Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What is a luxury car? 2. What is a fuel-efficient car? 3. What are the LCT thresholds for luxury cars and fuel-efficient cars?

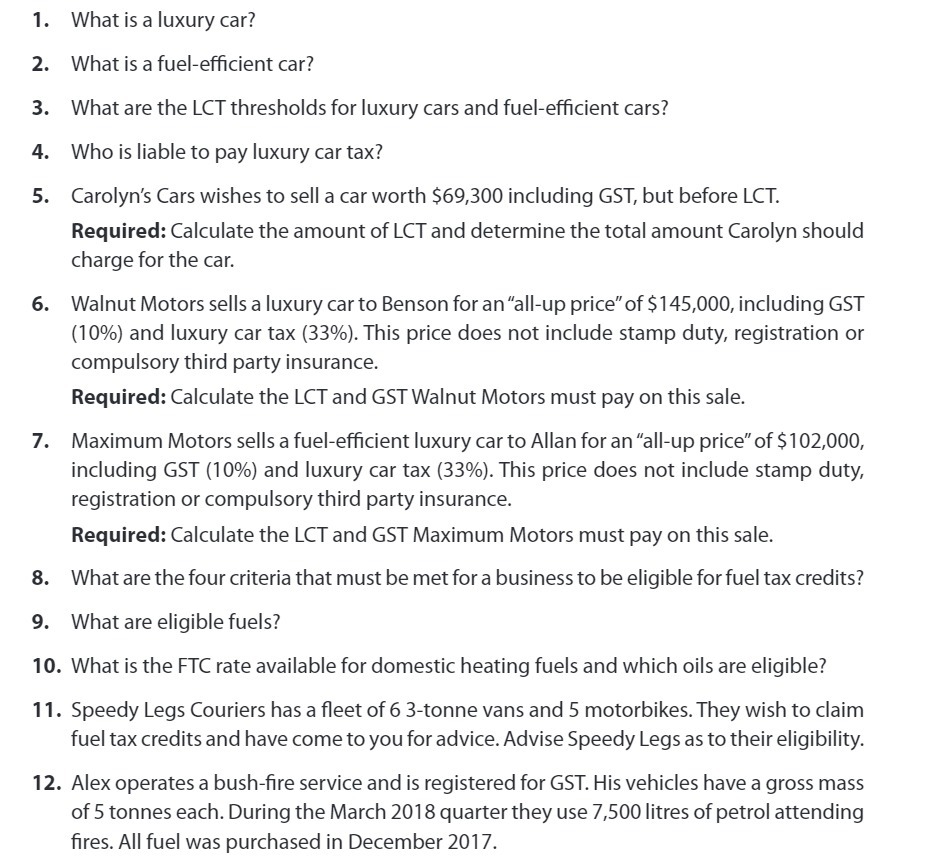

1. What is a luxury car? 2. What is a fuel-efficient car? 3. What are the LCT thresholds for luxury cars and fuel-efficient cars? 4. Who is liable to pay luxury car tax? 5. Carolyn's Cars wishes to sell a car worth $69,300 including GST, but before LCT. Required: Calculate the amount of LCT and determine the total amount Carolyn should charge for the car. 6. Walnut Motors sells a luxury car to Benson for an "all-up price" of $145,000, including GST (10%) and luxury car tax (33%). This price does not include stamp duty, registration or compulsory third party insurance. Required: Calculate the LCT and GST Walnut Motors must pay on this sale. 7. Maximum Motors sells a fuel-efficient luxury car to Allan for an "all-up price" of $102,000, including GST (10%) and luxury car tax (33%). This price does not include stamp duty, registration or compulsory third party insurance. Required: Calculate the LCT and GST Maximum Motors must pay on this sale. 8. What are the four criteria that must be met for a business to be eligible for fuel tax credits? 9. What are eligible fuels? 10. What is the FTC rate available for domestic heating fuels and which oils are eligible? 11. Speedy Legs Couriers has a fleet of 6 3-tonne vans and 5 motorbikes. They wish to claim fuel tax credits and have come to you for advice. Advise Speedy Legs as to their eligibility. 12. Alex operates a bush-fire service and is registered for GST. His vehicles have a gross mass of 5 tonnes each. During the March 2018 quarter they use 7,500 litres of petrol attending fires. All fuel was purchased in December 2017.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 A luxury car is a highend vehicle that offers superior quality comfort performance and advanced features compared to standard cars Luxury cars often have luxurious interiors highquality materials ad...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started