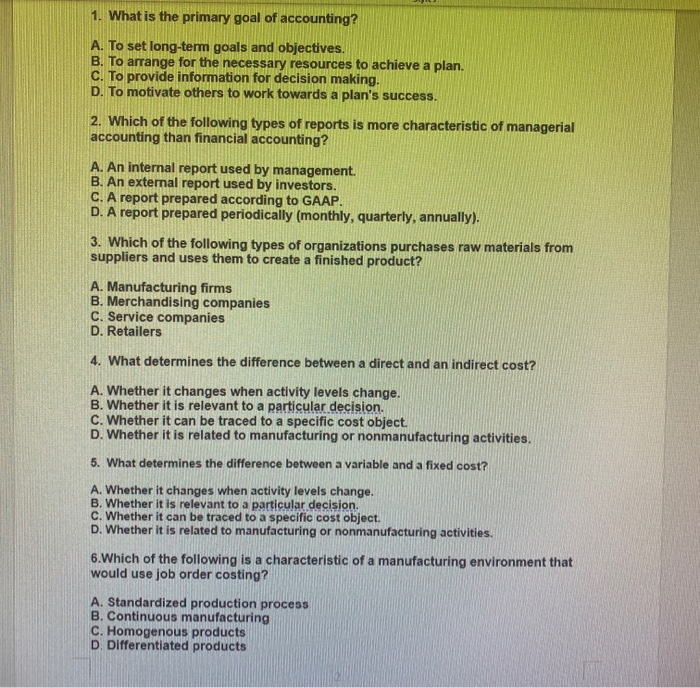

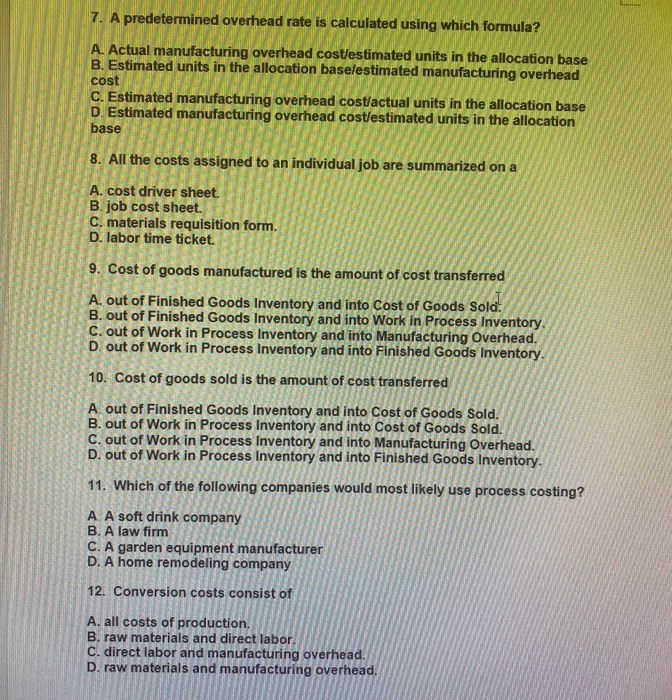

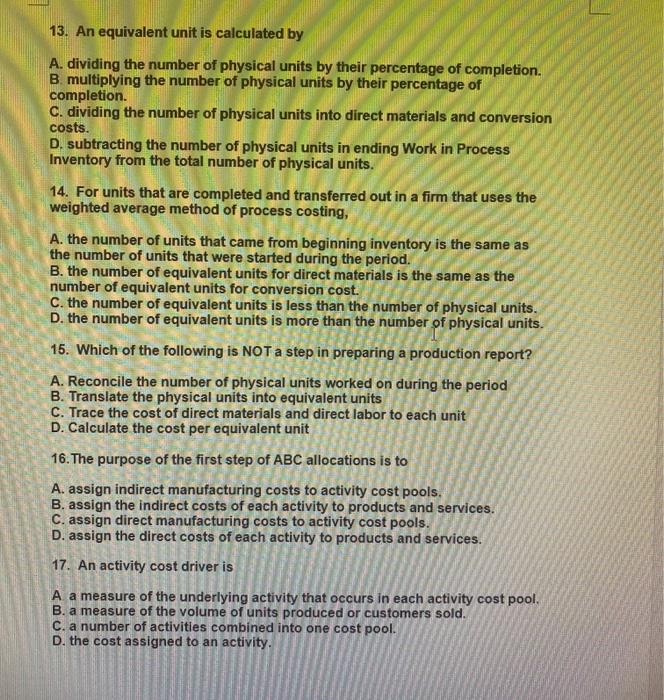

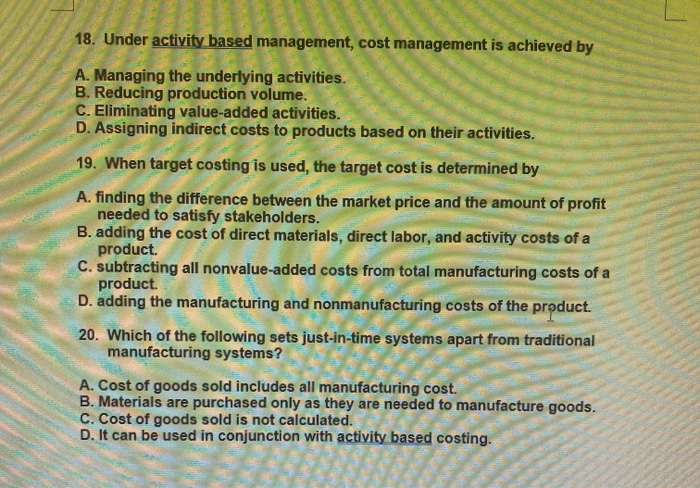

1. What is the primary goal of accounting? A. To set long-term goals and objectives. B. To arrange for the necessary resources to achieve a plan. C. To provide information for decision making. D. To motivate others to work towards a plan's success. 2. Which of the following types of reports is more characteristic of managerial accounting than financial accounting? A. An internal report used by management. B. An external report used by investors. C. A report prepared according to GAAP. D. A report prepared periodically (monthly, quarterly, annually). 3. Which of the following types of organizations purchases raw materials from suppliers and uses them to create a finished product? A. Manufacturing firms B. Merchandising companies C. Service companies D. Retailers 4. What determines the difference between a direct and an indirect cost? A. Whether it changes when activity levels change. B. Whether it is relevant to a particular decision. C. Whether it can be traced to a specific cost object. D. Whether it is related to manufacturing or nonmanufacturing activities. 5. What determines the difference between a variable and a fixed cost? A. Whether it changes when activity levels change. B. Whether it is relevant to a particular decision. C. Whether it can be traced to a specific cost object. D. Whether it is related to manufacturing or nonmanufacturing activities. 6.Which of the following is a characteristic of a manufacturing environment that would use job order costing? A. Standardized production process B. Continuous manufacturing C. Homogenous products D. Differentiated products 7. A predetermined overhead rate is calculated using which formula? A. Actual manufacturing overhead cost/estimated units in the allocation base B. Estimated units in the allocation baselestimated manufacturing overhead cost C. Estimated manufacturing overhead cost/actual units in the allocation base D Estimated manufacturing overhead cost estimated units in the allocation base 8. All the costs assigned to an individual job are summarized on a A. cost driver sheet. B job cost sheet. C. materials requisition form. D. labor time ticket. 9. Cost of goods manufactured is the amount of cost transferred A. out of Finished Goods Inventory and into Cost of Goods Sold B. out of Finished Goods Inventory and into Work in Process Inventory. C. out of Work in Process Inventory and into Manufacturing Overhead. Dout of Work in Process Inventory and into Finished Goods Inventory. 10. Cost of goods sold is the amount of cost transferred A out of Finished Goods Inventory and into Cost of Goods Sold. B. out of Work in Process Inventory and into Cost of Goods Sold. C. out of Work in Process Inventory and into Manufacturing Overhead. D. out of Work in Process Inventory and into Finished Goods Inventory. 11. Which of the following companies would most likely use process costing? A. A soft drink company B. A law firm C. A garden equipment manufacturer D. A home remodeling company 12. Conversion costs consist of A. all costs of production. B. raw materials and direct labor. C. direct labor and manufacturing overhead. D. raw materials and manufacturing overhead. 13. An equivalent unit is calculated by A. dividing the number of physical units by their percentage of completion B. multiplying the number of physical units by their percentage of completion. C. dividing the number of physical units into direct materials and conversion costs. D. subtracting the number of physical units in ending Work in Process Inventory from the total number of physical units. 14. For units that are completed and transferred out in a firm that uses the weighted average method of process costing, A. the number of units that came from beginning inventory is the same as the number of units that were started during the period. B. the number of equivalent units for direct materials is the same as the number of equivalent units for conversion cost. C. the number of equivalent units is less than the number of physical units. D. the number of equivalent units is more than the number of physical units. 15. Which of the following is NOT a step in preparing a production report? 33333333 A. Reconcile the number of physical units worked on during the period B. Translate the physical units into equivalent units C. Trace the cost of direct materials and direct labor to each unit D. Calculate the cost per equivalent unit 16. The purpose of the first step of ABC allocations is to A. assign indirect manufacturing costs to activity cost pools. B. assign the indirect costs of each activity to products and services. C. assign direct manufacturing costs to activity cost pools. D. assign the direct costs of each activity to products and services. 17. An activity cost driver is A a measure of the underlying activity that occurs in each activity cost pool. B. a measure of the volume of units produced or customers sold. C. a number of activities combined into one cost pool. D. the cost assigned to an activity. 18. Under activity based management, cost management is achieved by A. Managing the underlying activities. B. Reducing production volume. C. Eliminating value-added activities. D. Assigning indirect costs to products based on their activities. 19. When target costing is used, the target cost is determined by A. finding the difference between the market price and the amount of profit needed to satisfy stakeholders. B. adding the cost of direct materials, direct labor, and activity costs of a product. C. subtracting all nonvalue-added costs from total manufacturing costs of a product D. adding the manufacturing and nonmanufacturing costs of the product. 20. Which of the following sets just-in-time systems apart from traditional manufacturing systems? A. Cost of goods sold includes all manufacturing cost. B. Materials are purchased only as they are needed to manufacture goods. C. Cost of goods sold is not calculated. D. It can be used in conjunction with activity based costing