Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What type of accounting change is a change from the double-declining-balance method of depreciation to the straigh method for previously recorded assets as a

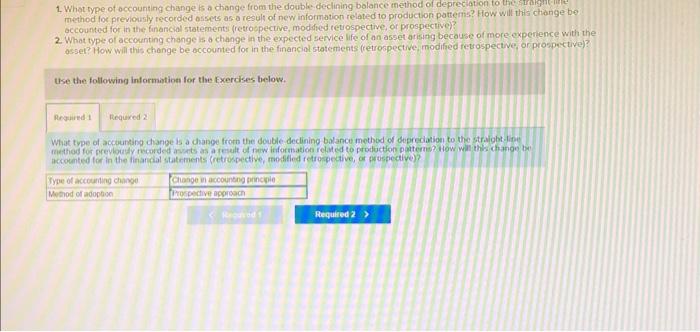

1. What type of accounting change is a change from the double-declining-balance method of depreciation to the straigh method for previously recorded assets as a result of new information related to production patterns? How will this change be accounted for in the financial statements (retrospective, modified retrospective, or prospective)?

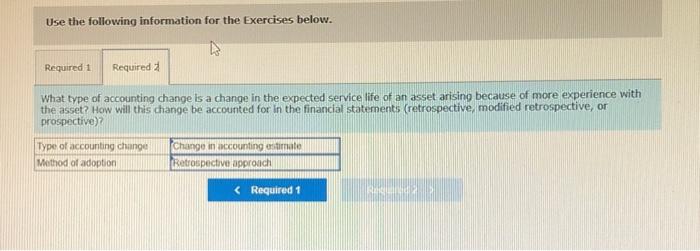

2. What type of accounting change is a change in the expected service life of an asset arising because of more experience with the asset? How will this change be accounted for in the financial statements (retrospective, modified retrospective, or prospective)? Use the following information for the Exercises below. Required 1 Required 2 What type of accounting change is a change from the double-declining-balance method of depreciation to the straight-line method for previously recorded assets as a result of new information related to production patterns? How will this change be accounted for in the financial statements (retrospective, modified retrospective, or prospective)? Type of accounting change Method of adoption Change in accounting principle Prospective approach

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started