Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1/ What is the carrying value of the lease liability on Reagan's December 31, 2014, balance sheet (after the third lease payment is made)? (Answer:

1/ What is the carrying value of the lease liability on Reagan's December 31, 2014, balance sheet (after the third lease payment is made)? (Answer: $280,531)

2/ At what amount would Reagan record the leased asset at inception of the agreement? (Answer: $519,115)

3/ What is the effective annual interest rate charged to Reagan on this lease? (Answer: 4%)

4/ What is the amount of residual value guaranteed by Reagan to the lessor? (Answer: $36,000)

*Please show the calculations!!

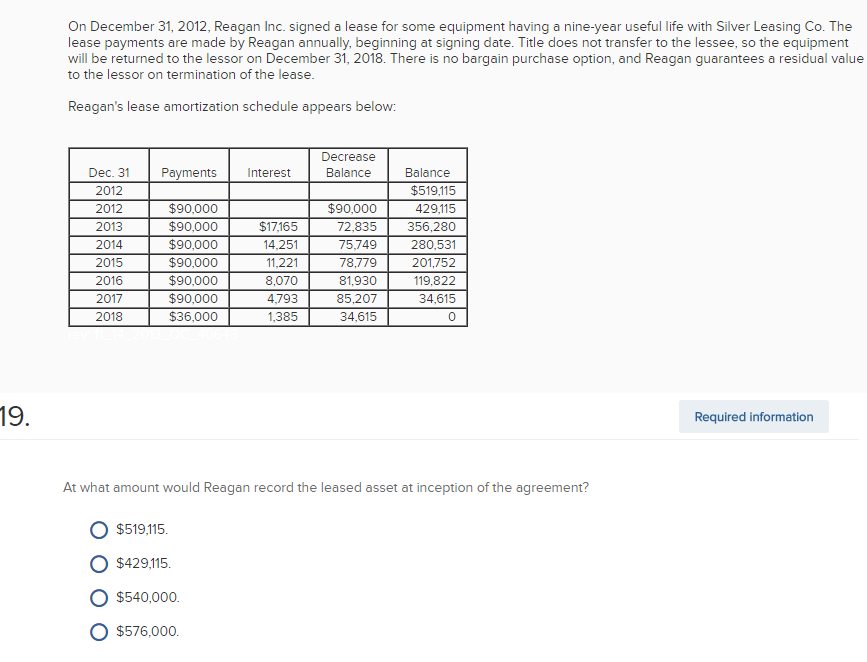

On December 31, 2012, Reagan Inc. signed a lease for some equipment having a nine-year useful life with Silver Leasing Co. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2018. There is no bargain purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease Reagan's lease amortization schedule appears below: Decrease Balance 31 Payments Dec. 31 2012 2012 2013 2014 2015 2016 2017 2018 Interest Balance $90,000 14,251 11,221 8,070 4,793 1,385 $90,000 72,835 75,749 78,779 81.930 85,207 34,615 356,280 280,531 201,752 19.822 34,615 0 $90,000 $36,000 19. Required information At what amount would Reagan record the leased asset at inception of the agreement? O $519115. O $429,115. $540,000 O$576,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started