Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What is the payback period for each of these investments? 2. What is the NPV of each of these investments if the annual cash-flows

1. What is the payback period for each of these investments?

2. What is the NPV of each of these investments if the annual cash-flows are discounted by 14%?

3. What is the IRR of each of these investments?

4. Briefly address the arguments made by each of the four senior managers and explain what (if anything) is wrong with their arguments?

5. Which of the project(s) should the CFO recommend to the CEO. Explain your reasoning for each project selected.

6. If only one could be funded, which one should it be? Why did you select that project?

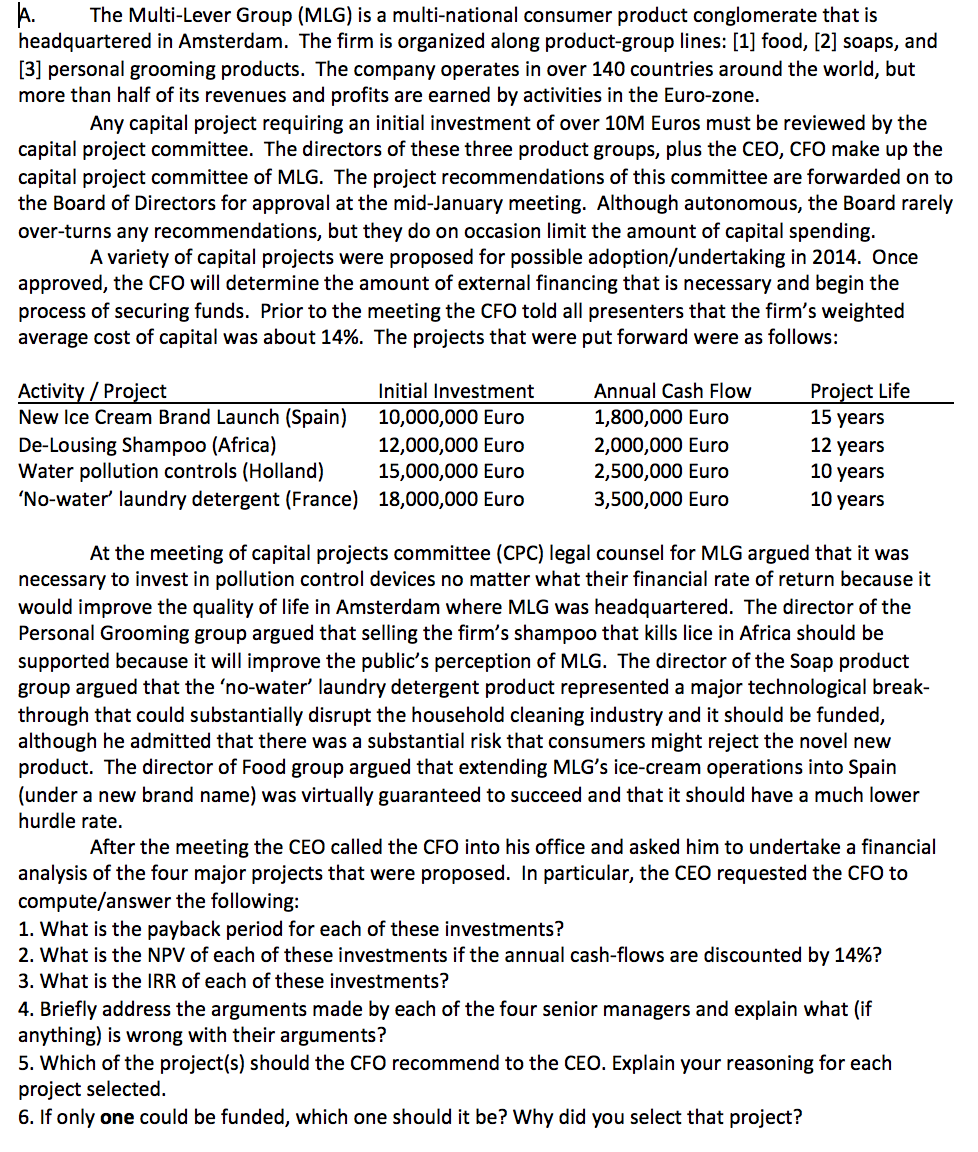

A. The Multi-Lever Group (MLG) is a multi-national consumer product conglomerate that is headquartered in Amsterdam. The firm is organized along product-group lines: [1] food, [2] soaps, and [3] personal grooming products. The company operates in over 140 countries around the world, but more than half of its revenues and profits are earned by activities in the Euro-zone. Any capital project requiring an initial investment of over 10M Euros must be reviewed by the capital project committee. The directors of these three product groups, plus the CEO, CFO make up the capital project committee of MLG. The project recommendations of this committee are forwarded on to the Board of Directors for approval at the mid-January meeting. Although autonomous, the Board rarely over-turns any recommendations, but they do on occasion limit the amount of capital spending. A variety of capital projects were proposed for possible adoption/undertaking in 2014. Once approved, the CFO will determine the amount of external financing that is necessary and begin the process of securing funds. Prior to the meeting the CFO told all presenters that the firm's weighted average cost of capital was about 14%. The projects that were put forward were as follows: Project Life Activity / Project Initial Investment New Ice Cream Brand Launch (Spain) 10,000,000 Euro De-Lousing Shampoo (Africa) 12,000,000 Euro Water pollution controls (Holland) 15,000,000 Euro 'No-water' laundry detergent (France) 18,000,000 Euro Annual Cash Flow 1,800,000 Euro 2,000,000 Euro 2,500,000 Euro 3,500,000 Euro 15 years 12 years 10 years 10 years At the meeting of capital projects committee (CPC) legal counsel for MLG argued that it was necessary to invest in pollution control devices no matter what their financial rate of return because it would improve the quality of life in Amsterdam where MLG was headquartered. The director of the Personal Grooming group argued that selling the firm's shampoo that kills lice in Africa should be supported because it will improve the public's perception of MLG. The director of the Soap product group argued that the 'no-water' laundry detergent product represented a major technological break- through that could substantially disrupt the household cleaning industry and it should be funded, although he admitted that there was a substantial risk that consumers might reject the novel new product. The director of Food group argued that extending MLG's ice-cream operations into Spain (under a new brand name) was virtually guaranteed to succeed and that it should have a much lower hurdle rate. After the meeting the CEO called the CFO into his office and asked him to undertake a financial analysis of the four major projects that were proposed. In ticular, the CEO requested the CFO to compute/answer the following: 1. What is the payback period for each of these investments? 2. What is the NPV of each of these investments if the annual cash-flows are discounted by 14%? 3. What is the IRR of each of these investments? 4. Briefly address the arguments made by each of the four senior managers and explain what (if anything) is wrong with their arguments? 5. Which of the project(s) should the CFO recommend to the CEO. Explain your reasoning for each project selected. 6. If only one could be funded, which one should it be? Why did you select that projectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started