Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What is Allowance for change in fair value of investment and unrealized holding gain/loss: available for sale security 2.what is the balance in the

1. What is Allowance for change in fair value of investment and unrealized holding gain/loss: available for sale security

2.what is the balance in the unrealized holding gain/loss account on dec31 2019

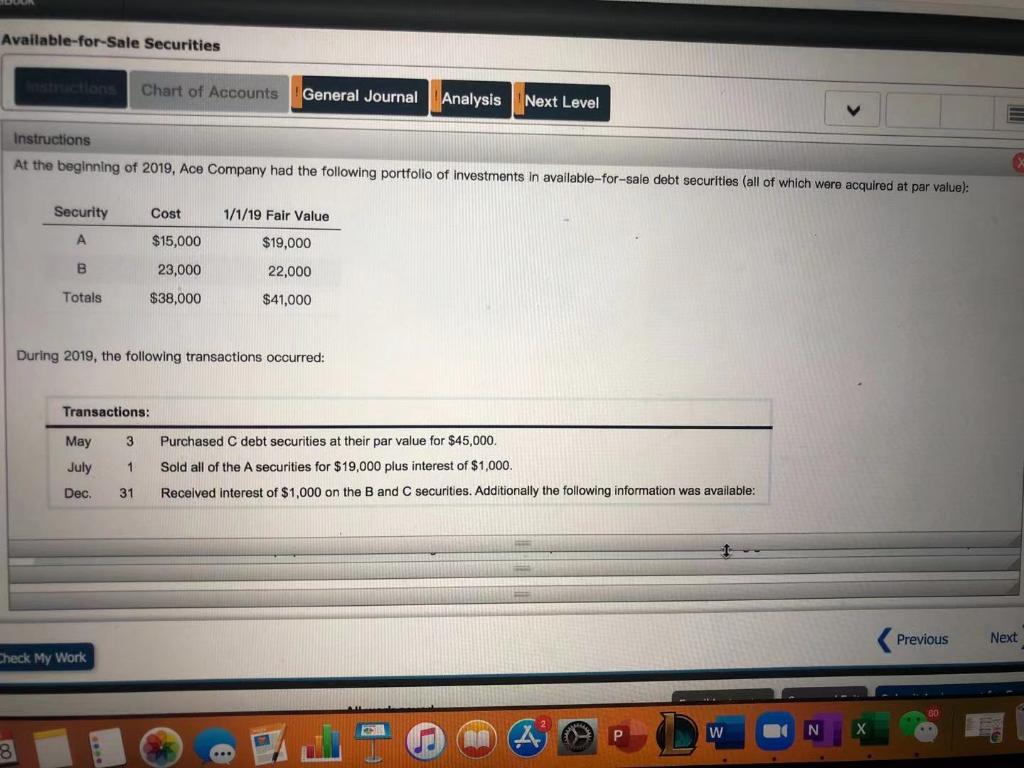

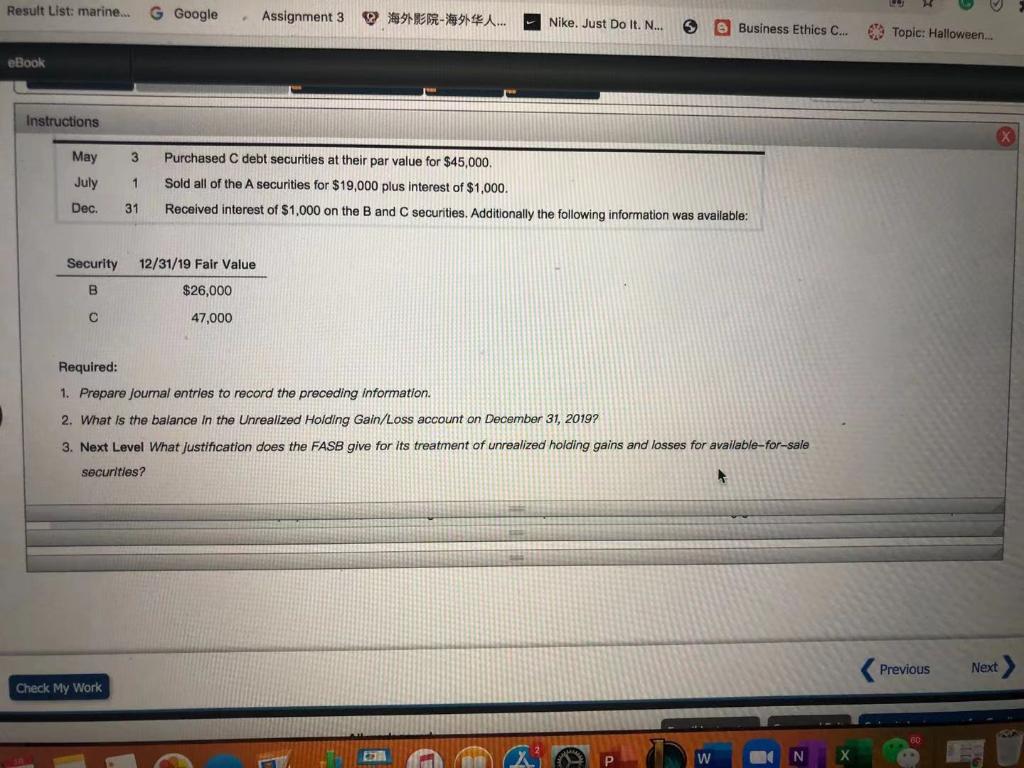

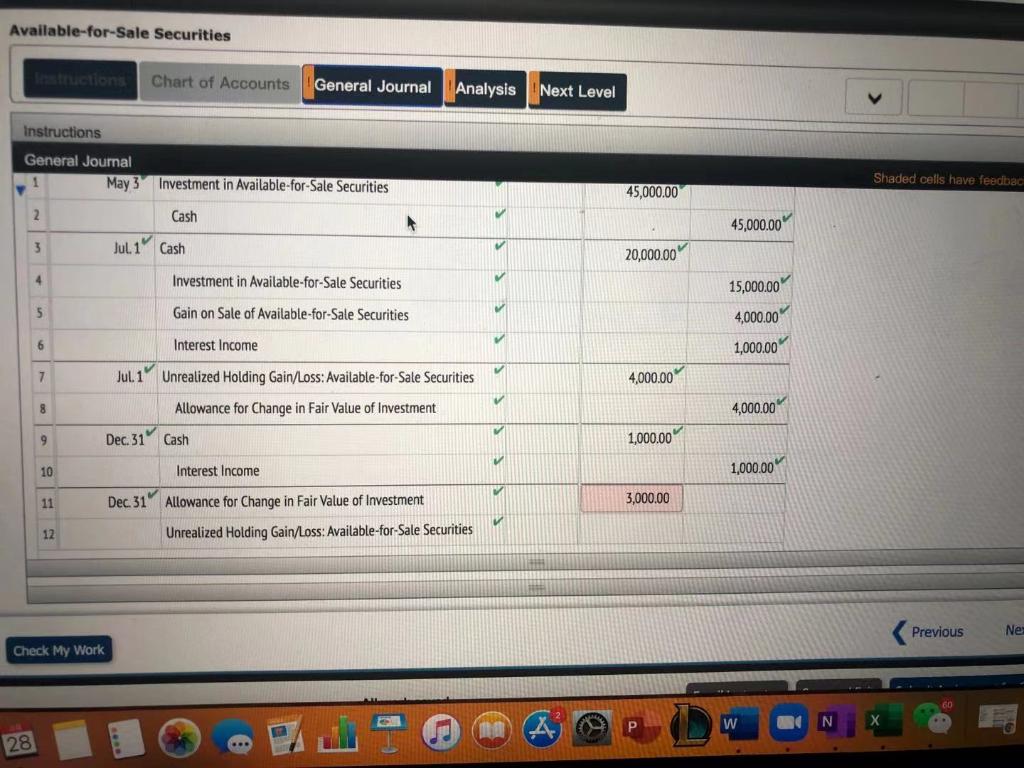

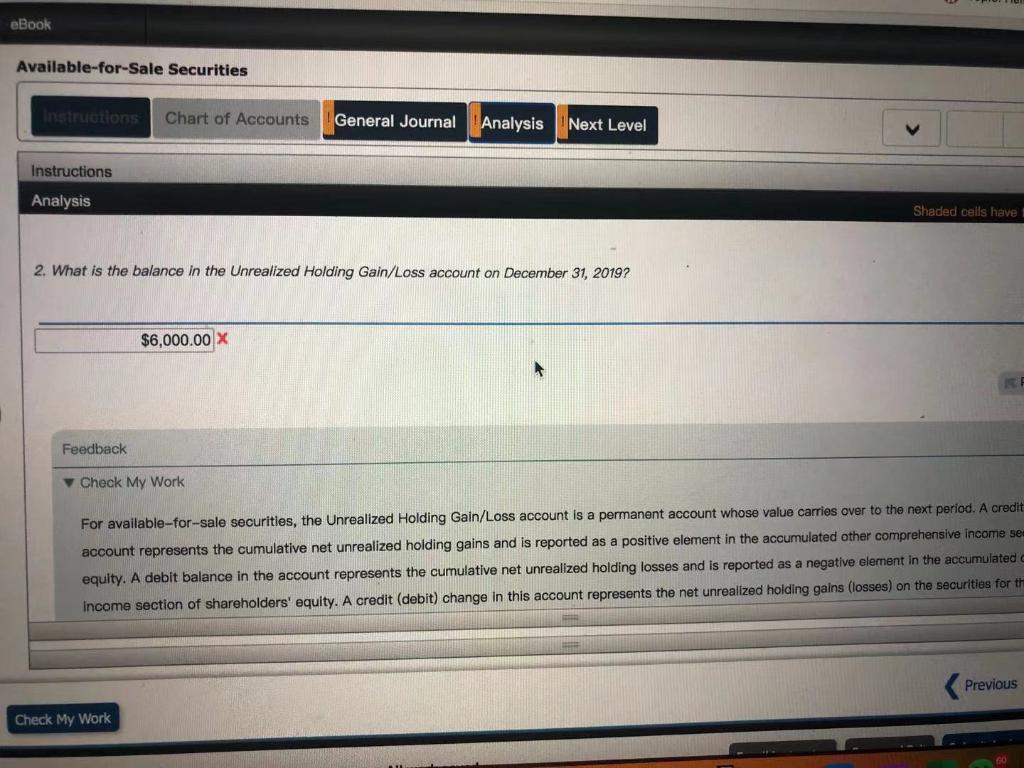

Available-for-Sale Securities Chart of Accounts General Journal Analysis Next Level Instructions At the beginning of 2019, Ace Company had the following portfolio of Investments in available-for-sale debt securities (all of which were acquired at par value): Security Cost 1/1/19 Fair Value $15,000 $19,000 B 23,000 22,000 Totals $38,000 $41,000 During 2019, the following transactions occurred: Transactions: 3 Purchased C debt securities at their par value for $45,000 May July Dec 1 Sold all of the A securities for $19,000 plus interest of $1,000 Received interest of $1,000 on the B and C securities. Additionally the following information was available: 31 Previous Next Check My Work P W 8 Result List: marine... G Google Assignment 3 - ... Nike. Just Do It. N... 5 Business Ethics C... 09 Topic: Halloween... eBook Instructions May 3 1 July Dec. Purchased C debt securities at their par value for $45,000 Sold all of the A securities for $19,000 plus interest of $1,000. Received interest of $1,000 on the B and C securities. Additionally the following information was available: 31 Security 12/31/19 Fair Value B $26,000 47,000 Required: 1. Prepare journal entries to record the preceding information. 2. What is the balance in the Unrealized Holding Gain/Loss account on December 31, 2019? 3. Next Level What Justification does the FASB give for its treatment of unrealized holding gains and losses for available-for-sale securities? Previous Next Check My Work W Available-for-Sale Securities Chart of Accounts General Journal Analysis Next Level Instructions General Journal 1 May 3 Investment in Available-for-Sale Securities Shaded cells have feedbac 45,000.00 2 Cash 45,000.00 3 Jul 1' Cash 20,000.00 4 Investment in Available-for-Sale Securities 15,000.00 5 Gain on Sale of Available-for-Sale Securities 4,000.00 Interest Income 1,000.00 V 7 Jul. 1 Unrealized Holding Gain/Loss: Available for Sale Securities 4,000.00 8 Allowance for Change in Fair Value of Investment 4,000.00 9 Dec. 31 Cash 1,000.00 10 Interest Income 1,000.00 11 3,000.00 Dec 31" Allowance for Change in Fair Value of Investment Unrealized Holding Gain/Loss: Available-for-Sale Securities V 12 Previous Ne Check My Work w OO N. 28 eBook Available-for-Sale Securities Instructions Chart of Accounts General Journal Analysis Next Level Instructions Analysis Shaded cells have 2. What is the balance in the Unrealized Holding Gain/Loss account on December 31, 2019? $6,000.00 X Feedback Check My Work For available-for-sale securities, the Unrealized Holding Gain/Loss account is a permanent account whose value carries over to the next period. A credit account represents the cumulative net unrealized holding gains and is reported as a positive element in the accumulated other comprehensive income se equity. A debit balance in the account represents the cumulative net unrealized holding losses and is reported as a negative element in the accumulated income section of shareholders' equity. A credit (debit) change in this account represents the net unrealized holding gains (losses) on the securities for th Previous Check My WorkStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started