Answered step by step

Verified Expert Solution

Question

1 Approved Answer

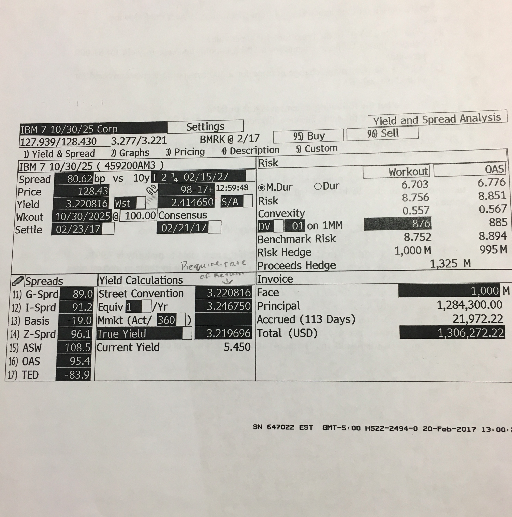

1. what is the DV01 of the bond for a $1000 par value? 2. What is the dollar price change for a 50 basis point

1. what is the DV01 of the bond for a $1000 par value?

2. What is the dollar price change for a 50 basis point decrease in yield for $1000 par value?

3. what is the percentage change in price for a 50 basis point decrease in yield for $1000 par value?

IRM 7 10, JO, 25 Torn Settings Yield and Spread Analysis 7,939/128.430 3.277/3.221 BMRK 2/17 91 Buy 9 Sell Yield & Spread Graphs Pricing 1 Description S Custom Risk RM7 10/30/25 459200AM3 0AS Workout Spread 80 bp vs 10y 2 02 1522, 6.776 6.703 12:59:49 M.Dur ODur 128.4 Price 8.851 8.756 Risk 2.111650 S A 3.22081 0.567 0.557 out 10/30/2025 3 100.00 consensus 885 on 1MM 02/23 17 Settle 8.894 8.752 Benchmark Risk 1,000 M 995 M Risk Hedge 1,325 M Peau re-raa Proceeds Hedge Invoice Spreads Yield Calculations 1,00 11 G-Sprd 89,0 Street Convention 3,22081 Face 2) I-sprd L01.2 equiv 1 Yr 3.216750 Principal 1,284,300.00 13) Basis 19. U Mmkt (Act/ 360 Accrued (113 Days) 21,972.22 4) z-Sprd 96.1 3.219696 Total (USD) 300,272.22 rue Yie Current Yield ASW 08. 5.450 16) OAS 95.4 1) TED 9N 647022 EST BMT-5.00 H522-2494-0 20 13.00. IRM 7 10, JO, 25 Torn Settings Yield and Spread Analysis 7,939/128.430 3.277/3.221 BMRK 2/17 91 Buy 9 Sell Yield & Spread Graphs Pricing 1 Description S Custom Risk RM7 10/30/25 459200AM3 0AS Workout Spread 80 bp vs 10y 2 02 1522, 6.776 6.703 12:59:49 M.Dur ODur 128.4 Price 8.851 8.756 Risk 2.111650 S A 3.22081 0.567 0.557 out 10/30/2025 3 100.00 consensus 885 on 1MM 02/23 17 Settle 8.894 8.752 Benchmark Risk 1,000 M 995 M Risk Hedge 1,325 M Peau re-raa Proceeds Hedge Invoice Spreads Yield Calculations 1,00 11 G-Sprd 89,0 Street Convention 3,22081 Face 2) I-sprd L01.2 equiv 1 Yr 3.216750 Principal 1,284,300.00 13) Basis 19. U Mmkt (Act/ 360 Accrued (113 Days) 21,972.22 4) z-Sprd 96.1 3.219696 Total (USD) 300,272.22 rue Yie Current Yield ASW 08. 5.450 16) OAS 95.4 1) TED 9N 647022 EST BMT-5.00 H522-2494-0 20 13.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started