1) What is the lower bound for the price of a call option that has 4 months until expiration when the stock price is $35,

1) What is the lower bound for the price of a call option that has 4 months until expiration when the stock price is $35, the strike price is $33 and the interest rate is 9%? (Assume no dividends).

2) A one-month put option, with a strike of 45, on a non-dividend stock is selling for $2. The stock's current price is $41 and the risk-free interest rate is 5%. Is there an arbitrage and, if so, map out the strategy and sketch the arbitrage payoff diagram.

3) A call and put option both have a strike of $30 and an expiration date of 5 months. They both sell for $4. The underlying stock price is $28. The interest rate is 7%. Identify the arbitrage and map out the strategy including the arbitrage profit.

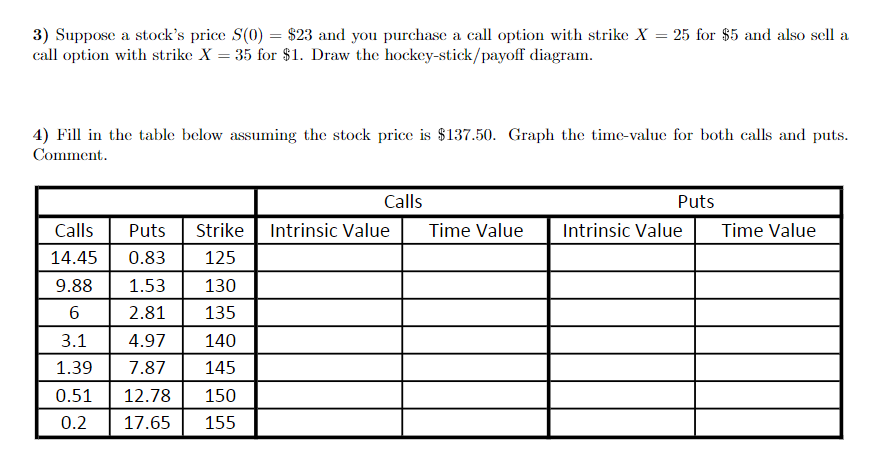

3) Suppose a stock's price S(0) = $23 and you purchase a call option with strike X = 25 for $5 and also sell a call option with strike X = 35 for $1. Draw the hockey-stick/payoff diagram. 4) Fill in the table below assuming the stock price is $137.50. Graph the time-value for both calls and puts. Comment. Calls 14.45 0.83 125 1.53 130 2.81 135 3.1 4.97 140 1.39 7.87 145 9.88 6 Puts Strike Intrinsic Value Time Value Calls 0.51 12.78 150 0.2 17.65 155 Puts Intrinsic Value Time Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started