Question

1. What is the goodwill at the acquisition date? 2. What is the ECOBV amortization? 3. Determine the unrealized gain on the sale of the

1. What is the goodwill at the acquisition date?

2. What is the ECOBV amortization?

3. Determine the unrealized gain on the sale of the building from Moore to Kirby in 2020

4. Determine the unrealized profits on the transfer of inventory from Kirby to Moore in

2020 and 2021?

5. Determine the balance of Investment in Kirby at December 2021. The parent company uses the equity method to account for the investment.

6. Determine the balance of Equity in Kirbys earnings at December 2021. The parent company uses the equity method to account for the investment

7. Prepare the consolidation journal entries

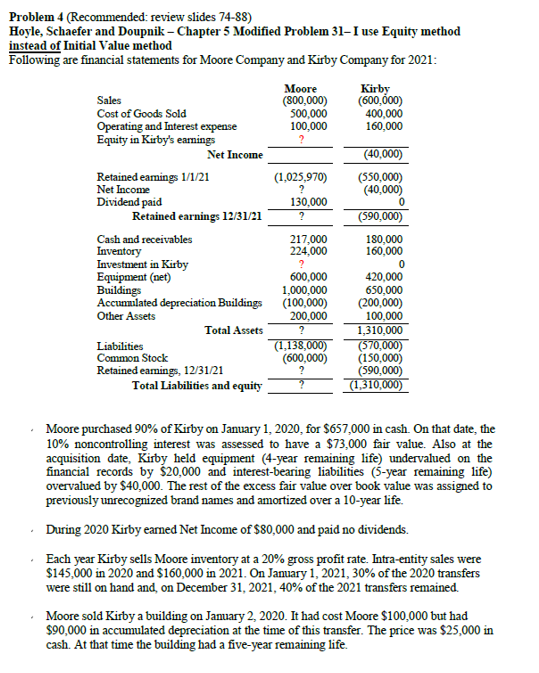

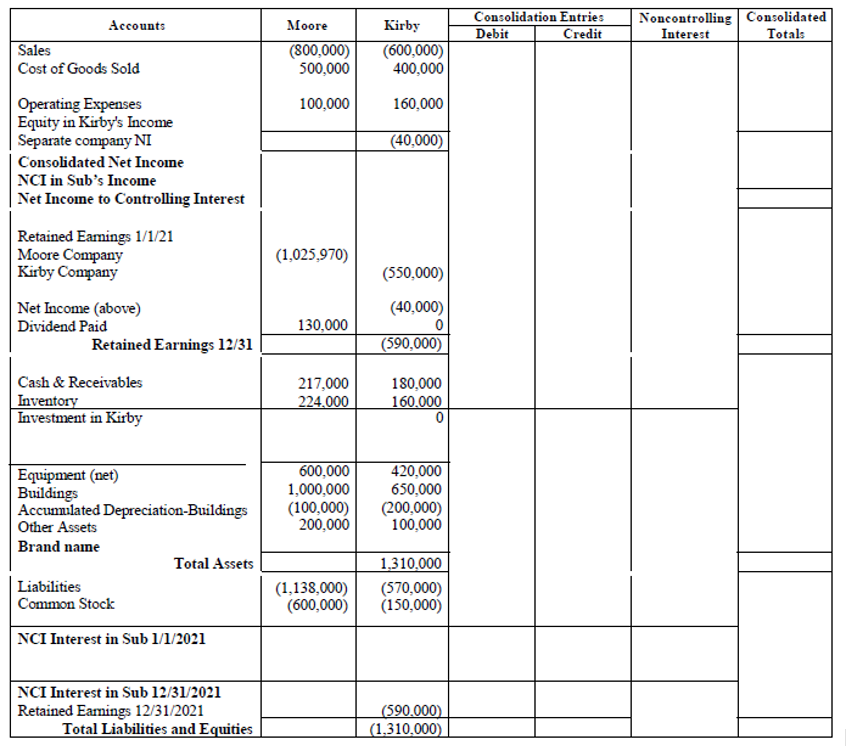

? Problem 4 (Recommended: review slides 74-88) Hoyle, Schaefer and Doupnik - Chapter 5 Modified Problem 31-I use Equity method instead of Initial Value method Following are financial statements for Moore Company and Kirby Company for 2021: Moore Kirby Sales (800,000) (600,000) Cost of Goods Sold 500,000 400,000 Operating and Interest expense 100,000 160,000 Equity in Kirby's earnings Net Income (40,000) Retained eamings 1/1/21 (1,025,970) (550,000) Net Income (40,000) Dividend paid 130,000 Retained earnings 12/31/21 ? (590,000) Cash and receivables 217,000 180,000 Inventory 224,000 160,000 Investment in Kirby 0 Equipment (net) 600,000 420,000 Buildings 1,000,000 650,000 Accumulated depreciation Buildings (100,000) (200,000) Other Assets 200,000 100,000 Total Assets 1,310,000 Liabilities (1,138,000) (570,000) Common Stock (600,000) (150.000) Retained eamings, 12/3121 (590,000) Total Liabilities and equity (1,310,000) Moore purchased 90% of Kirby on January 1, 2020, for $657,000 in cash On that date, the 10% noncontrolling interest was assessed to have a $73,000 fair value. Also at the acquisition date, Kirby held equipment (4-year remaining life) undervalued on the financial records by $20,000 and interest-bearing liabilities (5-year remaining life) overvalued by $40,000. The rest of the excess fair value over book value was assigned to previously unrecognized brand names and amortized over a 10-year life. During 2020 Kirby earned Net Income of $80,000 and paid no dividends. Each year Kirby sells Moore inventory at a 20% gross profit rate. Intra-entity sales were $145,000 in 2020 and $160,000 in 2021. On January 1, 2021, 30% of the 2020 transfers were still on hand and, on December 31, 2021, 40% of the 2021 transfers remained. Moore sold Kirby a building on January 2, 2020. It had cost Moore $100,000 but had $90,000 in accumulated depreciation at the time of this transfer. The price was $25,000 in cash. At that time the building had a five-year remaining life. Consolidation Entries Debit Credit Noncontrolling Consolidated Interest Totals Accounts Sales Cost of Goods Sold Moore (800,000) 500,000 Kirby (600,000) 400,000 100,000 160,000 (40,000) Operating Expenses Equity in Kirby's Income Separate company NI Consolidated Net Income NCI in Sub's Incoine Net Income to Controlling Interest Retained Eamings 1/1/21 Moore Company Kirby Company Net Income (above) Dividend Paid Retained Earnings 12/31 (1,025,970) (550,000) (40,000) 0 (590,000) 130,000 Cash & Receivables Inventory Investment in Kirby 217,000 224.000 180.000 160.000 600,000 1,000,000 (100,000) 200,000 420,000 650,000 (200,000) 100,000 Equipment (net) Buildings Accumulated Depreciation-Buildings Other Assets Brand naine Total Assets Liabilities Common Stock NCI Interest in Sub 1/1/2021 (1,138,000) (600,000) 1,310,000 (570,000) (150,000) NCI Interest in Sub 12/31/2021 Retained Eamings 12/31/2021 Total Liabilities and Equities (590.000) (1,310,000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started