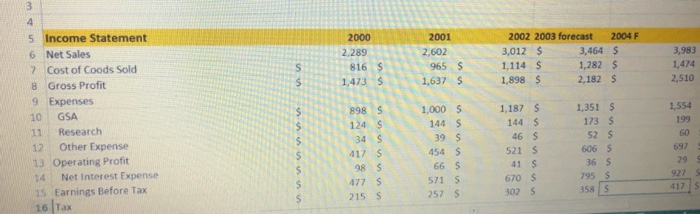

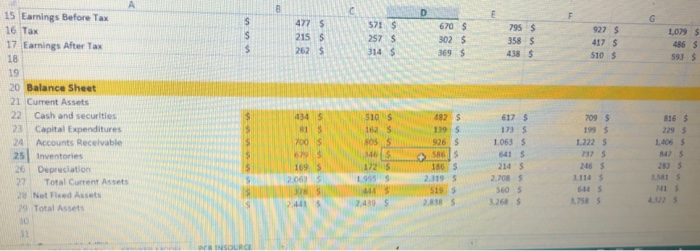

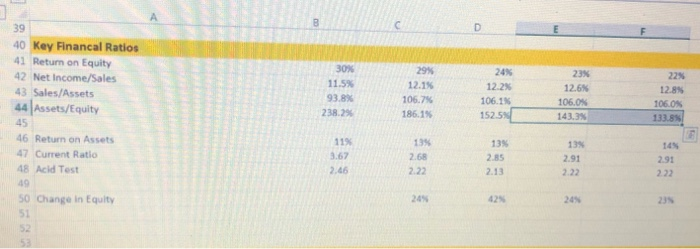

1. What is Strykers current financial situation. From an Income Statement and Balance Sheet point of view. 2.What are the pros and cons of the current plan vs. insourcing the production of PCBs. Provide thought and depth to this answer What are the key financial metrics you would look at to compare the current plan with the insourcing plan? 3. Insourcing will require several financial changes. What are those financial changes? And what are reasonable assumptions as to how much they will change? 4. Assuming it will cost $6 Billion to build a new PCB factory, what are the financials of this plan, and how does it compare with the current outsourcing plan? How does your answer change if that changes to $1B, or $10B? 2000 2.289 2001 2,602 965 1.637 2002 2003 forecast 2004 F 3,012 $ 3,464 5 1,114 $ 1.282 1,898 $ 2,182 $ S 3,983 1,474 2,510 1.473 S S 5 Income Statement 6 Net Sales 7 Cost of Coods Sold 8 Gross Profit 9 Expenses 10 GSA 11 Research 12 Other Expense 13 Operating Profit 14 Net Interest Expense 15 Earnings Before Tax 16 Tax 898 124 $ S 1,000 $ 144 $ 39S 454 S 1,187 $ 144 $ 46 5 521 S 41 S 670 $ 3025 1,351 $ 173 S 52 S 606 5 36 S 795 358S 1,554 199 60 697 29 $ 927 S 417 66 571 S 257 $ 15 Earings Before Tax 16 Tax 17 Earnings After Tax 670 S 302 S 369 $ 1,079 $ 486 5 590 $ 510 510S 816 $ 617 S 1735 1063 $ 20 Balance Sheet 21 Current Assets 22 Cash and securities 23 Capital Expenditures 24 Accounts Receivable 25 Inventories 26 Depreciation 27 Total Current Assets 28 Net Fixed Assets 9 Total Assets MS 1725 190S 709 S 199 $ 12225 7375 2165 111 5 225 285 214 2.708 S S 2015 2635 23% 22 106.7 40 Key Financal Ratios 41 Return on Equity 42 Net Income/Sales 43 Sales/Assets 44 Assets/Equity 45 46 Return on Assets 47 Current Ratio 48 Acid Test 12.2% 106.1% 152.53 12.6% 106.0% 143.3% 12.8% 106.0% 133.55 186.1% 134 13 7.68 135 2.85 21 2.91 2.22 50 Change in Equity 423 1. What is Strykers current financial situation. From an Income Statement and Balance Sheet point of view. 2.What are the pros and cons of the current plan vs. insourcing the production of PCBs. Provide thought and depth to this answer What are the key financial metrics you would look at to compare the current plan with the insourcing plan? 3. Insourcing will require several financial changes. What are those financial changes? And what are reasonable assumptions as to how much they will change? 4. Assuming it will cost $6 Billion to build a new PCB factory, what are the financials of this plan, and how does it compare with the current outsourcing plan? How does your answer change if that changes to $1B, or $10B? 2000 2.289 2001 2,602 965 1.637 2002 2003 forecast 2004 F 3,012 $ 3,464 5 1,114 $ 1.282 1,898 $ 2,182 $ S 3,983 1,474 2,510 1.473 S S 5 Income Statement 6 Net Sales 7 Cost of Coods Sold 8 Gross Profit 9 Expenses 10 GSA 11 Research 12 Other Expense 13 Operating Profit 14 Net Interest Expense 15 Earnings Before Tax 16 Tax 898 124 $ S 1,000 $ 144 $ 39S 454 S 1,187 $ 144 $ 46 5 521 S 41 S 670 $ 3025 1,351 $ 173 S 52 S 606 5 36 S 795 358S 1,554 199 60 697 29 $ 927 S 417 66 571 S 257 $ 15 Earings Before Tax 16 Tax 17 Earnings After Tax 670 S 302 S 369 $ 1,079 $ 486 5 590 $ 510 510S 816 $ 617 S 1735 1063 $ 20 Balance Sheet 21 Current Assets 22 Cash and securities 23 Capital Expenditures 24 Accounts Receivable 25 Inventories 26 Depreciation 27 Total Current Assets 28 Net Fixed Assets 9 Total Assets MS 1725 190S 709 S 199 $ 12225 7375 2165 111 5 225 285 214 2.708 S S 2015 2635 23% 22 106.7 40 Key Financal Ratios 41 Return on Equity 42 Net Income/Sales 43 Sales/Assets 44 Assets/Equity 45 46 Return on Assets 47 Current Ratio 48 Acid Test 12.2% 106.1% 152.53 12.6% 106.0% 143.3% 12.8% 106.0% 133.55 186.1% 134 13 7.68 135 2.85 21 2.91 2.22 50 Change in Equity 423