Question

1. What method of depreciation does the company use? 2. What is the amount of accumulated depreciation and amortization at the end of the most

1. What method of depreciation does the company use?

| 2. What is the amount of accumulated depreciation and amortization at the end of the most recent reporting year? | |

| 3. For depreciation purposes, what is the estimated useful life of furniture and fixtures? | |

| 4. What was the original cost of leasehold improvements owned by the company at the end of the most recent reporting year? | |

| 5. What amount of depreciation and amortization was reported as expense for the most recent reporting year? | |

6. What is the companys fixed asset turnover ratio for the most recent year? What does it suggest?

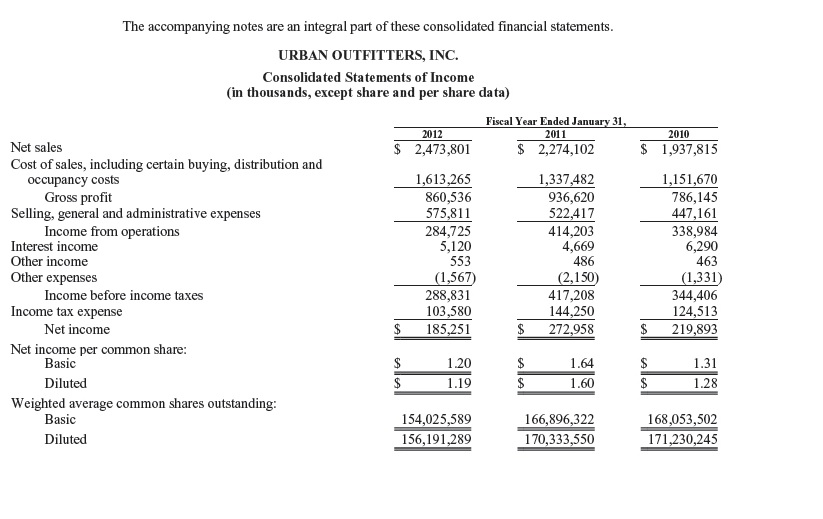

The accompanying notes are an integral part of these consolidated financial statements URBAN OUTFITTERS, INC. Consolidated Statements of Income (in thousands, except share and per share data) Fiscal Year Ended January 31 2011 2012 2010 Net sales Cost of sales, including certain buying, distribution and S 2,473,801 2,274,102 S 1,937,815 1,613,265 860,536 575,811 284,725 5,120 553 1,337,482 936,620 522,417 414,203 4,669 486 1,151,670 786,145 447,161 338,984 6,290 463 (1,331) 344,406 124,513 S 219,893 cy costs Gross profit Selling, general and administrative expenses Income from operations Interest income Other income Other expenses (2,150) Income before income taxes Net income Basic 288,831 103,580 $185,251 417,208 144,250 S 272,958 Income tax expense Net income per common share 1.20 1.19 1.64 1.60 1.31 1.28 Diluted Weighted average common shares outstanding Basic Diluted 154,025,589 156,191,289 166,896,322 170,333,550 168,053,502 171,230,245

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started