Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. what is the cost of equity 2. what is the market value of the bond issue (in $ million) 3. what is the weighted

1. what is the cost of equity

1. what is the cost of equity

2. what is the market value of the bond issue (in $ million)

3. what is the weighted average cost of capital?

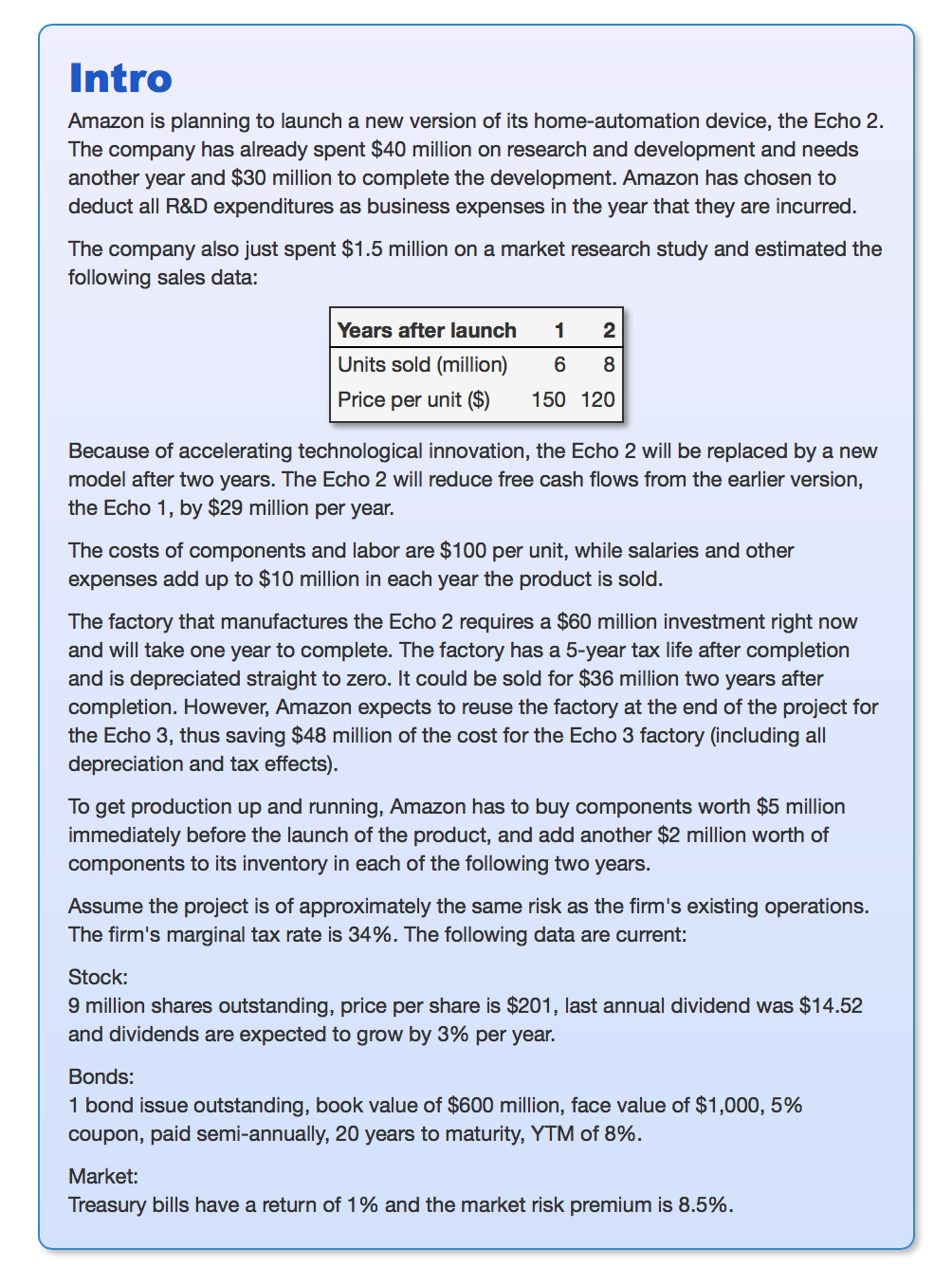

Intro Amazon is planning to launch a new version of its home-automation device, the Echo 2. The company has already spent $40 million on research and development and needs another year and $30 million to complete the development. Amazon has chosen to deduct all R&D expenditures as business expenses in the year that they are incurred. The company also just spent $1.5 million on a market research study and estimated the following sales data: 1 2 Years after launch Units sold (million) Price per unit ($) 6 8 150 120 Because of accelerating technological innovation, the Echo 2 will be replaced by a new model after two years. The Echo 2 will reduce free cash flows from the earlier version, the Echo 1, by $29 million per year. The costs of components and labor are $100 per unit, while salaries and other expenses add up to $10 million in each year the product is sold. The factory that manufactures the Echo 2 requires a $60 million investment right now and will take one year to complete. The factory has a 5-year tax life after completion and is depreciated straight to zero. It could be sold for $36 million two years after completion. However, Amazon expects to reuse the factory at the end of the project for the Echo 3, thus saving $48 million of the cost for the Echo 3 factory (including all depreciation and tax effects). To get production up and running, Amazon has to buy components worth $5 million immediately before the launch of the product, and add another $2 million worth of components to its inventory in each of the following two years. Assume the project is of approximately the same risk as the firm's existing operations. The firm's marginal tax rate is 34%. The following data are current: Stock: 9 million shares outstanding, price per share is $201, last annual dividend was $14.52 and dividends are expected to grow by 3% per year. Bonds: 1 bond issue outstanding, book value of $600 million, face value of $1,000, 5% coupon, paid semi-annually, 20 years to maturity, YTM of 8%. Market: Treasury bills have a return of 1% and the market risk premium is 8.5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started