Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 . What is the NBBO spread? Present it as a pair of prices. 2 . When a new buy limit order for 2 0

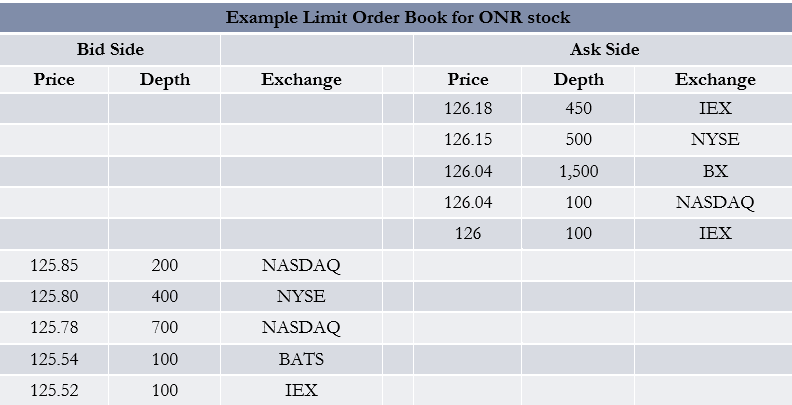

What is the NBBO spread? Present it as a pair of prices. When a new buy limit order for shares with the price of $ arrives on the market, it will be added on the bidask side and above the existing quote with the price of $ When a new sell limit order for shares with the price of $ arrives on the market, it will be added on the bidask side and below the existing quote with the price of $ Assume the limit order book is exactly what you see on the table above that is disregard any events in Questions above Suppose you submit a sell market order for shares. What would be your average execution price? Referring to the question above, what would be the price impact of your order? The following question does not refer to the table above. Suppose you have three dealers on the exchange and they quote the following prices for a stock: a Dealer A: b Dealer B: c Dealer C: What is the market spread on this exchange? Present it as a pair of prices. Suppose you purchased a stock for $ and would like to protect your position with a limit order. What limit order type would you place and what price would you indicate, assuming you are willing to lose at most $ on your position. Assume there are no transaction costs. a Buy stoploss order at $ b Buy stoploss order at $ c Sell stoploss order at $ d Sell stoploss order at $

What is the NBBO spread? Present it as a pair of prices.

When a new buy limit order for shares with the price of $ arrives on the market, it will be added on the bidask side and above the existing quote with the price of $

When a new sell limit order for shares with the price of $ arrives on the market, it will be added on the bidask side and below the existing quote with the price of $

Assume the limit order book is exactly what you see on the table above that is disregard any events in Questions above Suppose you submit a sell market order for shares. What would be your average execution price?

Referring to the question above, what would be the price impact of your order?

The following question does not refer to the table above. Suppose you have three dealers on the exchange and they quote the following prices for a stock:

a Dealer A:

b Dealer B:

c Dealer C:

What is the market spread on this exchange? Present it as a pair of prices.

Suppose you purchased a stock for $ and would like to protect your position with a limit order. What limit order type would you place and what price would you indicate, assuming you are willing to lose at most $ on your position. Assume there are no transaction costs.

a Buy stoploss order at $

b Buy stoploss order at $

c Sell stoploss order at $

d Sell stoploss order at $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started