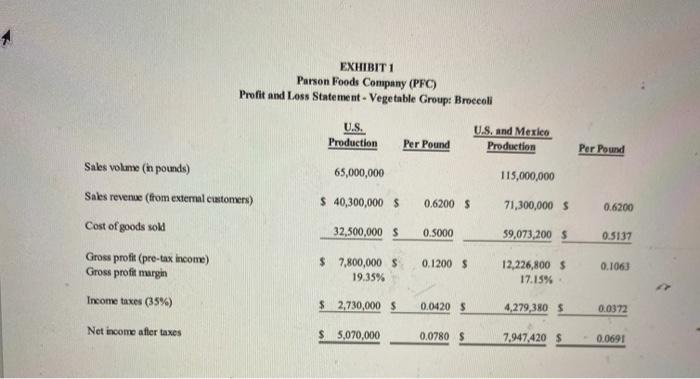

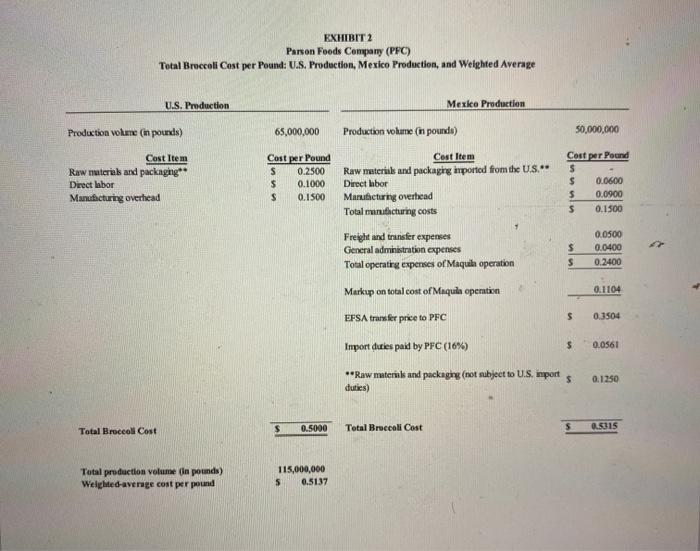

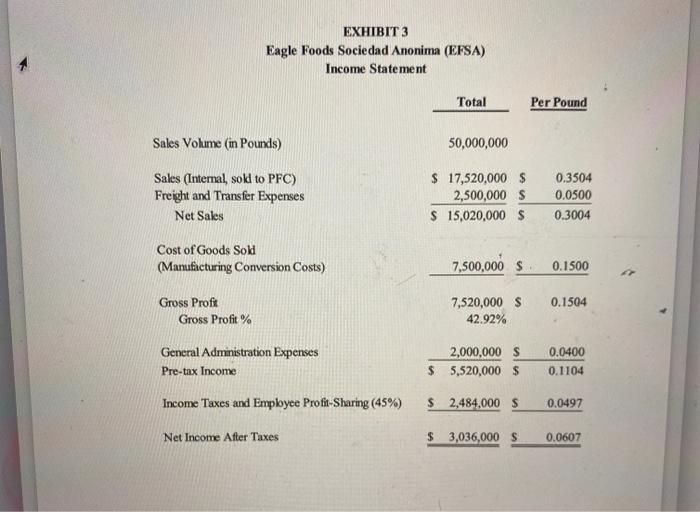

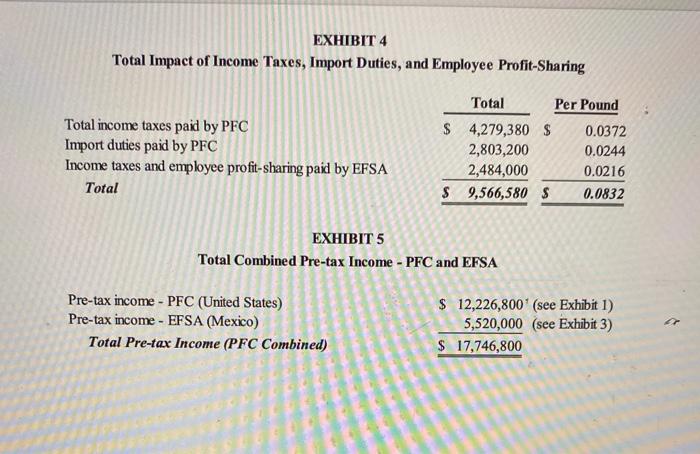

1. What markup is EFSA currently charging? Is EFSA in compliance with the maquiladora Safe Harbor provisions for transfer pricing? Please provide a single numerical answer here. Show calculations for markup in the spreadsheet tab labelled (Q1) markup. Be certain to use formulas in your spreadsheet. You are expected to I provide a written response to the second part of this question here. 2. What conditions might exist that encourage EFSA management not to charge the minimum allowable transfer price under the Safe Harbor provisions? 1 3. Calculate the minimum allowable maquiladora transfer price per pound under the Safe Harbor provisions. Using this new transfer price, calculate PFC's revised (a) total broccoli costs from EFSA (including import duties) and (b) combined weighted average broccoli cost. EXHIBIT 1 Parson Foods Company (PFC) Profit and Loss Statement - Vegetable Group: Broccoli U.S. U.S. and Mexico Production Per Pound Production 65,000,000 115,000,000 Per Pound Sales volume (in pounds) Sales revenue (from external customers) $ 40,300,000 $ 0.6200 S 71,300,000 $ 0.6200 Cost of goods sold 32,500,000 $ 0.5000 59,073,200 $ 0.5137 0.1200 $ Gross profit (pre-tax income) Gross profit margin Income taxes (35%) $ 7,800,000 $ 19.35% 12,226,800 $ 17.15% 0.1063 $ 2,730,000 $ 0.0420 $ 4,279,380 $ 0.0372 Net income after taxes $ 5,070,000 0.0780 $ 7,947,420 $ 0.0691 EXHIBIT 2 Parson Foods Company (PFC) Total Broccoli Cost per Pound: U.S. Production, Mexico Production, and weighted Average U.S. Production Mexico Production Production volume (in pounds) 65,000,000 Production volume (in pounds) 50,000,000 Cost Item Raw materials and packaging** Direct labor Manufacturing overhead Cost per Pound S 0.2500 $ 0.1000 $ 0.1500 Cost Item Raw materials and packaging imported from the U.S." Direct labor Manufacturing overhead Total murudheturing costs Cost per Pound s $ 0.0600 $ 0.0900 $ 0.1500 Freight and transfer expenses General administration expenses Total operating expenses of Maquil operation $ s 0.0500 0.0400 0.2400 0.1104 Markup on total cost of Maquin operation EFSA transfer price to PFC $ 0.3504 Import duties paid by PFC(16%) $ 0.0561 **Raw materials and packaghe (not subject to U.S. Import duties) $ 0.1250 $ Total Broccoli Cost 0.5000 s Total Broccoli Cost 0.5315 Total production volume da pounds) Weighted average cost per pound 115,000,000 5 0.5137 EXHIBIT 3 Eagle Foods Sociedad Anonima (EFSA) Income Statement Total Per Pound Sales Volume (in Pounds) 50,000,000 Sales (Internal, sold to PFC) Freight and Transfer Expenses Net Sales $ 17,520,000 $ 2,500,000 $ $ 15,020,000 $ 0.3504 0.0500 0.3004 Cost of Goods Sold (Manufacturing Conversion Costs) 7,500,000 $ 0.1500 0.1504 Gross Proft Gross Profit % 7,520,000 $ 42.92% General Administration Expenses Pre-tax Income 2,000,000 $ $ 5,520,000 $ 0.0400 0.1104 Income Taxes and Employee Profit-Sharing (45%) $ 2,484,000 $ 0.0497 Net Income After Taxes $ 3,036,000 0.060 EXHIBIT 4 Total Impact of Income Taxes, Import Duties, and Employee Profit-Sharing Total income taxes paid by PFC Import duties paid by PFC Income taxes and employee profit-sharing paid by EFSA Total Total Per Pound $ 4,279,380 $ 0.0372 2,803,200 0.0244 2,484,000 0.0216 $ 9,566,580 S 0.0832 EXHIBIT 5 Total Combined Pre-tax Income - PFC and EFSA Pre-tax income - PFC (United States) Pre-tax income - EFSA (Mexico) Total Pre-tax Income (PFC Combined) $ 12,226,800 (see Exhibit 1) 5,520,000 (see Exhibit 3) $ 17,746,800 1. What markup is EFSA currently charging? Is EFSA in compliance with the maquiladora Safe Harbor provisions for transfer pricing? Please provide a single numerical answer here. Show calculations for markup in the spreadsheet tab labelled (Q1) markup. Be certain to use formulas in your spreadsheet. You are expected to I provide a written response to the second part of this question here. 2. What conditions might exist that encourage EFSA management not to charge the minimum allowable transfer price under the Safe Harbor provisions? 1 3. Calculate the minimum allowable maquiladora transfer price per pound under the Safe Harbor provisions. Using this new transfer price, calculate PFC's revised (a) total broccoli costs from EFSA (including import duties) and (b) combined weighted average broccoli cost. EXHIBIT 1 Parson Foods Company (PFC) Profit and Loss Statement - Vegetable Group: Broccoli U.S. U.S. and Mexico Production Per Pound Production 65,000,000 115,000,000 Per Pound Sales volume (in pounds) Sales revenue (from external customers) $ 40,300,000 $ 0.6200 S 71,300,000 $ 0.6200 Cost of goods sold 32,500,000 $ 0.5000 59,073,200 $ 0.5137 0.1200 $ Gross profit (pre-tax income) Gross profit margin Income taxes (35%) $ 7,800,000 $ 19.35% 12,226,800 $ 17.15% 0.1063 $ 2,730,000 $ 0.0420 $ 4,279,380 $ 0.0372 Net income after taxes $ 5,070,000 0.0780 $ 7,947,420 $ 0.0691 EXHIBIT 2 Parson Foods Company (PFC) Total Broccoli Cost per Pound: U.S. Production, Mexico Production, and weighted Average U.S. Production Mexico Production Production volume (in pounds) 65,000,000 Production volume (in pounds) 50,000,000 Cost Item Raw materials and packaging** Direct labor Manufacturing overhead Cost per Pound S 0.2500 $ 0.1000 $ 0.1500 Cost Item Raw materials and packaging imported from the U.S." Direct labor Manufacturing overhead Total murudheturing costs Cost per Pound s $ 0.0600 $ 0.0900 $ 0.1500 Freight and transfer expenses General administration expenses Total operating expenses of Maquil operation $ s 0.0500 0.0400 0.2400 0.1104 Markup on total cost of Maquin operation EFSA transfer price to PFC $ 0.3504 Import duties paid by PFC(16%) $ 0.0561 **Raw materials and packaghe (not subject to U.S. Import duties) $ 0.1250 $ Total Broccoli Cost 0.5000 s Total Broccoli Cost 0.5315 Total production volume da pounds) Weighted average cost per pound 115,000,000 5 0.5137 EXHIBIT 3 Eagle Foods Sociedad Anonima (EFSA) Income Statement Total Per Pound Sales Volume (in Pounds) 50,000,000 Sales (Internal, sold to PFC) Freight and Transfer Expenses Net Sales $ 17,520,000 $ 2,500,000 $ $ 15,020,000 $ 0.3504 0.0500 0.3004 Cost of Goods Sold (Manufacturing Conversion Costs) 7,500,000 $ 0.1500 0.1504 Gross Proft Gross Profit % 7,520,000 $ 42.92% General Administration Expenses Pre-tax Income 2,000,000 $ $ 5,520,000 $ 0.0400 0.1104 Income Taxes and Employee Profit-Sharing (45%) $ 2,484,000 $ 0.0497 Net Income After Taxes $ 3,036,000 0.060 EXHIBIT 4 Total Impact of Income Taxes, Import Duties, and Employee Profit-Sharing Total income taxes paid by PFC Import duties paid by PFC Income taxes and employee profit-sharing paid by EFSA Total Total Per Pound $ 4,279,380 $ 0.0372 2,803,200 0.0244 2,484,000 0.0216 $ 9,566,580 S 0.0832 EXHIBIT 5 Total Combined Pre-tax Income - PFC and EFSA Pre-tax income - PFC (United States) Pre-tax income - EFSA (Mexico) Total Pre-tax Income (PFC Combined) $ 12,226,800 (see Exhibit 1) 5,520,000 (see Exhibit 3) $ 17,746,800