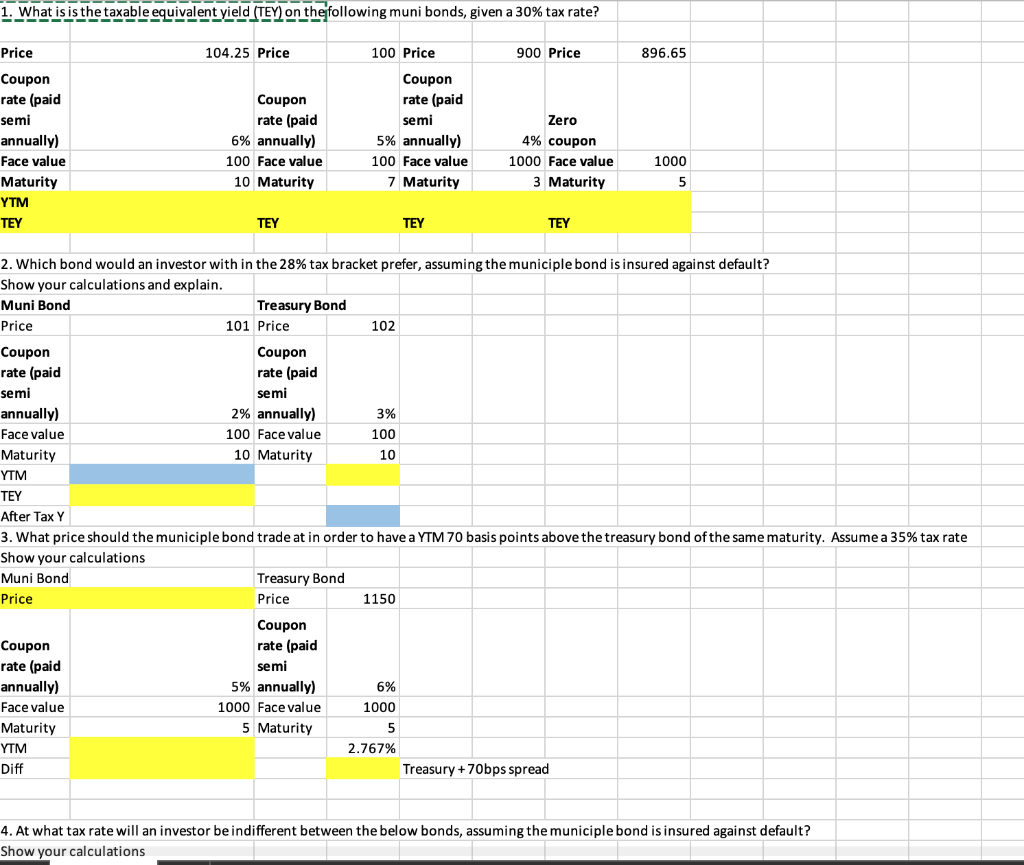

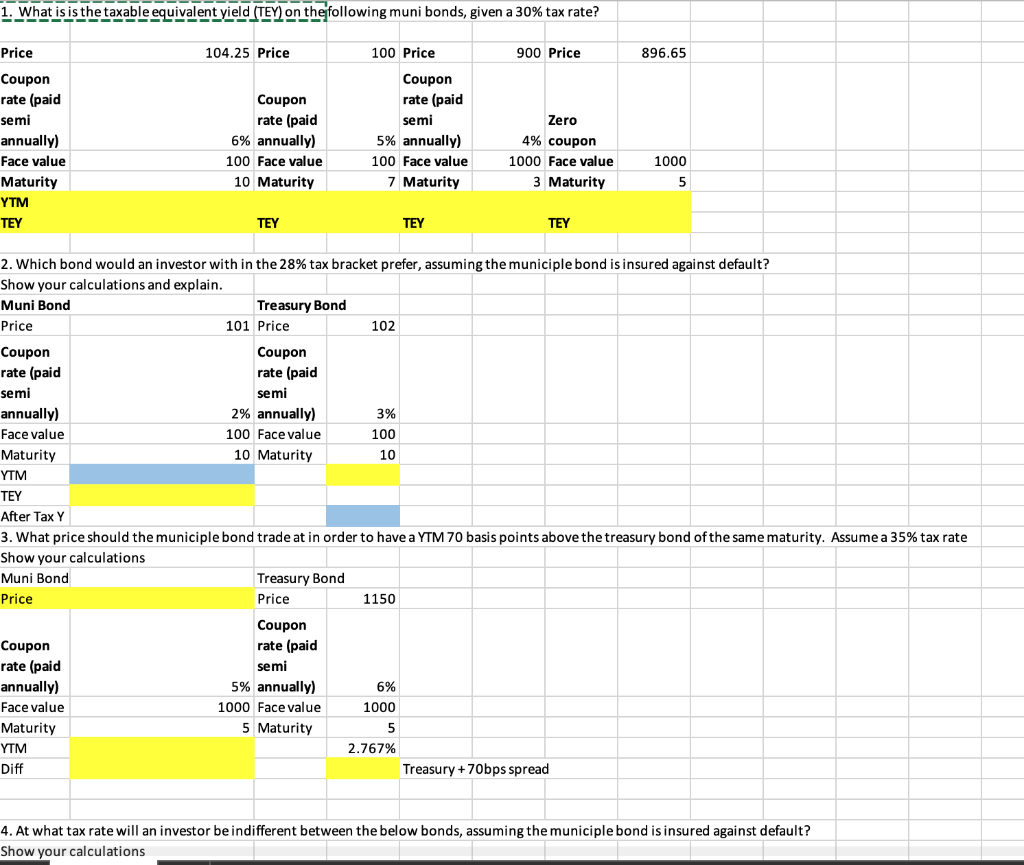

1. What is is the taxable equivalent yield (TEY) on the following muni bonds, given a 30% tax rate? 104.25 Price 100 Price 900 Price 896.65 Zero Price Coupon rate (paid semi annually) Face value Maturity YTM TEY Coupon rate (paid 6% annually) 100 Face value 10 Maturity Coupon rate (paid semi 5% annually) 100 Face value 7 Maturity 4% coupon 1000 Face value 3 Maturity 1000 5 TEY TEY TEY 2. Which bond would an investor with in the 28% tax bracket prefer, assuming the municiple bond is insured against default? Show your calculations and explain. Muni Bond Treasury Bond Price 101 Price 102 Coupon Coupon rate (paid rate (paid semi semi annually) 2% annually) 3% Face value 100 Face value 100 Maturity 10 Maturity 10 YTM TEY After Tax Y 3. What price should the municiple bond trade at in order to have a YTM 70 basis points above the treasury bond of the same maturity. Assume a 35% tax rate Show your calculations Muni Bond Treasury Bond Price Price 1150 Coupon rate (paid annually) Face value Maturity YTM Diff Coupon rate (paid semi 5% annually) 1000 Face value 5 Maturity 6% 1000 5 2.767% Treasury + 70bps spread 4. At what tax rate will an investor be indifferent between the below bonds, assuming the municiple bond is insured against default? Show your calculations 1. What is is the taxable equivalent yield (TEY) on the following muni bonds, given a 30% tax rate? 104.25 Price 100 Price 900 Price 896.65 Zero Price Coupon rate (paid semi annually) Face value Maturity YTM TEY Coupon rate (paid 6% annually) 100 Face value 10 Maturity Coupon rate (paid semi 5% annually) 100 Face value 7 Maturity 4% coupon 1000 Face value 3 Maturity 1000 5 TEY TEY TEY 2. Which bond would an investor with in the 28% tax bracket prefer, assuming the municiple bond is insured against default? Show your calculations and explain. Muni Bond Treasury Bond Price 101 Price 102 Coupon Coupon rate (paid rate (paid semi semi annually) 2% annually) 3% Face value 100 Face value 100 Maturity 10 Maturity 10 YTM TEY After Tax Y 3. What price should the municiple bond trade at in order to have a YTM 70 basis points above the treasury bond of the same maturity. Assume a 35% tax rate Show your calculations Muni Bond Treasury Bond Price Price 1150 Coupon rate (paid annually) Face value Maturity YTM Diff Coupon rate (paid semi 5% annually) 1000 Face value 5 Maturity 6% 1000 5 2.767% Treasury + 70bps spread 4. At what tax rate will an investor be indifferent between the below bonds, assuming the municiple bond is insured against default? Show your calculations