Answered step by step

Verified Expert Solution

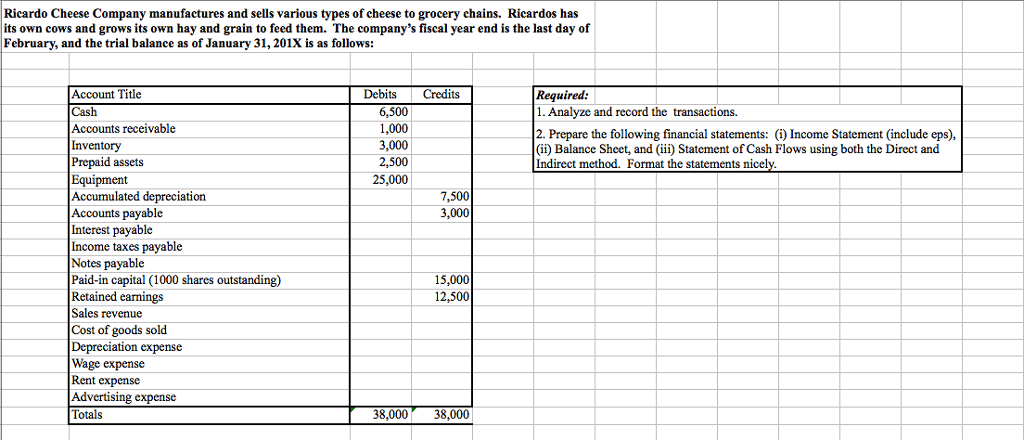

Question

1 Approved Answer

1, What is the Net Income for the month of February? 2, What is the ending balance in Retained Earnings at the end Feb? The

1, What is the Net Income for the month of February?

2, What is the ending balance in Retained Earnings at the end Feb?

| The following transactions occurred during February: | ||||||||||

| Feb | ||||||||||

| 1 | Borrowed $12,000, signing a 6 year, 6% note payable. | |||||||||

| 2 | Sold 500 lb blue cheese, 300 lb gouda, 400 lb parmesan, and 200 lb limburger for $6,500 cash. | |||||||||

| 4 | Received an invoice for $300 from the local newspaper for an advertisement to appear in March. | |||||||||

| 8 | Sold 300 lb romano, 800 lb cheddar, and 1 ton of cottage cheese on account for $12,000. | |||||||||

| 9 | Purchased on account: rennet, sodium chloride, salt (not iodized), thermophilic bacteria, and mesophilic bacteria for use in manufacturing cheese, $2,200. | |||||||||

| 13 | Received $6,200 from customers who previously purchased on account. | |||||||||

| 16 | Paid monthly rent ($1,200) to the owner of the manufacturing facility for March. | |||||||||

| 18 | Paid a cash dividend of $2,200 to shareholders. | |||||||||

| 21 | Paid trade vendors $3,500 of the balance due. | |||||||||

| 28 | Purchased equipment, paying $2,000 cash and signing a two year, 8% note for $4,000. | |||||||||

| 28 | Paid salaries, $4,200. Employees are paid once a month on the last day of the month | |||||||||

| Information for end-of-period adjusting entries: | ||||||||||

| a. | A physical count of inventory at month end indicated a balance of $2,100. | |||||||||

| b. | Depreciation on equipment, $850. | |||||||||

| c. | Interest accrued on notes payable (show calculation). | 60 | ||||||||

| d. | Income tax expense, $2,500, payable in June. | |||||||||

| e. | Recognized rent expense for the month of February. | |||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started