Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(1) What is the expected return and standard deviation of a portfolio that is invested 50% in Stock A and 50% in Stock B?

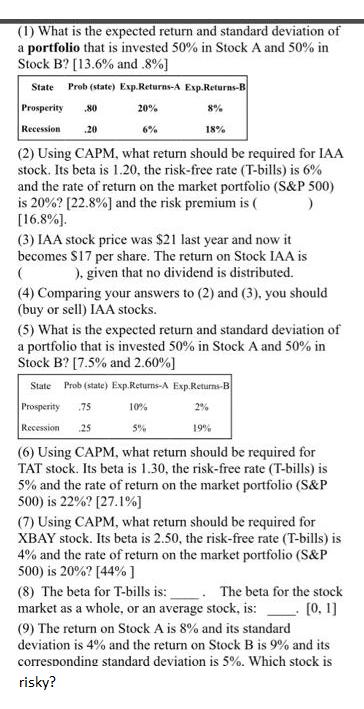

(1) What is the expected return and standard deviation of a portfolio that is invested 50% in Stock A and 50% in Stock B? [13.6% and .8%] State Prob (state) Exp.Returns-A Exp.Returns-B Prosperity .80 20% Recession .20 18% (2) Using CAPM, what return should be required for IAA stock. Its beta is 1.20, the risk-free rate (T-bills) is 6% and the rate of return on the market portfolio (S&P 500) is 20%? [22.8%] and the risk premium is ( [16.8%]. 6% (3) IAA stock price was $21 last year and now it becomes $17 per share. The return on Stock IAA is ( ), given that no dividend is distributed. (4) Comparing your answers to (2) and (3), you should (buy or sell) IAA stocks. (5) What is the expected return and standard deviation of a portfolio that is invested 50% in Stock A and 50% in Stock B? [7.5% and 2.60%] State Prob (state) Exp.Returns-A Exp.Returns-B Prosperity .75 10% 2% Recession 25 5% 19% (6) Using CAPM, what return should be required for TAT stock. Its beta is 1.30, the risk-free rate (T-bills) is 5% and the rate of return on the market portfolio (S&P 500) is 22%? [27.1%] (7) Using CAPM, what return should be required for XBAY stock. Its beta is 2.50, the risk-free rate (T-bills) is 4% and the rate of return on the market portfolio (S&P 500) is 20%? [44%] (8) The beta for T-bills is: market as a whole, or an average stock, is: The beta for the stock [0, 1] (9) The return on Stock A is 8% and its standard deviation is 4% and the return on Stock B is 9% and its corresponding standard deviation is 5%. Which stock is risky?

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 ER stock A080200206 172 Stock B08080201810 Expected return on Sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started