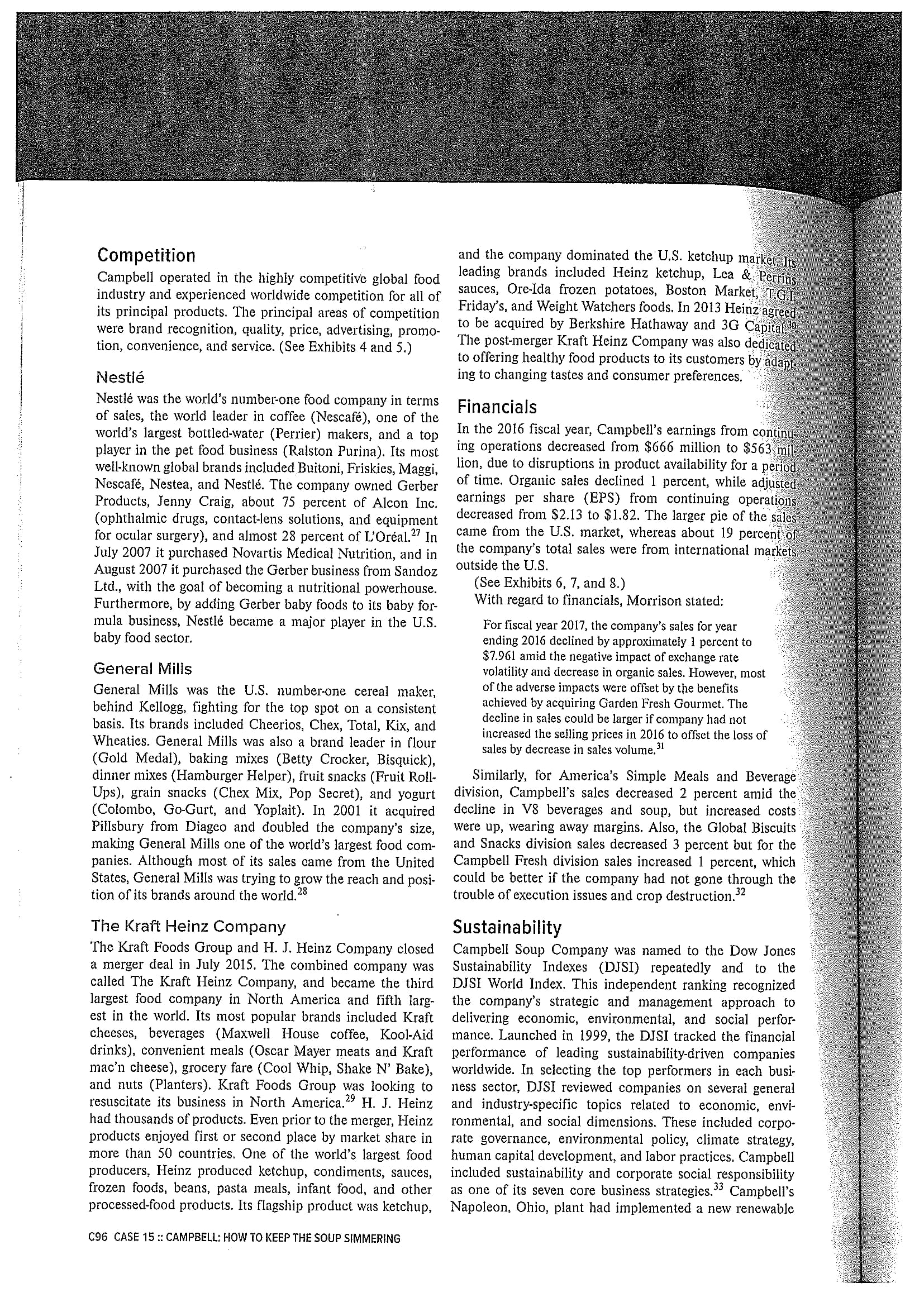

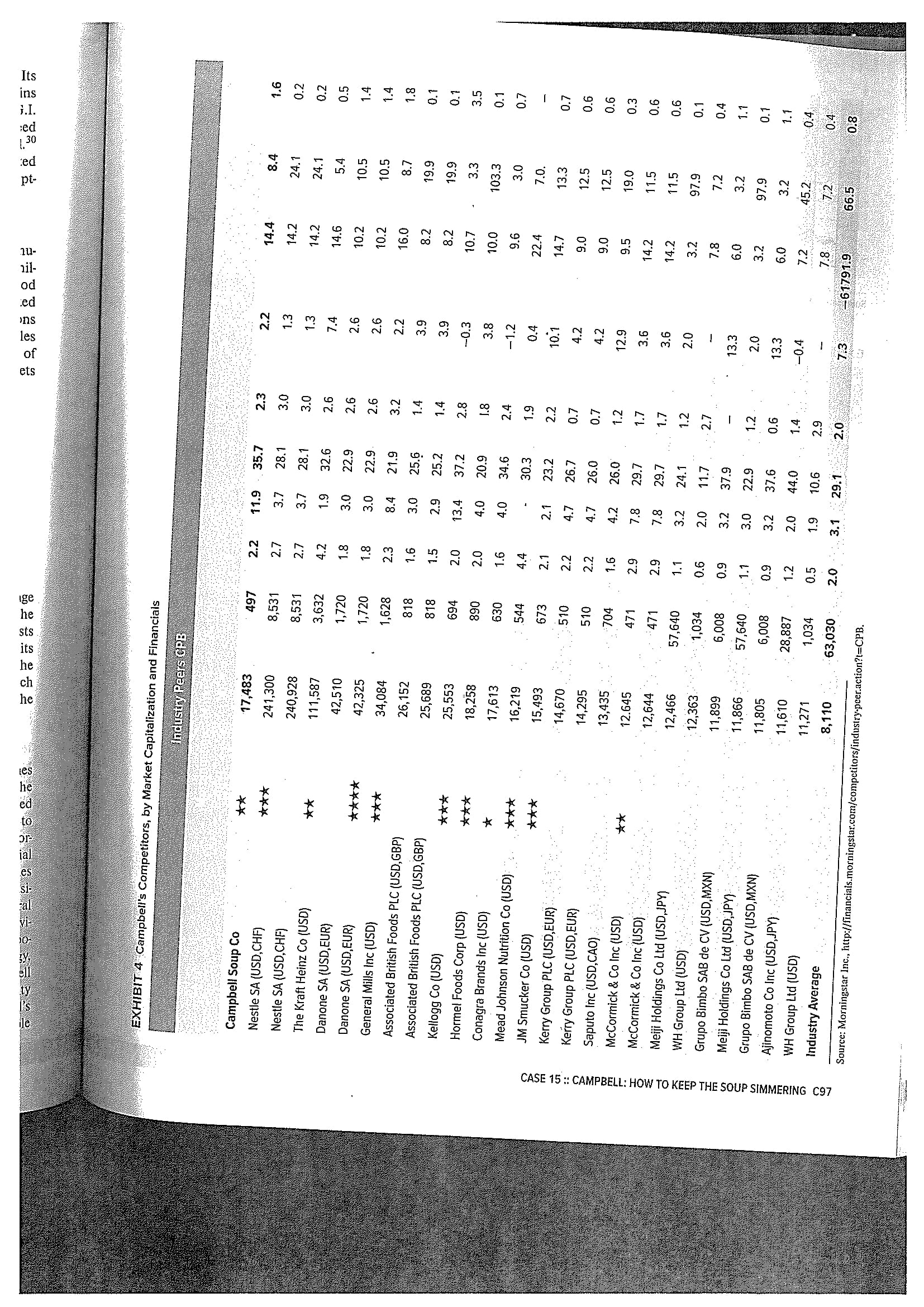

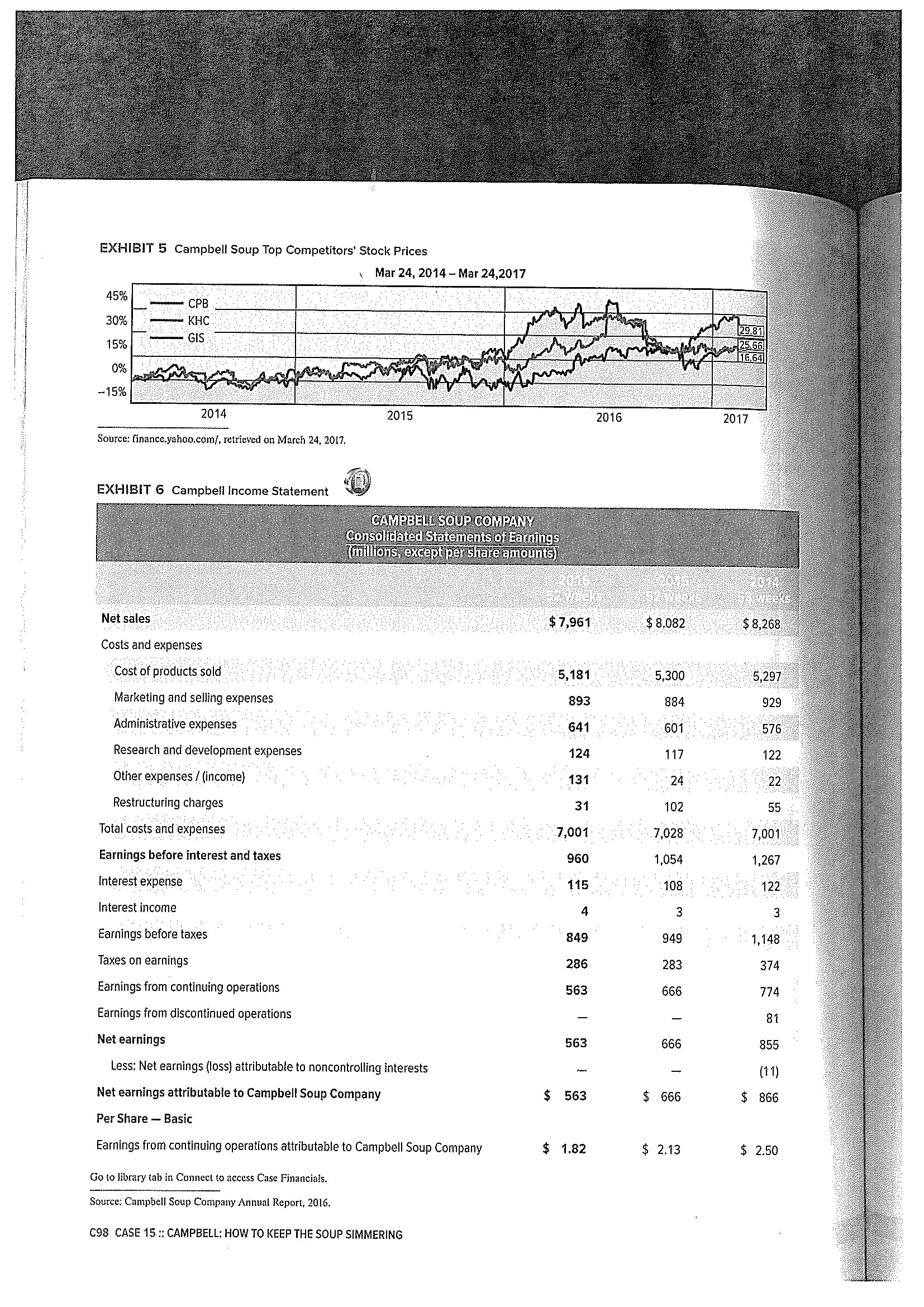

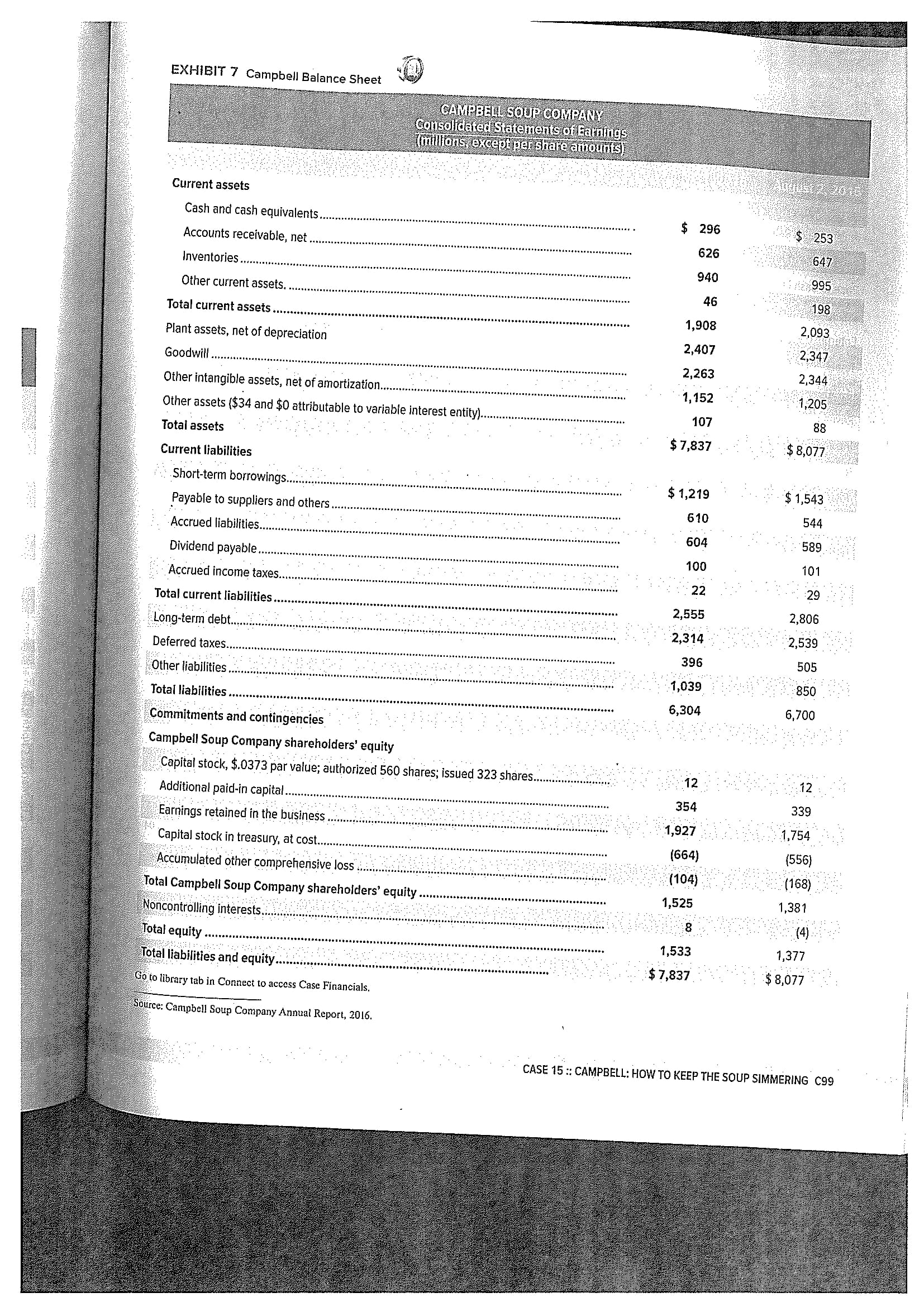

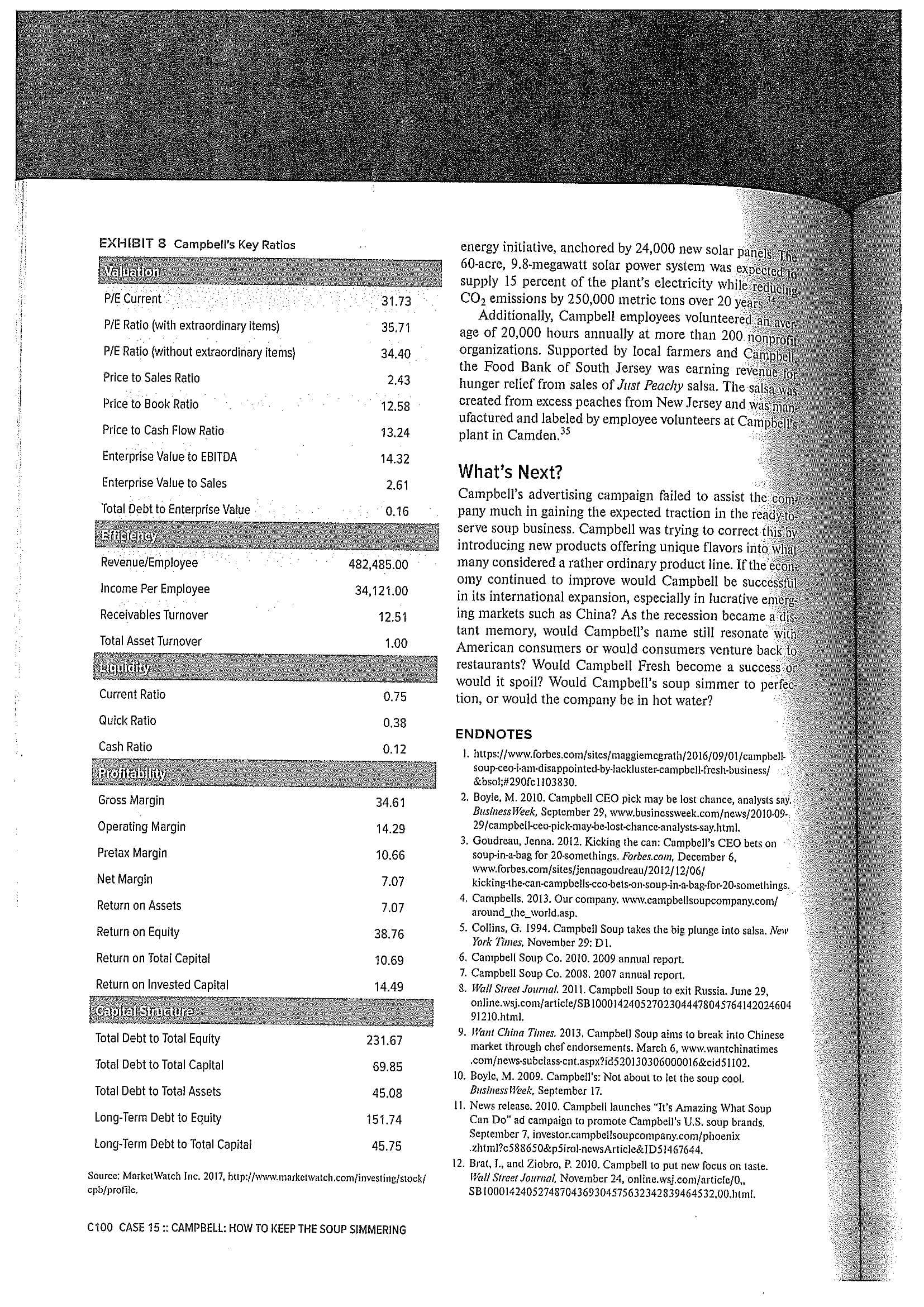

CASE 15 CAMPBELL: HOW TO KEEP THE SOUP SIMMERING* In 2017, Campbell Soup neared the boiling point with numer- the world's largest soup maker instead of bringing in out- ous challenges. The most important challenge related to its side talent to revive sales. intention of being attractive to health-conscious consum- By 2017, with Morrison at the helm, the Campbell ers, although there were others. The company had tried to Soup Company had launched more than 50 new prod- turn its focus toward fresh food categories, in response to a ucts, including 32 new soups. This number was way up shift in consumer tastes and preferences for fresh food, by from prior years. Morrison also shocked experts with the capitalizing on its fresh food division "Campbell Fresh." $1.55 billion buyout of California juice-and-carrot seller The company also acquired Garden Fresh Gourmet, one Bolthouse Farms, the largest acquisition in Campbell's his- of the most popular refrigerated salsa brands in the U.S. tory. Despite the revitalization of its product line, however, Under the umbrella of its fresh food division, the company the company failed to accomplish an impressive comeback. started selling fresh carrots, hummus, and salad dressings, but the sales did not meet the expectations of management. The company attributed Campbell Fresh's lack of success to Company Background the shortage of carrots amid unsuitable weather conditions Known for its red-and-white soup cans, the Campbell Soup in California for carrot crops. The company's CEO, Denise Company was founded in 1869 by Abram Anderson and Joseph Campbell as a canning and preserving business. Morrison, said, "I am not pleased with the results of our fourth Over 140 years later, Campbell offered a whole lot more quarter, 2016. The performance of our Campbell Fresh busi- ness, driven predominantly by execution issues, is disappoint- than just soup in a can. ing. However, we remain confident in our Campbell Fresh In 2016 the company, headquartered in Camden, New strategy and its ability to deliver long-term growth consistent Jersey, implemented a new product category structure by with its portfolio role, as the business remains well-positioned reducing from five categories to three: America's Simple to capitalize on the health and well-being consumer trend." Meals and Beverages, Global Biscuits and Snacks, and Denise Morrison, who formerly headed the company's Campbell Fresh (see Exhibit 1). North American soup business, had taken over as CEO In 2017 Campbell's products were sold in over 100 countries several years ago. The change at the top of the company around the world. The company had operations in the United States, Canada, Mexico, Australia, Belgium, China, France, received a lukewarm response from investors, who were Germany, Indonesia, Malaysia, and Sweden (see Exhibit 2). watching to see what drastic changes Morrison might have in store. Analysts suggested that Campbell might have missed The company had for a long time been pursuing strat- an opportunity by picking insider Denise Morrison to lead egies designed to expand the availability of its products in existing markets and to capitalize on opportunities in emerging channels and markets around the globe. As an This case study was prepared by Professors Alan B. Eisner and Dan Baugher early step, in 1994, Campbell Soup Company, synonymous of Pace University, Professor Helaine J. Korn of Baruch College, City University of New York and graduate student Saad Nazir of Pace University. with the all-American kitchen for 125 years, had acquired The purpose of the case is to stimulate class discussion rather than to illustrate Pace Foods Lid., the world's largest producer of Mexican effective or ineffective handling of a business situation. Copyright @ 2017 Alan sauces. Frank Weise, CFO at that time, said that a major B. Eisner. motivation for the purchase was to diversify Campbell and EXHIBIT 1 Sales by Segment ($ millions) Americas Simple Meals and $4,380 $4,483 $4,588 (2)% Beverages Go to library tab in Connect to access Global Biscuits and Snacks 2,564 2,631 2,725 (3) (3) Case Financials. Campbell Fresh 1,017 968 955 $7,961 $8,082 $8,268 2)% Source: The Campbell Soup Company, annual report, 2016. CASE 15 : CAMPBELL: HOW TO KEEP THE SOUP SIMMERING C91EXHIBIT 2 Campbell's Principal Manufacturing Facilities Inside the U.S. California Michigan Texas Bakersfield (CF) Femdale (CF) Paris (ASMB) Dixon (ASMB) Grand Rapids (CF) Utah Stockton (ASMB) New Jersey Richmond (GBS] Connecticut East Brunswick (GBS) Washington WAS Bloomfield (GBS) North Carolina Everett (CF) Florida Maxton (ASMB) Prosser (CF) Lakeland (GBS) Ohio Wisconsin Illinois Napoleon (ASMB) Milwaukee (ASMB) Downers Grove (GBS) Willard (GBS) Pennsylvania Denver (GBS) Downingtown (GBS) Outside the Australia Canada Indonesia Huntingwood (GBS) Toronto (ASMB) Jawa Barat (GBS) Marleston (GBS) Denmark Malaysia Shepparton (GBS) Norre Snede (GBS) Selangor Darul Ehsan (GBS) Virginia (GBS) Ribe (GBS) ASMB-Americas Simple Meals and Beverages GBS-Global Biscuits and Snacks CF-Campbell Fresh Source: The Campbell Soup Company, annual report, 2016. to extend the Pace brand to other products. In addition, he China and Russia said, the company saw a strong potential for Pace products Historically, consumption of soup in Russia and China internationally. Campbell also saw an overlap with its raw has far exceeded that in the United States, but in both material purchasing operations, since peppers, onions, and countries nearly all of the soup is homemade. With their tomatoes were already used in the company's soups, V8 launch of products tailored to local tastes, trends, and eat- juice, barbecue sauce, and pasta sauces.' To help reduce ing habits, nevertheless, Campbell presumed that it had a some of the price volatility for ingredients, the company chance to lead in soup commercialization in Russia and used various commodity risk management tools for a num- China. According to Campbell, "We have an unrivaled ber of its ingredients and commodities, such as natural gas, understanding of consumers' soup consumption behavior heating oil, wheat, soybean oil, cocoa, aluminum, and corn. and innovative technology capabilities within the Simple A leading food producer in the United States, Campbell Meals category. The products we developed are designed Soup had some presence in approximately 9 out of 10 U.S. to serve as a base for the soups and other meals Russian households. However, in recent years, the company faced a and Chinese consumers prepare at home." For about three slowdown in its soup sales, as consumers were seeking more years, in both Russia and China, Campbell sent its market- convenient meal options, such as ready meals and dining out. To compete more effectively, especially against General Mills' ing teams to study the local markets. The main focus was on how Russians and Chinese ate soup and how Campbell Progresso brand, Campbell had undertaken various efforts to could offer something new. As a result, Campbell came improve the quality and convenience of its products. up with a production line specifically created for the local C92 CASE 15 :: CAMPBELL: HOW TO KEEP THE SOUP SIMMERINGRussian market. Called "Domashnaya Klassika," the line But amid the attention on salt-cutting, management focused was a stock base for soups that contains pieces of mush- rooms, beef, or chicken. Based on this broth, the main tra- less on other consumer needs, such as better tastes and excit- ditional Russian soup recipes could be prepared. ing varieties," said former CEO Douglas Conant. "I think we've addressed the sodium issue in a very satisfactory way. But after just four short years, Campbell pulled out of The challenge for us now is to create some taste adventure."? the Russian market that it had thought would be a simmer- ing new location for its products. Campbell's chief operat- Campbell Soup Company began moving away from reducing ing officer and newly elected CEO Denise Morrison said salt in its products and focusing more on "taste adventure" as results in Russia fell below what the company had expected. its U.S. soup business was turning cold. "We believe that opportunities currently under exploration With Campbell reinventing its product offerings and in other emerging markets, notably China, offer stronger revitalizing its soup line, Conant had decided that his work prospects for driving profitable growth within an accept- was done and it was time to retire. He stepped down as able time frame," Morrison said. CEO in July 2011 at the age of 60. Denise Morrison, for- When the company entered Russia, Campbell knew that merly president of the North America Soup division, took it would be challenging to persuade a country of homemade- the reins as chief executive. At the time of her promotion, many were hesitant to accept her as the best candidate for soup eaters to adopt ready-made soups. When Campbell the position. After all, the soup division, which had been initially researched the overseas markets, it learned that her responsibility, had been losing steam and encountering Russians eat soup more than five times a week, on average, compared with once a week among Americans. This indi- declining sales under her tenure. Yet the company asserted confidence in her to do the job, and Morrison assured cated that both the quality and sentiment of the soup meant everyone that changes were on the way and a shift in focus a great deal to Russian consumers-something that, despite its research, Campbell may have underestimated. was in the works. Morrison said that Campbell would bring As for China, a few years after Campbell infiltrated both the "taste and adventure" back to its soups, with a new expanded product line offering unique flavors and "adding the market, CEO Denise Morrison was quoted by Global the taste back" by doing away with sodium reduction. Entrepreneur as saying, "The Chinese market consumes roughly 300 billion servings of soup a year, compared with only 14 billion servings in the U.S." When entering the Firm Structure and Management Chinese market, Campbell had determined that if the com- Campbell Soup was controlled by the descendants of John T. pany could capture at least 3 percent of the at-home con- Dorrance, the chemist who invented condensed soup more sumption, the size of the business would equal that of its than a century ago. In struggling times, the Dorrance family U.S. market share. "The numbers blow your hair back," said had faced agonizing decisions: Should they sell the Campbell Larry S. McWilliams, president of Campbell's international Soup Company, which had been in the family's hands for group. " While the company did successfully enter the mar- three generations? Should they hire new management to ket, it remained to be seen whether Campbell had the right revive flagging sales of its chicken noodle and tomato soups offerings in place to capture such a market share or whether and Pepperidge Farm cookies? Or should Campbell per- China's homemade-soup culture would be as disinclined to haps become an acquirer itself? The company went public change as Russia's was. in 1954, when William Murphy was the president and CEO Dorrance family members continued to hold a large portion U.S. Soup Revitalization of the shares. After CEO David Johnson left Campbell in 1998, the company weakened and lost customers, " until In September 2010, Campbell launched its first-ever Douglas Conant became CEO and transformed Campbell umbrella advertising campaign to support all of its U.S. soup into one of the food industry's best performers brands with the slogan "It's Amazing What Soup Can Do," highlighting the convenience and health benefits of canned Conant became CEO and director of Campbell Soup Company in January 2001. He joined the Campbell's soup. The new campaign supported Campbell's condensed team with an extensive background in the processed soups, Campbell's Chunky soups, Campbell's Healthy Request soups, and Campbell's Select Harvest soups, as and packaged-food industry. He had spent 10 years with well as soups sold in microwaveable bowls and cups under General Mills, filled top management positions in market- these brands."Despite other departments flourishing, the ing and strategy at Kraft Foods, and served as president of soup division continued to struggle, however. Nabisco Foods. Conant worked toward the goal of imple- Campbell Soup was one of the first large U.S. packaged- menting the Campbell's mission of "building the world's food makers to focus heavily on decreasing sodium across most extraordinary food company by nourishing people's its product line. The salt-reduction push was one of the com- lives everywhere, every day."* He was confident that the pany's biggest initiatives in acknowledgement of the health- company had the people, the products, the capabilities, and the plans in place to actualize that mission. conscious market. "The company had pursued reducing Under Conant's direction, Campbell made many sodium levels and other nutritional health initiatives partly to reforms through investments in improving product quality, prepare for expected nutritional labeling changes in the U.S. packaging, and marketing. He worked to create a company CASE 15 :: CAMPBELL: HOW TO KEEP THE SOUP SIMMERING C93characterized by innovation. During his tenure, the com- pany improved its nancial profile, upgraded its supply chain system, developed a more positive relationship with its customers, and enhanced employee engagement. Conant focused on winning in both the marketplace and the work- place. His efforts produced an increase in net sales from $7.] billion in fiscal 2005 to $7.67 billion in fiscal 2010.\" For Conant, the main targets for investment, following the divestiture of many brands, included simple meals, baked snacks, and Vegetablebased beverages. In 2010, the baking and snacking segments sales increased 7 percent, primarily due to currency conditions. Pepperidge Farm sales were comparable to those a year earlier, as the additional sales from the acqui- sition of Ecce Panis, Inc., and volume gains were offset by increased promotional spending. Some of the reasons for this growth were the brand's positioning, advertising investments, and improvements and additions in the distribution system. Conant also secured an agreement with Coca-Cola North America and Coca-Cola Enterprises Inc. for distribution of Campbell's refrigerated single-serve beverages in the United States and Canada through the Coca-Cola bottler network.'6 In fiscal year 2010, the company continued its focus on delivering superior long-term total shareowner returns by executing the following seven key strategies: '7 - Grow its icon brands'within simple meals, baked snacks, and healthy beverages. - Deliver higher levels of consumer satisfaction through superior innovation focused on wellness while providing good value, quality, and convenience. 0 Make its products more broadly available and relevant in existing and new markets, consumer segments, and eating occasions. - Strengthen its business through outside partnerships and acquisitions. I Increase margins by impIOVing price realization and companywide total cost management. 0 improve overall organizational excellence, diversity, and engagement. 0 Advance a powerful commitment to sustainability and corporate social responsibility. Other major focuses for Conant and Campbell Soup were care for their customers' wellness needs, overall prod- uct quality, and product convenience. Some of the main considerations regarding wellness in the US. market were obesity and high blood pressure. For example, building on the success of the V8 V-Fusion juice offerings, the com- pany planned to introduce a number of new V8 VFusion Plus Tea products. In the baked snacks category, the com- pany planned to continue upgrading the health credentials of its cracker (or savory biscuit) offerings. Responding to consumers' value-oriented focus, Campbell's condensed soups were relaunched with a new contemporary packag- ing design and an upgrade to the company's gravityfed shelving system}8 C94 CASE 15 :: CAMPBELL: HOW TO KEEP THE SOUP SiMMERlNG in 2011, after 10 years leading the company, G retired. His successor, Denise Morrison, had work Conant for quite some time, not just at Campbe Nabisco as well earlier in their careers. In August 20 her first day as CEO, she was set on employing a ne for the company: \"Stabilize the soup and simple meal nesses, expand internationally, grow faster in healthy- ages and baked snacksand add back the salt."19 With younger generation now making up an increasingly lar centage of the population, Morrison knew that the comp had to change in order to increase the appeal of its prod At that time, the US. population included 80 million peop' between the ages of 18 and 34, approximately 25 per of the population. Early on in her role as chief execu Morrison dispatched Campbell's employees to hipster hu including Austin, Texas; Portland, Oregon; London Paristo find out what these potential customers wante . To build employee engagement, Campbell provide manager training across the organization. This training w just one part of the curriculum at Campbell University, tl company's internal employee learning and developme company emphasized employees' innovation capabilitie leadership behavior, workplace flexibility, and wellness. Challenges Ahead In her new role, Morrison said she planned to \"accelerate the rate of innovation\" at the company. Morrison planned to grow the company's brands through a combination of healthier food and beverage offerings, global expansion, and the use of technology to woo younger consumers. While innovation isn't a term typically associated with the food-processing industry, Morrison said that innovation was a key to the company's future success. As an example, she cited Campbell's develop- ment of an iPhone application that provided consumers with Campbell's Kitchen recipes. The companys marketing team devised the plan as a way to appeal to technologically savvy, millennial-generation consumers, Morrison said.\" In fiscal year 2017, under the ongoing leadership of Morrison, the company continued its focus on unleashing the power of its overall potential and performance. The future plan was to focus on four key strategies to enhance the company's growth:22 1. Elevate Trust Through Real Food, Transparency and Sustainability 2. Increase Engagement and Drive Sales Through Digital and E-Commerce 3. Continue to Diversify the Product Portfolio in Health and Well-Being 4. Expand the Company's Presence in Developing Markets Yet more than a few years into her governance, analysts still had a lukewarm response about Morrisbn taking over. They still expresscd their doubt about whether Morrison was the right choice, rather than some new blood as a CEO replacement. Industry Overview traction by offering lower prices or more convenience. The The U.S. packaged-food industry had recorded faster recession forced shoppers to consider alternative retail current-value growth in recent years mainly due to a rise in channels as they looked for ways to save money. A big ben- commodity prices. In retail volume, however, many catego- eficiary of this consumer trend was the discounters, which ries saw slower growth rates because Americans began to carried fewer items and national brands than supermarkets eat out more often again. This dynamic changed for a cou- but offered lower prices in return. For example, dollar store ple of years when cooking at home became a more popular chains Dollar General and Family Dollar expanded their alternative in response to the recession and the sharp rise food selections to increase their appeal. Drugstore chains in commodity prices in 2008.23 CVS and Walgreens expanded their food selections as well, After years of expansions and acquisitions, U.S. packaged- especially in urban areas, to leverage their locations as a fac- food companies were beginning to downsize. In August 2011, tor of convenience. Mass merchandiser Target continued to Kraft Foods announced that it would split into two compa- expand its PFresh initiative, featuring fresh produce, frozen nies: a globally focused biscuits and confectionery enterprise food, dairy products, and dry groceries.? and a domestically focused cheese, chilled processed-meats, The increasing availability of refrigeration and other kinds and ready-meals firm. After purchasing Post cereals from of storage space in homes influenced the demand for pack Kraft in 2008, Ralcorp Holdings spun off its Post cereals aged goods in emerging markets. However, for consumers business (Post Holdings Inc.) in February 2012.24 who lacked the ability to preserve and keep larger quantities, Though supermarkets were the main retail channel for U.S. companies began selling smaller packages, with portions buying packaged food, other competitors were gaining that could be consumed more quickly (see Exhibit 3),26 EXHIBIT 3 Leading U.S. Agricultural Export Destinations, by Value ($US) Top 15 U.S. agricultural destinations, by fis World Total 129,726, 142,939 World Total 139, 742, 129,299 World Total ..152,321,615,876 Canada 20,338,201,356 China 22,610,826,845 China 25,694,818,817 China 19, 170,564,522 Canada 21,422, 125,064 Canada 21,783,496,415 Mexico 17,656, 109,699 Mexico 18,005, 1 15,309 Mexico 19,489,884,901 European Union-28 11,645,339,464 European Union-28 . 12,309,001,795 Japan 13,363, 172,381 Japan 10,614,410,394 Japan 1 1,691,008,030 European Unoin-28 12,694,931,484 South Korea 5,708,473,736 South Korea 6,421,506,394 South Korea 6,869, 115,885 Hong Kong 3,504,972,386 Hong Kong 3,932,441,222 Hong Kong 4,052, 103,438 Taiwan 3,080, 164,670 Taiwan 3,932,441,222 Taiwan 3,491,316,446 Philippines 2,461,280,059 Colombia 2,583,239,620 Indonesia 2,963,928,886 Indonesia $2,386,390,705 indonesia 2,441,427,114 Philippines 2,774,280,054 Vietnam 2,354,728,383 Philippines 2,417,382,646 Colombia 2,310,665,909 Colombia 2,251, 154,942 Vietnam 2,404,677,258 Vietnam 2,229,935,830 Thailand 1,470,071,504 Thailand 1,713,215,105 Turkey 2,089,835,119 Turkey 1,365,728,465 Turkey 1,572,644,817 Egypt 1,858, 177, 130 Australia 1,304,071,600 Australia 1,452,910,628 Brazil 1,642,408,763 European Union-27 history revised 12/11/07 to include Romania and Bulgaria who accede in January 2007. European Union-28 includes Croatia, who acceded in July 2003. Economic Research Service, USDA. Updated 12/16/2016. Source: U.S. Economic Research Service, U.S. Department of Agriculture, 2016, https://www.ers.usda.gov/data-products/ foreign-agricultural-trade-of-the-united states-fatus/fiscal-year/ CASE 15 :: CAMPBELL: HOW TO KEEP THE SOUP SIMMERING C95Competition and the company dominated the U.S. ketchup market, Its Campbell operated in the highly competitive global food leading brands included Heinz ketchup, Lea & Perrins industry and experienced worldwide competition for all of sauces, Ore-Ida frozen potatoes, Boston Market, T.G.I its principal products. The principal areas of competition Friday's, and Weight Watchers foods. In 2013 Heinz agreed were brand recognition, quality, price, advertising, promo- to be acquired by Berkshire Hathaway and 3G Capital, tion, convenience, and service. (See Exhibits 4 and 5.) The post-merger Kraft Heinz Company was also dedicated to offering healthy food products to its customers by adapt. Nestle ing to changing tastes and consumer preferences. Nestle was the world's number-one food company in terms of sales, the world leader in coffee (Nescafe), one of the Financials world's largest bottled-water (Perrier) makers, and a top In the 2016 fiscal year, Campbell's earnings from continu- player in the pet food business (Ralston Purina). Its most ing operations decreased from $666 million to $563 mil well-known global brands included Buitoni, Friskies, Maggi, lion, due to disruptions in product availability for a period Nescafe, Nestea, and Nestle. The company owned Gerber of time. Organic sales declined 1 percent, while adjusted Products, Jenny Craig, about 75 percent of Alcon Inc. earnings per share (EPS) from continuing operations (ophthalmic drugs, contact-lens solutions, and equipment decreased from $2.13 to $1.82. The larger pie of the sales for ocular surgery), and almost 28 percent of L'oreal." In came from the U.S. market, whereas about 19 percent of July 2007 it purchased Novartis Medical Nutrition, and in the company's total sales were from international markets August 2007 it purchased the Gerber business from Sandoz outside the U.S. Lid., with the goal of becoming a nutritional powerhouse. Exhibits 6, 7, and 8.) Furthermore, by adding Gerber baby foods to its baby for- With regard to financials, Morrison stated: mula business, Nestle became a major player in the U.S. baby food sector. For fiscal year 2017, the company's sales for year ending 2016 declined by approximately 1 percent to $7.961 amid the negative impact of exchange rate General Mills volatility and decrease in organic sales. However, most General Mills was the U.S. number-one cereal maker, of the adverse impacts were offset by the benefits behind Kellogg, fighting for the top spot on a consistent achieved by acquiring Garden Fresh Gourmet. The basis. Its brands included Cheerios, Chex, Total, Kix, and decline in sales could be larger if company had not Wheaties. General Mills was also a brand leader in flour increased the selling prices in 2016 to offset the loss of (Gold Medal), baking mixes (Betty Crocker, Bisquick), sales by decrease in sales volume. 31 dinner mixes (Hamburger Helper), fruit snacks (Fruit Roll- Similarly, for America's Simple Meals and Beverage Ups), grain snacks (Chex Mix, Pop Secret), and yogurt division, Campbell's sales decreased 2 percent amid the (Colombo, Go-Gurt, and Yoplait). In 2001 it acquired decline in VS beverages and soup, but increased costs Pillsbury from Diageo and doubled the company's size, were up, wearing away margins. Also, the Global Biscuits making General Mills one of the world's largest food com- and Snacks division sales decreased 3 percent but for the panies. Although most of its sales came from the United Campbell Fresh division sales increased 1 percent, which States, General Mills was trying to grow the reach and posi- could be better if the company had not gone through the tion of its brands around the world.2 trouble of execution issues and crop destruction. The Kraft Heinz Company Sustainability The Kraft Foods Group and H. J. Heinz Company closed Campbell Soup Company was named to the Dow Jones a merger deal in July 2015. The combined company was Sustainability Indexes (DJSI) repeatedly and to the called The Kraft Heinz Company, and became the third DJSI World Index. This independent ranking recognized largest food company in North America and fifth larg- the company's strategic and management approach to est in the world. Its most popular brands included Kraft delivering economic, environmental, and social perfor- cheeses, beverages (Maxwell House coffee, Kool-Aid mance. Launched in 1999, the DJSI tracked the financial drinks), convenient meals (Oscar Mayer meats and Kraft performance of leading sustainability-driven companies mac'n cheese), grocery fare (Cool Whip, Shake N' Bake), worldwide. In selecting the top performers in each busi and nuts (Planters). Kraft Foods Group was looking to ness sector, DJSI reviewed companies on several general resuscitate its business in North America. H. J. Heinz and industry-specific topics related to economic, envi- had thousands of products. Even prior to the merger, Heinz ronmental, and social dimensions. These included corpo- products enjoyed first or second place by market share in rate governance, environmental policy, climate strategy, more than 50 countries. One of the world's largest food human capital development, and labor practices. Campbell producers, Heinz produced ketchup, condiments, sauces, included sustainability and corporate social responsibility frozen foods, beans, pasta meals, infant food, and other as one of its seven core business strategies. Campbell's processed-food products. Its flagship product was ketchup, Napoleon, Ohio, plant had implemented a new renewable C96 CASE 15 : CAMPBELL: HOW TO KEEP THE SOUP SIMMERINGsts he ets of les Ins ed od 1il- pt- :ed 30 :ed i.I. ins Its Campbell Soup Co 17,483 497 11.9 35.7 Nestle SA (USD, CHF) 2.3 14.4 8.4 241,300 1.6 8,531 Nestle SA (USD,CHF) 28.1 14.2 24. 240,928 0.2 8,531 3.7 28.1 3.0 The Kraft Heinz Co (USD) 14.2 111,587 24.1 3,632 1.9 Danone SA (USD, EUR) 32.6 2.6 14.6 5.4 0.5 42,510 1,720 3.0 Danone SA (USD,EUR) 22.9 2.6 10.2 10.5 42,325 1,720 General Mills Inc (USD) 22.9 2.6 10.2 AXA 34,084 10.5 1,628 21.9 Associated British Foods PLC (USD, GBP) 16.0 26,152 818 3.0 25.6 3.9 Associated British Foods PLC (USD, GBP) 19.9 25,68 818 2.9 Kellogg Co (USD 25.2 1.4 19.9 25,553 694 13.4 Hormel Foods Corp (USD) -0.3 10.7 3.3 18,258 890 4.0 20.9 Conagra Brands Inc (USD) 3.8 17,613 10.0 103.3 630 4.0 34.6 Mead Johnson Nutrition Co (USD):": -1.2 9.6 3.0 16,219 .544 30.3 JM Smucker Co (USD 8 22.4 CASE 15 :: CAMPBELL: HOW TO KEEP THE SOUP SIMMERING C97 15,493 673 Kerry Group PLC (USD, EUR) 23.2 10.1 14.7 14,670 510 26.7 Kerry Group PLC (USD, EUR) oi 12.5 14,295 510 26.0 Saputo Inc (USD,CAO) 9.0 12.5 13,435 704 4.2 Mccormick & Co Inc (USD) 26.0 12.9 19.0 0.3 12.645 471 2.9 7.8 Mccormick & Co. Inc (USD) 29.7 14.2 12,644 471 11.5 0.6 Meiji Holdings Co Ltd (USD, JPY) 7.8 29.7 3.6 14.2 11.5 2,466 g 57,640 WH Group Led (USD) 24.1 2.0 97.9 0.1 12,363 11.7 Grupo Bimbo SAB de CV (USD, MXN) 11,899 6,008 3.2 Meiji Holdings Co Ltd (USD, JPY) 37.9 3.2 11,866 Grupo Bimbo SAB de CV (USD, MXN) 22.9 3.2 97.9 11,805 Ajinomoto Co Inc (USD,JPY) 37.6 13.3 mi 11,610 28,887 2.0 WH Group Lid (USD) 44.0 -0.4 45.2 :0.4: 10.6 2.9 Industry Average 8,110 .63,030 2.0 203 66.5 08 Source: Morningstar Inc., http://financials.morningstar.com/competitors/industry-peer.action?t=CPB.EXHIBIT 5 Campbell Soup Top Competitors' Stock Prices Mar 24, 2014 - Mar 24,2017 45% CPB 30% KHC GIS 29.87 15% 16.64 0% -15% 2014 2015 2016 2017 Source: finance.yahoo.com/, retrieved on March 24, 2017. EXHIBIT 6 Campbell Income Statement Consolid ted Statements illions, except per share amounts) Net sales $7,961 $ 8.082 $ 8,268 Costs and expenses Cost of products sold 5,181 5,300 5.297 Marketing and selling expenses 893 884 929 Administrative expenses 641 601 : 576 Research and development expenses 124 117 122 Other expenses / (income) 131 . 24 22 Restructuring charges 31 102 55 Total costs and expenses 7,001 7,028 7,001 Earnings before interest and taxes 960 1,054 1,267 Interest expense 115 108 122 Interest income 4 3 3 Earnings before taxes 849 949 1,148 Taxes on earnings 286 283 374 Earnings from continuing operations 563 666 774 Earnings from discontinued operations 81 Net earnings 563 666 855 Less: Net earnings (loss) attributable to noncontrolling interests 11) Net earnings attributable to Campbell Soup Company $ 563 $ 666 B $ Per Share - Basic Earnings from continuing operations attributable to Campbell Soup Company $ 1.82 $ 2.13 $ 2.50 Go to library tab in Connect to access Case Financials. Source: Campbell Soup Company Annual Report, 2016. C98 CASE 15 :: CAMPBELL: HOW TO KEEP THE SOUP SIMMERINGEXHIBIT 7 Campbell Balance Sheet UP COMP Consolidated Statements of Earnings (millions, except per share amounts) Current assets Cash and cash equivalents.. $ 296 $ 253 Accounts receivable, net ...... 626 8 647 Inventories .... 940 995 Other current assets. ... 46 198 Total current assets ..... 1,908 2,093 Plant assets, net of depreciation 2,407 2,347 Goodwill ......... ."" 2,263 2,344 Other intangible assets, net of amortization....... 1, 152 1,205 Other assets ($34 and $0 attributable to variable interest entity)......................"' 107 Total assets $ 7,837 $ 8,077 Current liabilities Short-term borrowings.............. $ 1,219 $ 1,543 Payable to suppliers and others ..... 610 544 Accrued liabilities... 604 589 Dividend payable .... 100 101 Accrued income taxes...... 22 29 Total current liabilities . ....... 2,555 2,806 Long-term debt.... 2,314 2,539 Deferred taxes........" 396 505 Other liabilities ..... .1,039 850 Total liabilities . .... 6,304 6,700 Commitments and contingencies Campbell Soup Company shareholders' equity Capital stock, $.0373 par value; authorized 560 shares; issued 323 shares........... 12 12 Additional paid-in capital ........4.4..45:414:"."" 354 339 Earnings retained in the business ..........civic 1,927 : 1,754 Capital stock in treasury, at Cost....4.4.4.4#414145041451645454545414519545456549545,149545954545 (664) (556) Accumulated other comprehensive loss ....ing (104) (168) Total Campbell Soup Company shareholders' equity .....................44.(14...#14:1:" 1,525 1,381 oncontrolling interests..................mummummummum (4 ). Total equity ..... ,533 1,377 Total liabilities and equity ................4.450535451254545285021050545456256.mmm.5054 : $7,837 $ 8,077 Go to library tab in Connect to access Case Financials. Source: Campbell Soup Company Annual Report, 2016. CASE 15 :: CAMPBELL: HOW TO KEEP THE SOUP SIMMERING C99EXHIBIT 8 Campbell's Key Ratios energy initiative, anchored by 24,000 new solar panels, The Valuation 60-acre, 9.8-megawatt solar power system was expected to supply 15 percent of the plant's electricity while reducing P/E Current 31.73 CO2 emissions by 250,000 metric tons over 20 years." P/E Ratio (with extraordinary items) 35.71 Additionally, Campbell employees volunteered an aver. age of 20,000 hours annually at more than 200 nonprofit P/E Ratio (without extraordinary items) 34.40 organizations. Supported by local farmers and Campbell. Price to Sales Ratio 2.43 the Food Bank of South Jersey was earning revenue for hunger relief from sales of Just Peachy salsa. The salsa was Price to Book Ratio 12.58 created from excess peaches from New Jersey and was man. Price to Cash Flow Ratio 13,24 ufactured and labeled by employee volunteers at Campbell's plant in Camden. 35 Enterprise Value to EBITDA 14.32 Enterprise Value to Sales 2.61 What's Next? Campbell's advertising campaign failed to assist the com Total Debt to Enterprise Value 0.16 pany much in gaining the expected traction in the ready-to- Efficiency serve soup business. Campbell was trying to correct this by introducing new products offering unique flavors into what Revenue/Employee 482,485.00 many considered a rather ordinary product line. If the econ Income Per Employee 34, 121.00 omy continued to improve would Campbell be successful in its international expansion, especially in lucrative emerg Receivables Turnover 12.51 ing markets such as China? As the recession became a dis Total Asset Turnover 1.00 tant memory, would Campbell's name still resonate with American consumers or would consumers venture back to Liquidity restaurants? Would Campbell Fresh become a success or would it spoil? Would Campbell's soup simmer to perfect Current Ratio 0.75 tion, or would the company be in hot water? Quick Ratio 0.38 ENDNOTES Cash Ratio 0.12 I. https://www.forbes.com/sites/maggiemcgrath/2016/09/01/campbell- Profitability soup-ceo-i-am-disappointed-by-lackluster-campbell-fresh-business/ \#290fc 1103830. Gross Margin 34.61 2. Boyle, M. 2010. Campbell CEO pick may be lost chance, analysts say. Business Week, September 29, www.businessweek.comews/2010-09. Operating Margin 14.29 9/campbell-ceo-pick-may-be-lost-chance-analysts-say.html. 3. Goudreau, Jenna. 2012. Kicking the can: Campbell's CEO bets on Pretax Margin 10.66 soup-in-a-bag for 20-somethings. Forbes.com, December 6, www.forbes.com/sites/jennagoudreau/2012/12/06/ Net Margin 7.07 kicking-the-can-campbells-ceo-bets-on-soup-in-a-bag-for-20-somethings. Return on Assets 7.07 4. Campbells. 2013. Our company. www.campbellsoupcompany.com/ around_the_world.asp. Return on Equity 38.76 5. Collins, G. 1994. Campbell Soup takes the big plunge into salsa. New York Times, November 29: DI. Return on Total Capital 10.69 6. Campbell Soup Co. 2010. 2009 annual report. 7. Campbell Soup Co. 2008. 2007 annual report. Return on Invested Capital 14.49 B. Wall Street Journal. 2011. Campbell Soup to exit Russia. June 29, online.wsj.com/article/SB 100014240527023044478045764142024604 Capital Structure 91210.html Total Debt to Total Equity 231.67 9. Want China Times. 2013, Campbell Soup aims to break into Chinese market through chef endorsements. March 6, www.wantchinatimes Total Debt to Total Capital 69.85 comews-subclass-ent.aspx?id520130306000016&cid51102. 10. Boyle, M. 2009. Campbell's: Not about to let the soup cool. Total Debt to Total Assets 45.08 Business Week, September 17. 11. News release. 2010. Campbell launches "It's Amazing What Soup m Debt to Equity 151.74 Can Do" ad campaign to promote Campbell's U.S. soup brands. Long-Term Debt to Total Capital September 7, investor.campbellsoupcompany.com/phoenix 45.75 .zhtml?c588650&pirol-newsArticle&ID$1467644. 12. Brat, I., and Ziobro, P. 2010. Campbell to put new focus on taste. Source: Market Watch Inc. 2017, http://www.marketwatch.com/investing/stock/ Wall Street Journal, November 24, online.wsj.com/article/0, cpb/profile. B 10001424052748704369304575632342839464532,00.html. C100 CASE 15 :: CAMPBELL: HOW TO KEEP THE SOUP SIMMERINGhe 13. Abelson, Reed. 2000. The first family of soup, feeling the squeeze; Should it sell or try to go it alone? New York Times, July 30, www. 24. ReportsnReports. 2013. Packaged food in the US. April, www. ng nytimes.com/2010/07/30/business/first-family-soup-feeling-squeeze- should-it-sell-try-go-it-alone.html?pagewanted$all&src5pm. 25. Ibid. reportsnreports.com/reports/150486-packaged-food-in-the-us.html. 14. Campbell Soup Co. 2008. 2007 annual report. 26. Graves, T., and Kwon, E. Y. 2009. Standard and Poor's foods and nonalcoholic beverages industry report. July. er- 15. Campbell Soup Co. 2011. 2010 annual report. 16. Press release. 2007. The Coca-cola Company, Campbell Soup 27. Hoovers. Undated. Company profiles: Nestle. www.hoovers. Company and Coca-cola Enterprises sign agreement for distribution com/company-information/cs/company-profile.Nestle_. or of Campbell's beverage portfolio, investor.shareholder.com/campbell/ SA.6a719827106beoff.html, accessed April 2013. releasedetail.cfm?ReleaseID5247903. 28. Hoovers. Undated. Company profiles: General Mills. www.hoovers. as 17. Campbell Soup Co. 2011. 2010 annual report. com/company-information/cs/company-profile.General_Mills_Inc. a90ba57dc8f51a65.html, accessed April 2013. In- 18. Ibid. 29. Hoovers. Undated. Company profiles: Kraft Foods. www.hoovers. I's 19. Goudreau, op. cit. com/company-information/es/company-profile.Kraft_Foods_Group_ 20. Ibid. Inc.43af8ed4b4ae51f2.html, accessed April 2013. 21. Katz, Jonathan. 2010. Campbell Soup cooking up 30. Hoovers. Undated. Company profiles: H. J. Heinz Company. www a new recipe? Industry Week, December 15, www. hoovers.com/company-information/cs/company-profile.H_J_Heinz_ industryweek.com/companies-amp-exccutives/ Company. 1696242275f81d38.html, accessed April 2013. iw-50-profile-campbell-soup-cooking-new-recipe. 31. Campbell Soup Co. 2016 annual report. 22. Campbell Soup Co. 2017 annual report. 32. Ibid. 23. PRNewswire. 2012. U.S. Packaged Food Market-Consumers seek 33. News release. 2010. Campbell Soup company named to Dow Jones out ethnic & bold flavours-new industry report. PRNewswire, Sustainability Indexes. investor.campbellsoupcompany.com/phoenix. March 12, www.prnewswire.comews-releases/us-packaged-food- zhtml?c588650&pSirol-newsArticle&ID51471 159. market-consumers-seek-out-ethnic-bold-flavours-new-industry- 34. Campbell Soup Co. 2013. 2012 annual report. report-142292805.html. 35. Ibid. CASE 15 :: CAMPBELL: HOW TO KEEP THE SOUP SIMMERING C101