Answered step by step

Verified Expert Solution

Question

1 Approved Answer

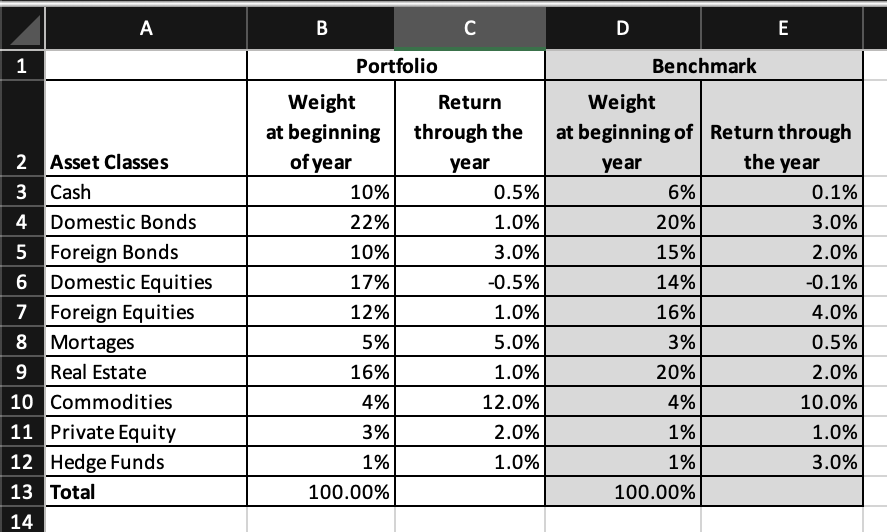

1. What is the Active Return of the foundation? (i.e., return of fund minus return of benchmark) 2. What is the Allocation component of the

1. What is the Active Return of the foundation? (i.e., return of fund minus return of benchmark)

2. What is the Allocation component of the Active Return?

3. What is the Pure Selection component of the Active Return (ie., not including Interaction/Mixed Origin)?

A B 1 C D E Portfolio Weight Return Weight Benchmark at beginning through the at beginning of Return through 2 Asset Classes of year year year the year 3 Cash 10% 0.5% 6% 0.1% 4 Domestic Bonds 22% 1.0% 20% 3.0% 5 Foreign Bonds 10% 3.0% 15% 2.0% Domestic Equities 17% -0.5% 14% -0.1% 7 Foreign Equities 12% 1.0% 16% 4.0% 8 Mortages 5% 5.0% 3% 0.5% 9 Real Estate 16% 1.0% 20% 2.0% 10 Commodities 4% 12.0% 4% 10.0% 11 Private Equity 3% 2.0% 1% 1.0% 12 Hedge Funds 1% 1.0% 1% 3.0% 13 Total 100.00% 100.00% 14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The Active Return of the foundation is calculated as the return of the fund minus the return of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started