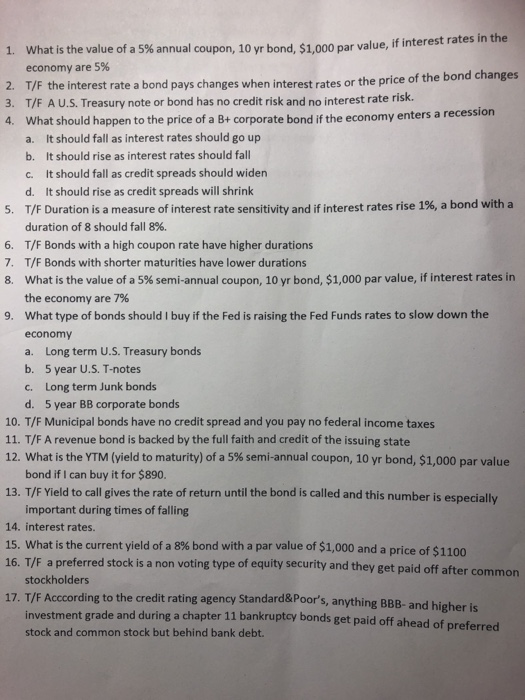

1. What is the value of a 5% annual coupon, 10 vr bond. $1.000 par value, if interest rates in the economy are 5% 2. T/F the interest rate a bond pays changes when interest rates or the price of the bond changes 3. T/F A U.S. Treasury note or bond has no credit risk and no interest rate risk. 4. What should happen to the price of a B+ corporate bond if the economy enters a recession a. It should fall as interest rates should go up b. It should rise as interest rates should fall C. It should fall as credit spreads should widen d. It should rise as credit spreads will shrink 5. T/F Duration is a measure of interest rate sensitivity and if interest rates rise 1%, a bond with a duration of 8 should fall 8%. 6. T/F Bonds with a high coupon rate have higher durations 7. T/F Bonds with shorter maturities have lower durations 8. What is the value of a 5% semi-annual coupon, 10 yr bond, $1,000 par value, if interest rates in the economy are 7% 9. What type of bonds should I buy if the Fed is raising the Fed Funds rates to slow down the economy a. Long term U.S. Treasury bonds b. 5 year U.S. T-notes C. Long term Junk bonds d. 5 year BB corporate bonds 10. T/F Municipal bonds have no credit spread and you pay no federal income taxes 11. T/F A revenue bond is backed by the full faith and credit of the issuing state 12. What is the YTM (yield to maturity) of a 5% semi-annual coupon, 10 yr bond, $1,000 par value bond if I can buy it for $890. 13. T/F Yield to call gives the rate of return until the bond is called and this number is especially important during times of falling 14. interest rates. 15. What is the current yield of a 8% bond with a par value of $1,000 and a price of $1100 16. T/F a preferred stock is a non voting type of equity security and they get paid off after common stockholders 17. T/F Acccording to the credit rating agency Standard&Poor's, anything BBB-and higher is Investment grade and during a chapter 11 bankruptcy bonds get paid off ahead of preferred stock and common stock but behind bank debt