Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What is SpaceX's FY21 operating cash flow? 2. Calculate SpaceX's net capital spending in FY21. 3. Calculate SpaceX's change in net working capital during

1. What is SpaceX's FY21 operating cash flow?

2. Calculate SpaceX's net capital spending in FY21.

3. Calculate SpaceX's change in net working capital during FY21.

4. What is SpaceX's FY21 cash flow from assets?

5. What is SpaceX's cash flow to creditors?

6. What is SpaceX's cash flow to stockholders?

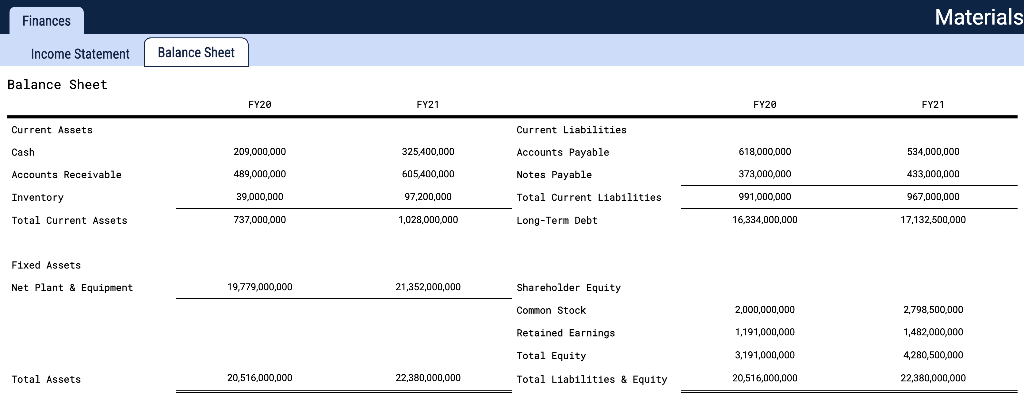

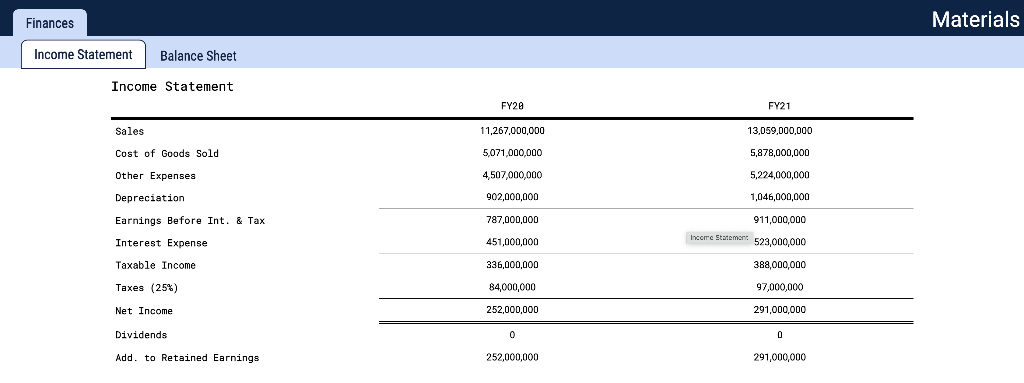

Finances Materials Income Statement Balance Sheet Balance Sheet F1xed Assets Net Plant \& Equipment Finances Materials Income Statement Balance Sheet Income Statement \begin{tabular}{lcc} & FY28 & FY21 \\ \hline Sales & 11,267,000,000 & 13,059,000,000 \\ Cost of Goods Sold & 5,071,000,000 & 5,878,000,000 \\ Other Expenses & 4,507,000,000 & 5,224,000,000 \\ Depreciation & 902,000,000 & 1,046,000,000 \\ Earnings Before Int. \& Tax & 787,000,000 & 911,000,000 \\ Interest Expense & 451,000,000 & 388,000,000 \\ Taxable Income & 336,000,000 & 97,000,000 \\ Taxes (25\%) & 84,000,000 & 291,000,000 \\ Net Income & 252,000,000 & 0 \\ Dividends & 0 & 291,000,000 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started