1) What type of strategy is the Waterford Spinning Mills acquisition based on? What are the specific risks & benefits DCC faces as a result?Has

1) What type of strategy is the Waterford Spinning Mills acquisition based on? What are the specific risks & benefits DCC faces as a result?Has it worked out as planed for DCC?

2) What business-level strategy is DCC performing and how well does its competitive advantage support it?

3)What type of strategy decision does the Elite Carpet opportunity represent? What would be logic of pursuing it and factors would Jim need to consider before deciding on it? If acquired, what would need to be done in order for it to meet Jim's expectations

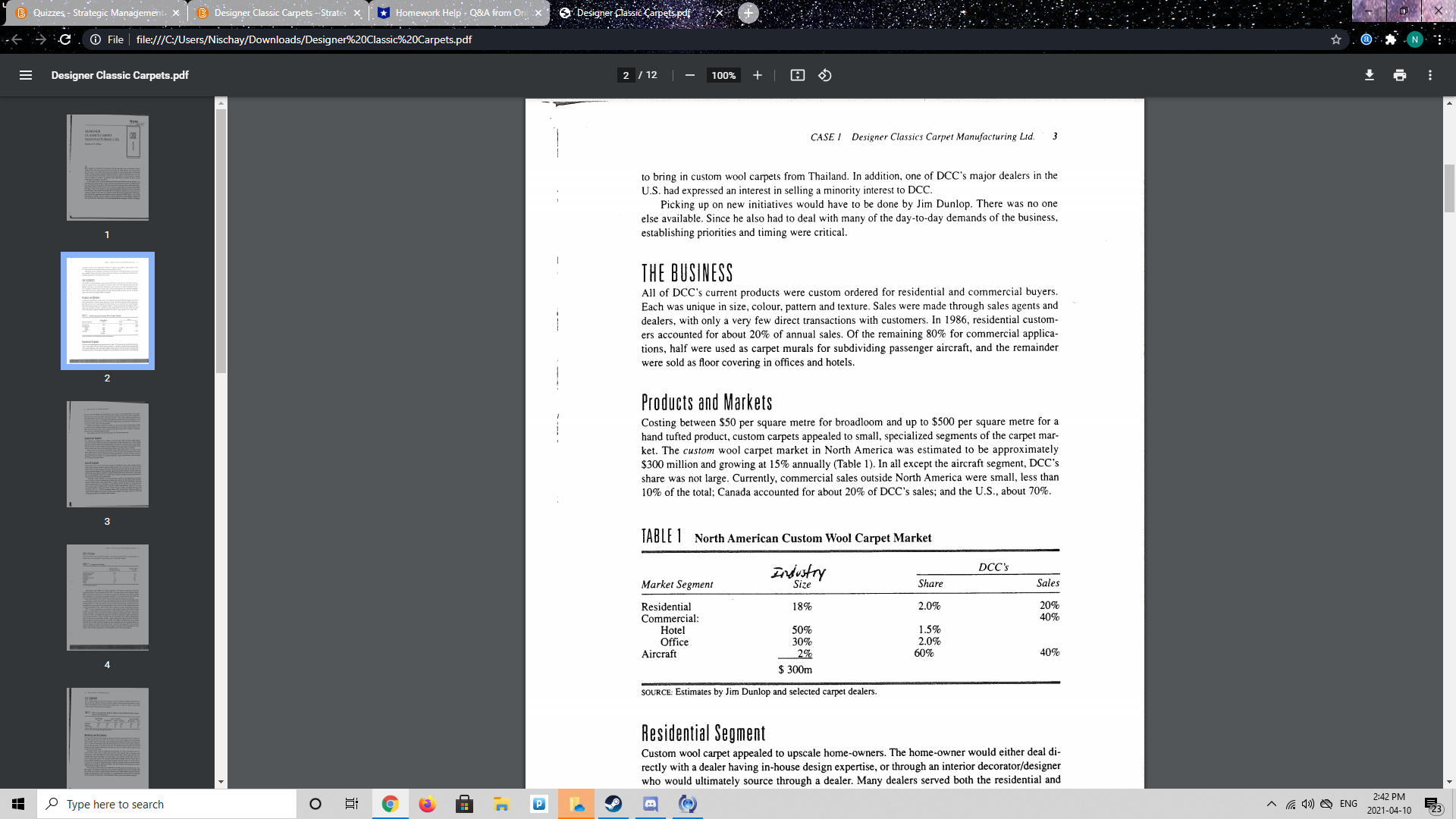

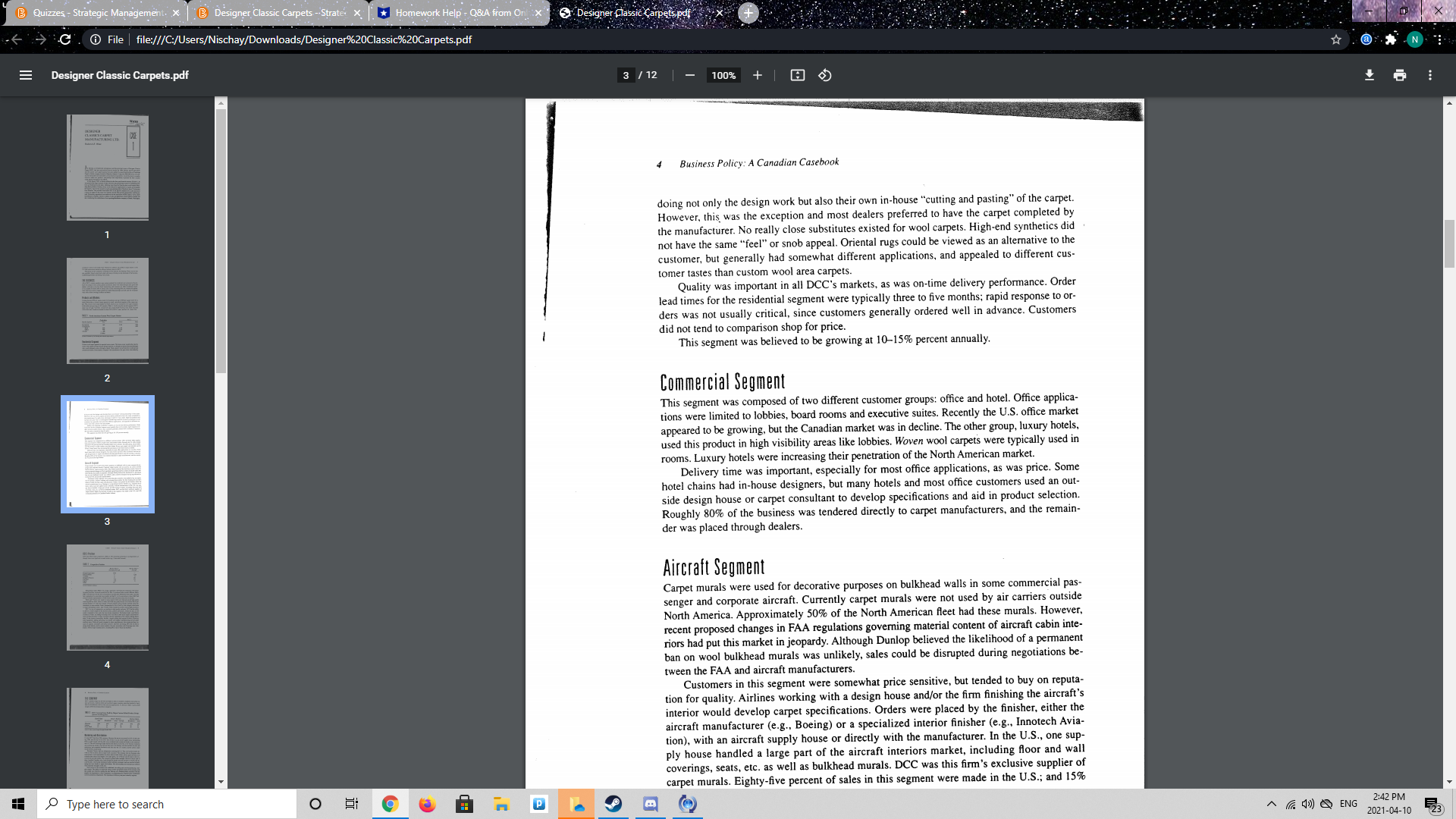

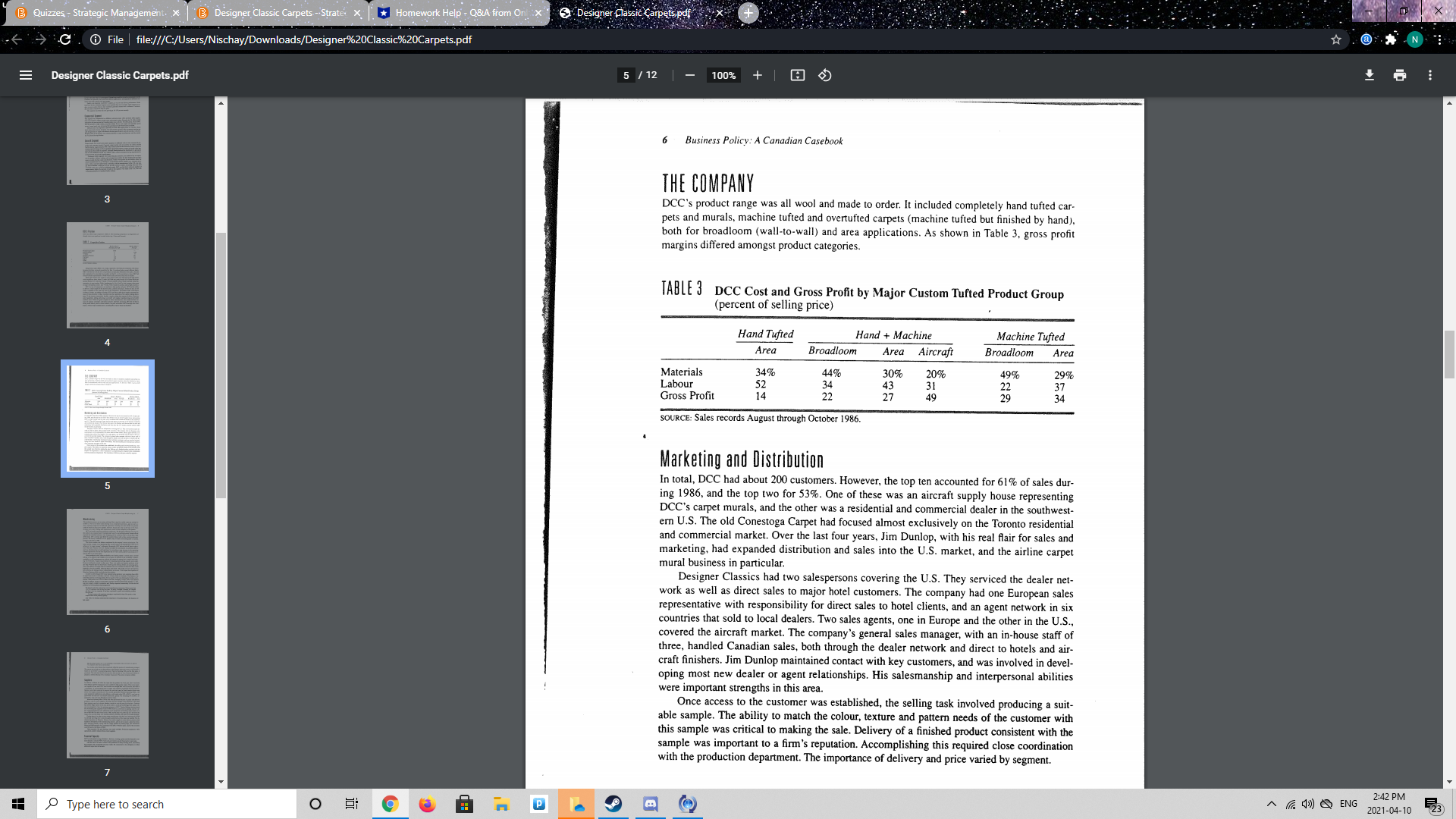

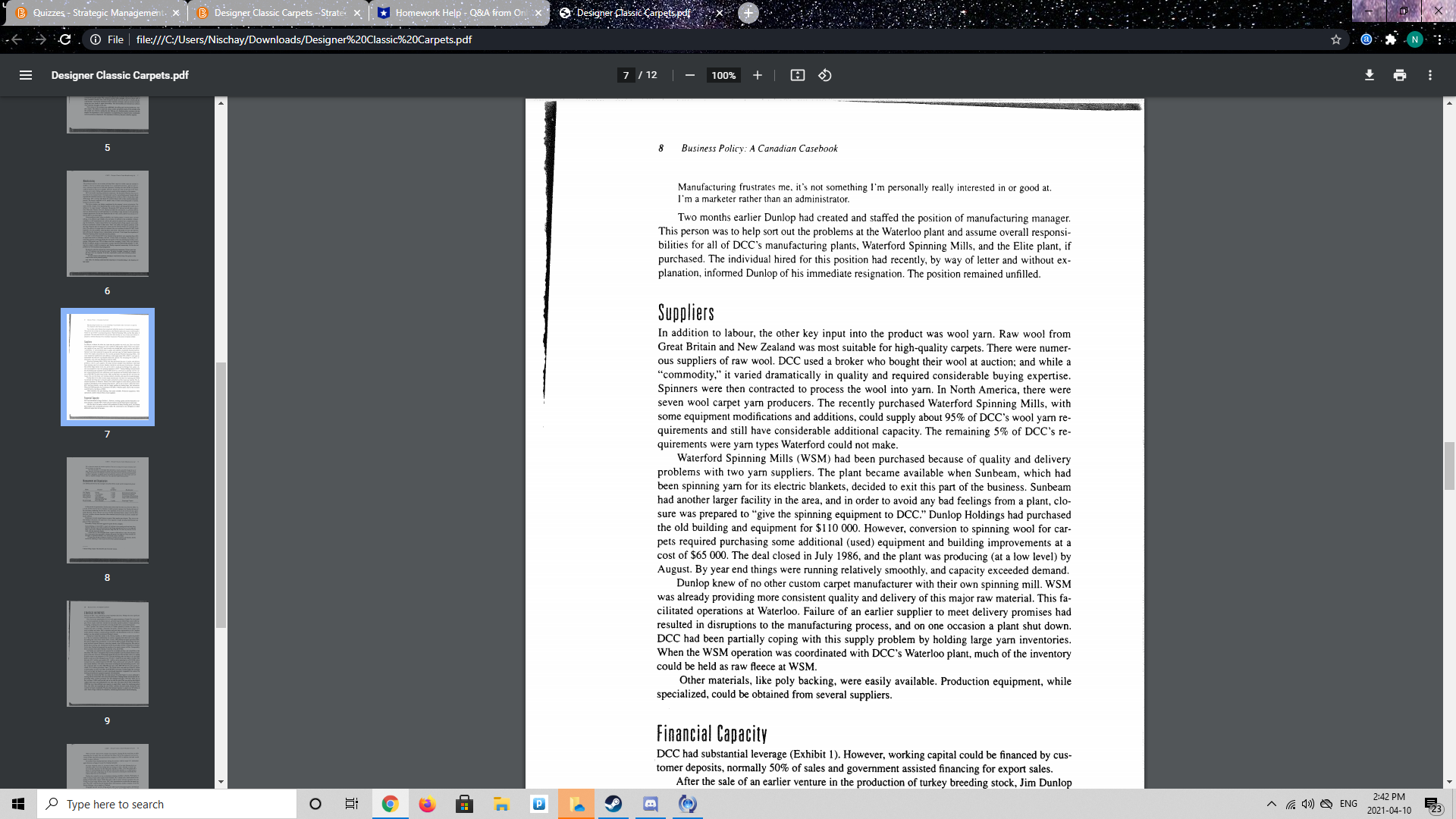

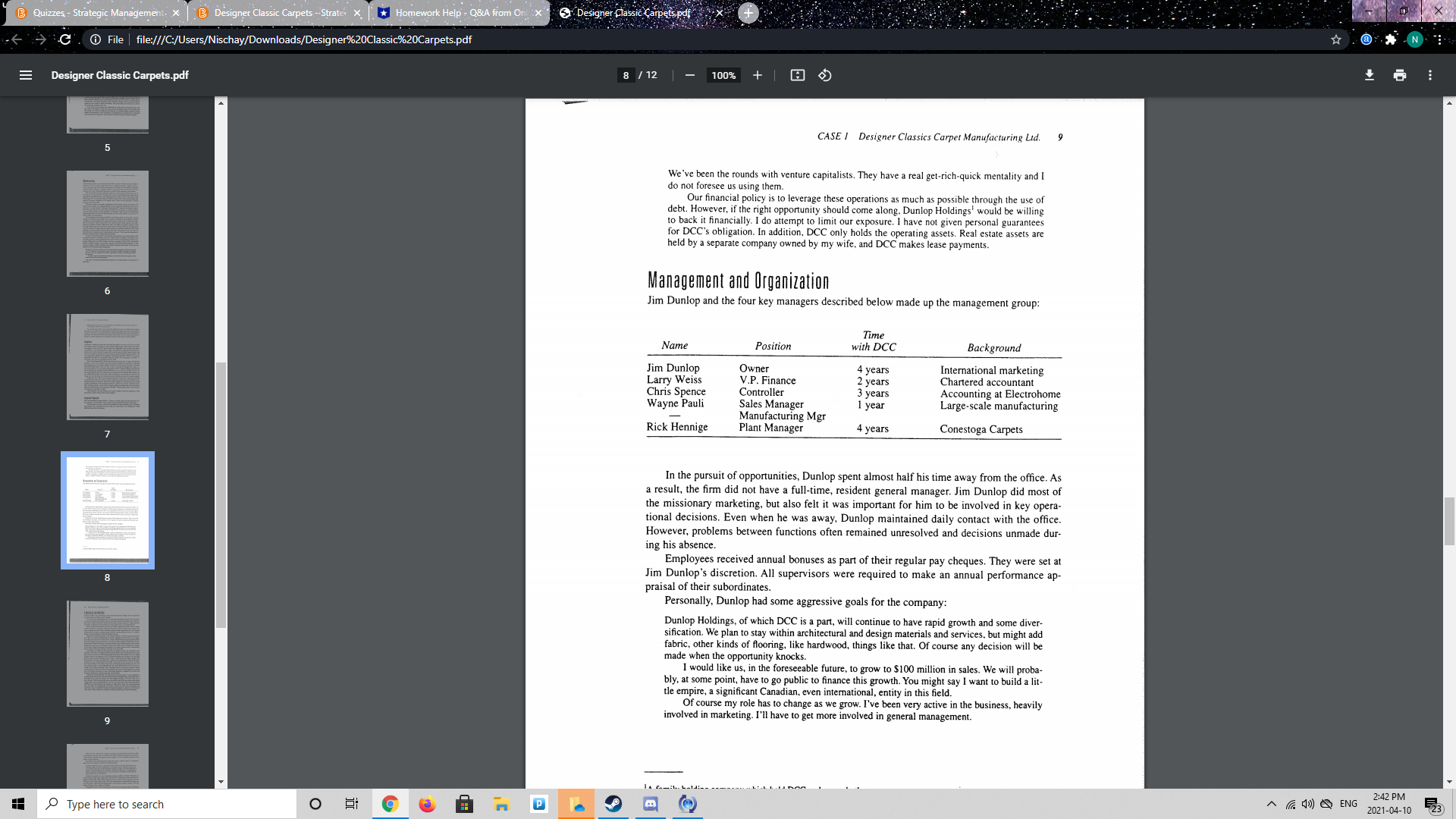

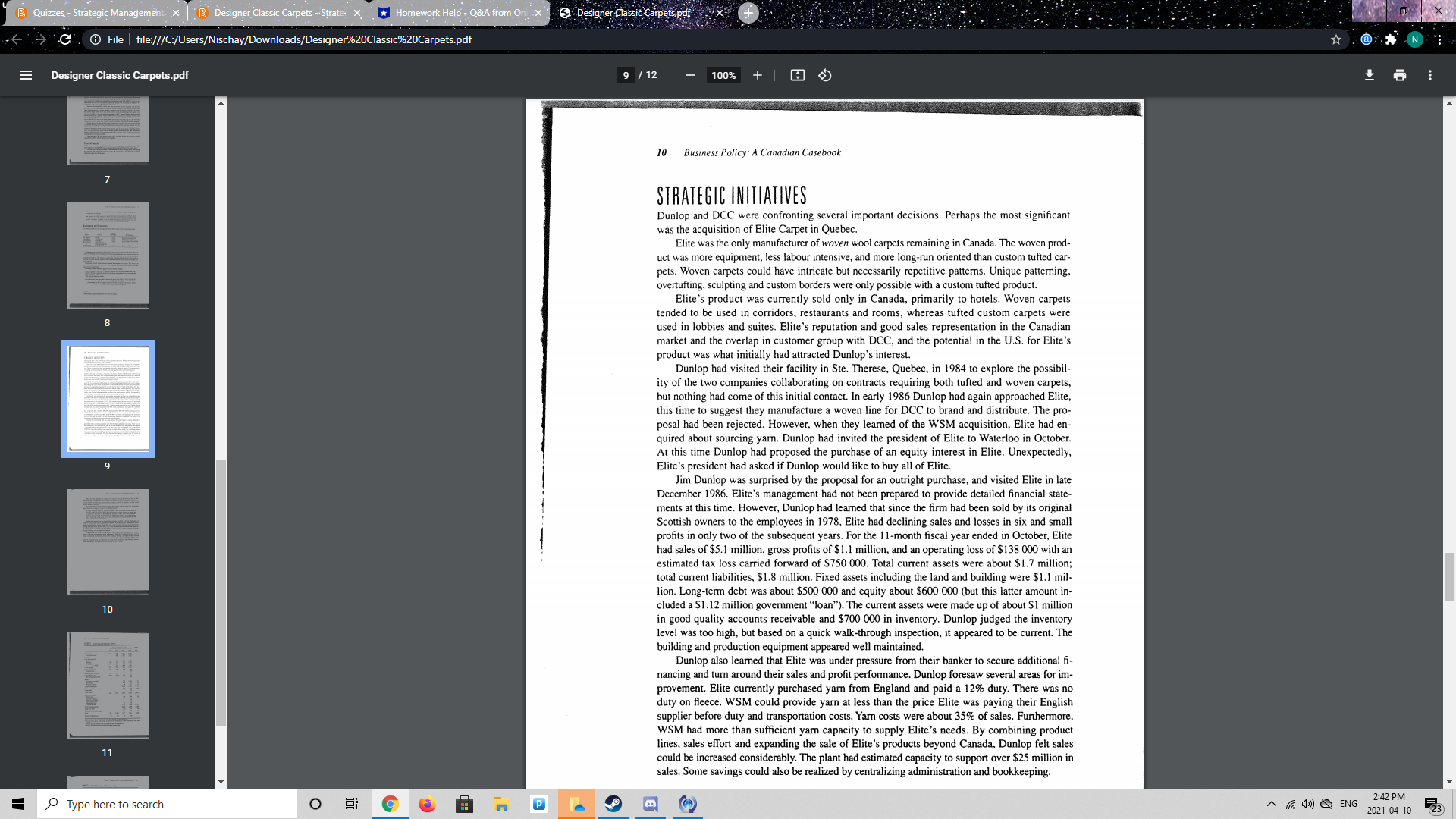

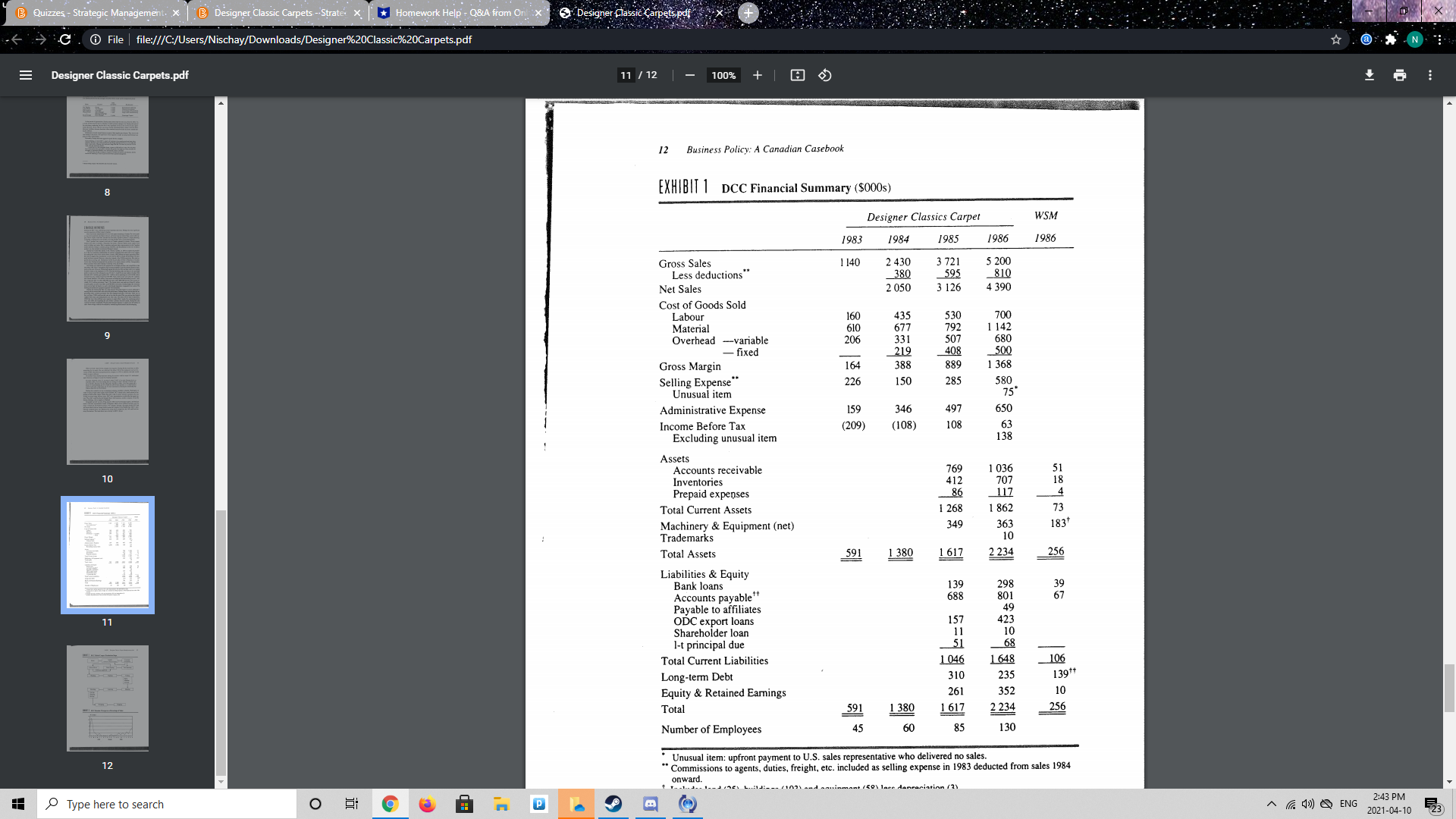

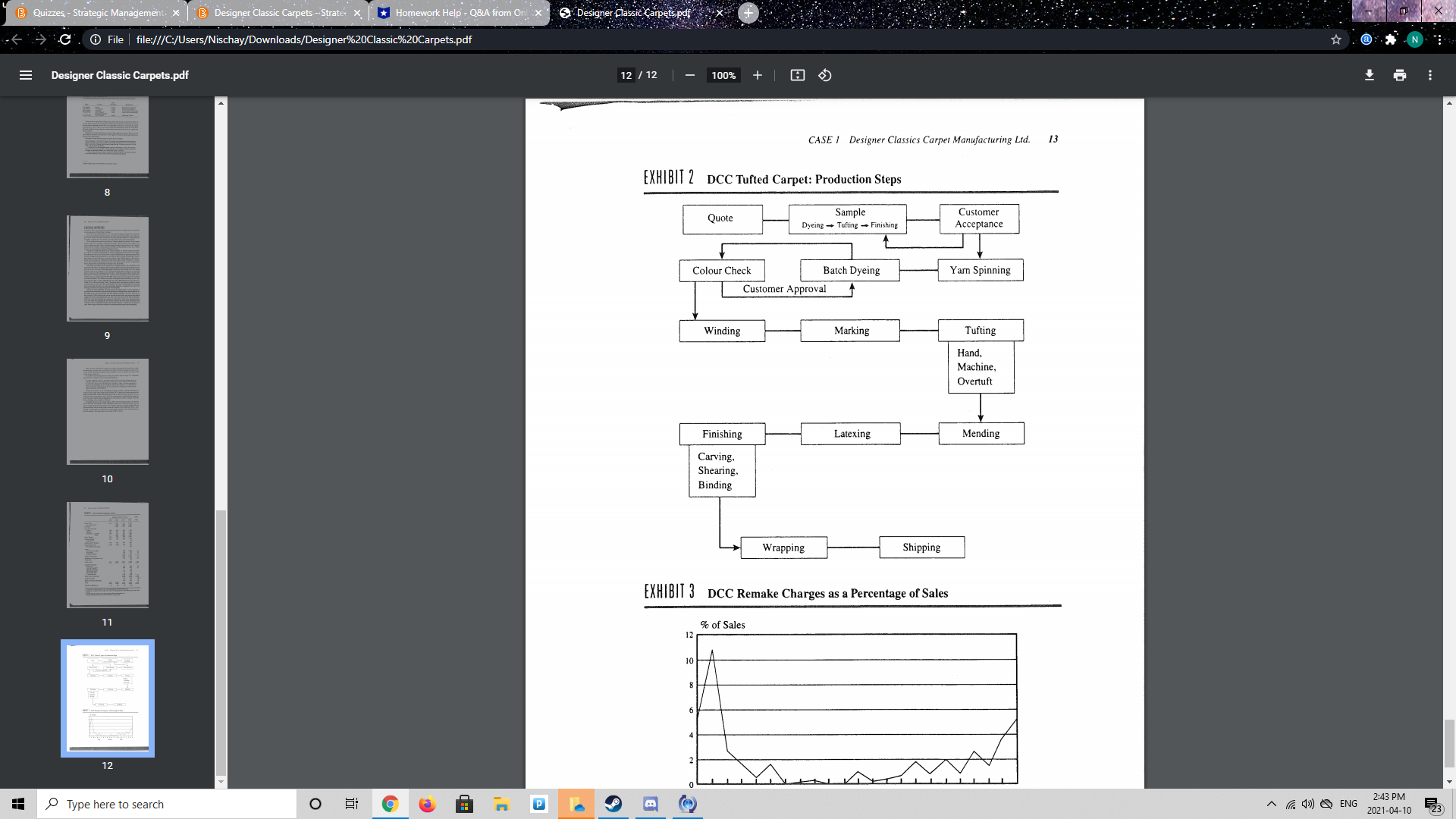

Quizzes - Strategic Management. X | @ Designer Classic Carpets - Strate. *Homework Help - Q&A from On Designer a N C. O File | file:///C:/Users/Nischay/Downloads/Designer%20Classic%20Carpets.pdf E Designer Classic Carpets.pdf 1 / 12 100% + WICKS DESIGNER CLASSICS CARPET CASE MANUFACTURING LTD. Roderick E. White - 2 Jim Dunlop, a self-admitted entrepreneur and the principal owner of Designer Classics 3 Carpet (DCC), had just received the financial results for 1986. Dunlop, age 39, had gotten into the custom wool carpet business four years earlier by acquiring the assets of Conestoga Carpet, a failed company located in Waterloo, Ontario. Using over $300 000 of his own cap- ital, he had modernized and added some production equipment, moved the plant to a nearby location, added new products, and perhaps most importantly, expanded the firm's market scope greatly through his own efforts. In mid-January 1987, as Dunlop reflected on the four-year financial summary (Exhibit 1), he was proud of the large increases in sales. However, this growth had resulted in scheduling prob- lems and bottlenecks in the plant. Additional sales from the Waterloo plant would require allevi- ating these problems. Dunlop, always on the lookout for opportunities to expand and strengthen the business, had recently acquired a wool yarn spinning mill in Waterford, about 75 kilometres from Waterloo. This purchase would allow DCC to set specific standards for its yam and secure source of supply for this major raw material. Several other growth opportunities could be pur- sued. Preliminary negotiations were underway for the acquisition of Elite Carpet, a woven carpet manufacturer in Quebec with $5.1 million in sales and significant unused capacity. Dunlop was also considering the establishment of an importing/distribution company in Seattle, Washington, 2:42 PM Type here to search O 16 ~ (7 41 ) ENG 2021-04-10 23Quizzes - Strategic Management. X | @ Designer Classic Carpets - Strate. *Homework Help - Q&A from On " Designer C . O File | file:///C:/Users/Nischay/Downloads/Designer%20Classic%20Carpets.pdf a N E Designer Classic Carpets.pdf 2 / 12 100% + CASE I Designer Classics Carpet Manufacturing Lid. to bring in custom wool carpets from Thailand. In addition, one of DCC's major dealers in the U.S. had expressed an interest in selling a minority interest to DCC. Picking up on new initiatives would have to be done by Jim Dunlop. There was no one else available. Since he also had to deal with many of the day-to-day demands of the business, establishing priorities and timing were critical. THE BUSINESS All of DCC's current products were custom ordered for residential and commercial buyers. Each was unique in size, colour, pattern and texture. Sales were made through sales agents and dealers, with only a very few direct transactions with customers. In 1986, residential custom- ers accounted for about 20% of annual sales. Of the remaining 80% for commercial applica- tions, half were used as carpet murals for subdividing passenger aircraft, and the remainder were sold as floor covering in offices and hotels. 2 Products and Markets Costing between $50 per square metre for broadloom and up to $500 per square metre for a hand tufted product, custom carpets appealed to small, specialized segments of the carpet mar- ket. The custom wool carpet market in North America was estimated to be approximately $300 million and growing at 15% annually (Table 1). In all except the aircraft segment, DCC's share was not large. Currently, commercial sales outside North America were small, less than 10% of the total; Canada accounted for about 20% of DCC's sales; and the U.S., about 70%. 3 TABLE 1 North American Custom Wool Carpet Market Industry DCC' Market Segment Share Sales Residential 18% 2.0% 20% Commercial: 40% Hotel 50% 1.5% Office 30% 2.0% Aircraft 2% 60% 40% $ 300m SOURCE: Estimates by Jim Dunlop and selected carpet dealers. Residential Segment Custom wool carpet appealed to upscale home-owners. The home-owner would either deal di- rectly with a dealer having in-house design expertise, or through an interior decorator/designer who would ultimately source through a dealer. Many dealers served both the residential and Type here to search O le 2:42 PM ~ (7 41) ) ENG 2021-04-10 23Quizzes - Strategic Management. X | @ Designer Classic Carpets - Strate. *Homework Help - Q&A from On 5. Designer C. O File | file:///C:/Users/Nischay/Downloads/Designer%20Classic%20Carpets.pdf a N E Designer Classic Carpets.pdf 3 / 12 100% + -8 Business Policy: A Canadian Casebook doing not only the design work but also their own in-house "cutting and pasting" of the carpet. However, this was the exception and most dealers preferred to have the carpet completed by the manufacturer. No really close substitutes existed for wool carpets. High-end synthetics did not have the same "feel" or snob appeal. Oriental rugs could be viewed as an alternative to the customer, but generally had somewhat different applications, and appealed to different cus- tomer tastes than custom wool area carpets. Quality was important in all DCC's markets, as was on-time delivery performance. Order lead times for the residential segment were typically three to five months; rapid response to or- ders was not usually critical, since customers generally ordered well in advance. Customers did not tend to comparison shop for price. This segment was believed to be growing at 10-15% percent annually. 2 Commercial Segment This segment was composed of two different customer groups: office and hotel. Office applica- tions were limited to lobbies, board rooms and executive suites. Recently the U.S. office market appeared to be growing, but the Canadian market was in decline. The other group, luxury hotels, used this product in high visibility areas like lobbies. Woven wool carpets were typically used in rooms. Luxury hotels were increasing their penetration of the North American market. Delivery time was important, especially for most office applications, as was price. Some hotel chains had in-house designers, but many hotels and most office customers used an out- side design house or carpet consultant to develop specifications and aid in product selection. 3 Roughly 80% of the business was tendered directly to carpet manufacturers, and the remain- der was placed through dealers. Aircraft Segment Carpet murals were used for decorative purposes on bulkhead walls in some commercial pas- senger and corporate aircraft. Currently carpet murals were not used by air carriers outside North America. Approximately 50% of the North American fleet had these murals. However. recent proposed changes in FAA regulations governing material content of aircraft cabin inte riors had put this market in jeopardy. Although Dunlop believed the likelihood of a permanent ban on wool bulkhead murals was unlikely, sales could be disrupted during negotiations be- tween the FAA and aircraft manufacturers. Customers in this segment were somewhat price sensitive, but tended to buy on reputa- tion for quality. Airlines working with a design house and/or the firm finishing the aircraft's interior would develop carpet specifications. Orders were placed by the finisher, either the aircraft manufacturer (e.g., Boeing) or a specialized interior finisher (e.g., Innotech Avia tion), with an aircraft supply house or directly with the manufacturer. In the U.S., one sup- ply house handled a large part of the aircraft interiors market, including floor and wall coverings, seats, etc. as well as bulkhead murals. DCC was this firm's exclusive supplier of carpet murals. Eighty-five percent of sales in this segment were made in the U.S.; and 15% Type here to search O 16 ~ ( 7 41 ) ) ENG 2:42 PM 2021-04-10 23Quizzes - Strategic Management. X | @ Designer Classic Carpets - Strate. *Homework Help - Q&A from On Designer C . O File | file:///C:/Users/Nischay/Downloads/Designer%20Classic%20Carpets.pdf a N E Designer Classic Carpets.pdf 4 / 12 - 100% + CASE I Designer Classics Carpet Manufacturing Lid. L. 5 -8 DCC's Position DCC faced three major competitors (Table 2). The remaining competition was fragmented, al- though some were significant in small niches (e.g.. Carter and Carousel). TABLE 2 Competitive Position Market Share- Market Share- Excluding Aircraft Aircraft Hong Kong Carpet 65% Edward Fields 10% V'Soske 9 Designer Classics 60 Carousel 0.5 14 2 Carter 0.5 Other 24 SOURCE: Industry estimates Hong Kong Carpet (HKC) was a large, apparently well-financed corporation with manu- facturing facilities scattered around the Far East. It produced under several different labels. HKC was believed to be the low-cost producer and typically offered the lowest price, but also had a reputation for somewhat lower quality and had 12- to 24-week delivery times. HKC had extensive dealer representation in North America and advertised exclusively to dealers. 3 Fields and V'Soske were similar in many respects. Both were high-priced and high-quality with long delivery times: about 21 weeks for Fields and, partly because of its Puerto Rican pro- duction facilities, 23 weeks for V'Soske. V'Soske utilized exclusive dealers and had strong rep- resentatives in most markets. Fields, headquartered in New York City, had company showrooms in major metropolitan centres. Like VSoske, Fields branded its product and had high awareness. DCC, by way of comparison, was medium to high quality and price. DCC had the ability to deliver a small sample of the desired colour, pattern and texture, within ten days to two weeks; compared to four weeks for most of the competition. The finished order would follow in about six weeks. According to Dunlop, DCC was able to offer faster sample turnaround be- cause of their proximity to major customers and the capabilities of the sample making depart- ment. To the extent economically feasible, sample making had separate facilities. However, some equipment, tufting and dying, was shared with regular manufacturing and inevitable conflicts arose. While still good compared to other manufacturers, this turnaround time, be- cause of capacity constraints and labour turnover, had been increasing. DCC did not have a strong brand identity, and in certain markets, the prior association with Conestoga was a hin- drance. All four major manufacturers, including DCC, had in-house dye facilities. Type here to search 2:42 PM O ~ (7 41) ) ENG 2021-04-10 23Quizzes - Strategic Management. X | B Designer Classic Carpets -.Strate. *Homework Help - Q&A from On Designer a N C. @ File | file:///C:/Users/Nischay/Downloads/Designer%20Classic%20Carpets.pdf Designer Classic Carpets.pdf 5 / 12 100% + E 6 Business Policy: A Canadian Casebook THE COMPANY 3 DCC's product range was all wool and made to order. It included completely hand tufted car- pets and murals, machine tufted and overtufted carpets (machine tufted but finished by hand), both for broadloom (wall-to-wall) and area applications. As shown in Table 3, gross profit margins differed amongst product categories. TABLE 3 DCC Cost and Gross Profit by Major Custom Tufted Product Group (percent of selling price) Hand Tufted Hand + Machine Machine Tufted Area Broadloom Area Aircraft Broadloom Area Materials 34% 44% 30% 20% 199 29% Labour 52 34 43 22 37 Gross Profit 14 22 27 29 34 SOURCE: Sales records August through October 1986. Marketing and Distribution In total, DCC had about 200 customers. However, the top ten accounted for 61% of sales dur- 15 ing 1986, and the top two for 53%. One of these was an aircraft supply house representing DCC's carpet murals, and the other was a residential and commercial dealer in the southwest- ern U.S. The old Conestoga Carpet had focused almost exclusively on the Toronto residential and commercial market. Over the last four years, Jim Dunlop, with his real flair for sales and marketing, had expanded distribution and sales into the U.S. market, and the airline carpet mural business in particular. Designer Classics had two salespersons covering the U.S. They serviced the dealer net- work as well as direct sales to major hotel customers. The company had one European sales representative with responsibility for direct sales to hotel clients, and an agent network in six countries that sold to local dealers. Two sales agents, one in Europe and the other in the U.S., 16 covered the aircraft market. The company's general sales manager, with an in-house staff of three, handled Canadian sales, both through the dealer network and direct to hotels and air- craft finishers. Jim Dunlop maintained contact with key customers, and was involved in devel- oping most new dealer or agent relationships. His salesmanship and interpersonal abilities were important strengths in this area Once access to the customer was established, the selling task involved producing a suit- able sample. The ability to match the colour, texture and pattern needs of the customer with this sample was critical to making the sale. Delivery of a finished product consistent with the sample was important to a firm's reputation. Accomplishing this required close coordination with the production department. The importance of delivery and price varied by segment. 2:42 PM 16 ~ (7 41 ) ENG 2021-04-10 23 Type here to search OQuizzes - Strategic Management. X | B Designer Classic Carpets -.Strate. *Homework Help - Q&A from On Designer C. @ File | file:///C:/Users/Nischay/Downloads/Designer%20Classic%20Carpets.pdf a N E Designer Classic Carpets.pdf 6 / 12 - 100% + CASE I Designer Classics Carpet Manufacturing Lid. 7 Manufacturing 3 The production process was a custom job shop. Basic steps for a tufted carpet are outlined in Exhibit 2. The mix of skills varied: dyeing was a complicated operation-part art, part sci- ence, requiring a high level of skill and experience. Finishing was semi-skilled; an operator could be trained in one to two months. However, because this step was the last in the chain, mistakes were costly. Tufting skill requirements varied with the complexity of the pattern. DCC had trouble retaining production employees. The Kitchener-Waterloo area was in the midst of an economic boom. Unemployment was 4%, and an Employment Canada official reported that unskilled labourers were changing jobs for as little as 10c to 154 per hour wage differentials. DCC currently paid $6.20 for unskilled labour (after a three-month probationary period). The factory workforce of 101 people, many of them recent immigrants to Canada, turned over by 34% in 1986. The labour situation was further complicated by the company's recent unionization. The union and the company were negotiating their second contract, and management's goal was to achieve a "no wage increase" settlement. Historically, DCC had not laid off plant workers, even when sales volumes were low. Dunlop had taken the unionization as a personal affront, and was determined not to lend legitimacy by conceding a wage increase in the upcoming contract negotiations. He felt most employees did not want a union, and he was anxious to re- turn his firm to non-union status. Union problems aside, labour availability was limiting output in certain areas. In hand tufting, it was difficult to get reliable, low-cost labour. In addition to the availability of labour, 5 variability in skill requirements on a job-by-job, pattern-by-pattern basis complicated break- ing this bottleneck. Capital requirements for expanding hand tufting capacity were small. However, bottlenecks existed in other areas. There were quality and capacity problems in the dye shop. Waterloo had very hard water, which required softening before use in dyeing opera- tions. The addition of storage tanks for softened water, an investment of about $12 000, would hopefully solve this problem, reducing delays and rework. The quality of wool yarn had also been affecting the dyeing process, causing delays and rework. It was hoped the acquisition of Waterford Spinning Mills would alleviate this problem. In order to meet demand, DCC's key manufacturing operations were operating three shifts of eight hours each on weekdays, and two 12-hour shifts on weekends. The business was somewhat seasonal, increasing during the last quarter of the year. During the October to De- 6 cember 1986 period, over 70% of orders were late, averaging 15 days; 90% were labelled RUSH. In addition, quality as measured by remakes had been deteriorating (Exhibit 3). Add ing more capacity would be expensive and, Dunlop suspected, unnecessary. He felt the real problem lay with manufacturing management: The growth in sales has overtaxed our current manufacturing management. We have gone from 14 to 130 employees over the last four years. The ability to manage a schedule in a complex job shop is now very important. It has been complicated by quality and availability problems for wool yam. We need someone with experience managing a complicated job shop. The specifics of the carpet business can be picked up quickly. And while Jim Dunlop understood the importance of manufacturing to his business, he had stated: 2:42 PM Type here to search O 16 ~ (7 41) ) ENG 2021-04-10 23Quizzes - Strategic Management. x | @ Designer Classic Carpets - Strate. *Homework Help - Q&A from On Designer C . O File | file:///C:/Users/Nischay/Downloads/Designer%20Classic%20Carpets.pdf a N E Designer Classic Carpets.pdf 7 / 12 - 100% + Business Policy: A Canadian Casebook Manufacturing frustrates me. it's not something I'm personally really interested in or good at. I'm a marketer rather than an administrator. Two months earlier Dunlop had created and staffed the position of manufacturing manager. This person was to help sort out the problems at the Waterloo plant and assume overall responsi- bilities for all of DCC's manufacturing plants, Waterford Spinning Mills, and the Elite plant, if purchased. The individual hired for this position had recently, by way of letter and without ex- planation, informed Dunlop of his immediate resignation. The position remained unfilled. 16 Suppliers In addition to labour, the other key input into the product was wool yarn. Raw wool from Great Britain and New Zealand was most suitable for high-quality carpets. There were numer- ous suppliers of raw wool. DCC used a broker who bought their wool at auction; and while a "commodity," it varied dramatically in quality and required considerable buying expertise. Spinners were then contracted to process the wool into yarn. In North America, there were seven wool carpet yarn producers. The recently purchased Waterford Spinning Mills, with some equipment modifications and additions, could supply about 95% of DCC's wool yarn re- quirements and still have considerable additional capacity. The remaining 5% of DCC's re- quirements were yarn types Waterford could not make. Waterford Spinning Mills (WSM) had been purchased because of quality and delivery problems with two yarn suppliers. The plant became available when Sunbeam, which had been spinning yarn for its electric blankets, decided to exit this part of the business. Sunbeam had another larger facility in the area, and in order to avoid any bad feelings from a plant, clo- sure was prepared to "give the spinning equipment to DCC." Dunlop Holdings had purchased the old building and equipment for $1 10 000. However, conversion to spinning wool for car- pets required purchasing some additional (used) equipment and building improvements at a cost of $65 000. The deal closed in July 1986, and the plant was producing (at a low level) by August. By year end things were running relatively smoothly, and capacity exceeded demand. 8 Dunlop knew of no other custom carpet manufacturer with their own spinning mill. WSM was already providing more consistent quality and delivery of this major raw material. This fa- cilitated operations at Waterloo. Failure of an earlier supplier to meet delivery promises had resulted in disruptions to the manufacturing process, and on one occasion a plant shut down. DCC had been partially coping with this supply problem by holding large yarn inventories. When the WSM operation was coordinated with DCC's Waterloo plant, much of the inventory could be held as raw fleece at WSM. Other materials, like poly backing, were easily available. Production equipment, while specialized, could be obtained from several suppliers. Financial Capacity DCC had substantial leverage (Exhibit 1). However, working capital could be financed by cus- tomer deposits, normally 50% of sales and government assisted financing for export sales. After the sale of an earlier venture in the production of turkey breeding stock, Jim Dunlop 2:42 PM Type here to search O le ~ (7 (1) ) ENG 2021-04-10 23Quizzes - Strategic Management. x | @ Designer Classic Carpets - Strate. *Homework Help - Q&A from On Designer a N C . O File | file:///C:/Users/Nischay/Downloads/Designer%20Classic%20Carpets.pdf E Designer Classic Carpets.pdf 8 / 12 - 100% + CASE I Designer Classics Carpet Manufacturing Lid. 9 We've been the rounds with venture capitalists. They have a real get-rich-quick mentality and I do not foresee us using them. Our financial policy is to leverage these operations as much as possible through the use of debt. However, if the right opportunity should come along. Dunlop Holdings' would be willing to back it financially. I do attempt to limit our exposure. I have not given personal guarantees for DCC's obligation. In addition, DCC only holds the operating assets. Real estate assets are held by a separate company owned by my wife, and DCC makes lease payments. Management and Organization 16 Jim Dunlop and the four key managers described below made up the management group: Time Name Position with DCC Background Jim Dunlop Owner 4 years International marketing Larry Weiss V.P. Finance 2 years Chartered accountant Chris Spence Controller 3 years Accounting at Electrohome Wayne Pauli Sales Manager year Large-scale manufacturing Manufacturing Mer Rick Hennige Plant Manager years Conestoga Carpets In the pursuit of opportunities, Dunlop spent almost half his time away from the office. As a result, the firm did not have a full-time, resident general manager. Jim Dunlop did most of the missionary marketing, but also felt it was important for him to be involved in key opera- tional decisions. Even when he was away, Dunlop maintained daily contact with the office. However, problems between functions often remained unresolved and decisions unmade dur- ing his absence. Employees received annual bonuses as part of their regular pay cheques. They were set at Jim Dunlop's discretion. All supervisors were required to make an annual performance ap- 8 praisal of their subordinates. Personally, Dunlop had some aggressive goals for the company: Dunlop Holdings, of which DCC is a part, will continue to have rapid growth and some diver- sification. We plan to stay within architectural and design materials and services, but might add fabric, other kinds of flooring, like hardwood, things like that. Of course any decision will be made when the opportunity knocks. I would like us, in the foreseeable future, to grow to $100 million in sales. We will proba bly, at some point, have to go public to finance this growth. You might say I want to build a lit- the empire, a significant Canadian, even international, entity in this field. Of course my role has to change as we grow. I've been very active in the business, heavily involved in marketing. I'll have to get more involved in general management. 2:42 PM Type here to search O 16 ~ (7 41) ) ENG 2021-04-10 23Quizzes - Strategic Management. X | B Designer Classic Carpets - Strate. *Homework Help - Q&A from On " Designer C. 1 File | file:///C:/Users/Nischay/Downloads/Designer%20Classic%20Carpets.pdf a N E Designer Classic Carpets.pdf 9 / 12 - 100% + 10 Business Policy: A Canadian Casebook STRATEGIC INITIATIVES Dunlop and DCC were confronting several important decisions. Perhaps the most significant mmm...... was the acquisition of Elite Carpet in Quebec. Elite was the only manufacturer of woven wool carpets remaining in Canada. The woven prod- uct was more equipment, less labour intensive, and more long-run oriented than custom tufted car- pets. Woven carpets could have intricate but necessarily repetitive patterns. Unique patterning, overtufting, sculpting and custom borders were only possible with a custom tufted product. Elite's product was currently sold only in Canada, primarily to hotels. Woven carpets tended to be used in corridors, restaurants and rooms, whereas tufted custom carpets were 8 used in lobbies and suites. Elite's reputation and good sales representation in the Canadian market and the overlap in customer group with DCC, and the potential in the U.S. for Elite's product was what initially had attracted Dunlop's interest. Dunlop had visited their facility in Ste. Therese, Quebec, in 1984 to explore the possibil ity of the two companies collaborating on contracts requiring both tufted and woven carpets, but nothing had come of this initial contact. In early 1986 Dunlop had again approached Elite, this time to suggest they manufacture a woven line for DCC to brand and distribute. The pro- posal had been rejected. However, when they learned of the WSM acquisition, Elite had en- quired about sourcing yarn. Dunlop had invited the president of Elite to Waterloo in October. At this time Dunlop had proposed the purchase of an equity interest in Elite. Unexpectedly, 9 Elite's president had asked if Dunlop would like to buy all of Elite. Jim Dunlop was surprised by the proposal for an outright purchase, and visited Elite in late December 1986. Elite's management had not been prepared to provide detailed financial state- ments at this time. However, Dunlop had learned that since the firm had been sold by its original Scottish owners to the employees in 1978, Elite had declining sales and losses in six and small profits in only two of the subsequent years. For the 11-month fiscal year ended in October, Elite had sales of $5.1 million, gross profits of $1.1 million, and an operating loss of $138 000 with an estimated tax loss carried forward of $750 000. Total current assets were about $1.7 million; total current liabilities, $1.8 million. Fixed assets including the land and building were $1.1 mil- lion. Long-term debt was about $500 000 and equity about $600 000 (but this latter amount in- 10 cluded a $1.12 million government "loan"). The current assets were made up of about $1 million in good quality accounts receivable and $700 000 in inventory. Dunlop judged the inventory level was too high, but based on a quick walk-through inspection, it appeared to be current. The building and production equipment appeared well maintained Dunlop also learned that Elite was under pressure from their banker to secure additional fi- nancing and turn around their sales and profit performance. Dunlop foresaw several areas for im- provement. Elite currently purchased yam from England and paid a 12% duty. There was no duty on fleece. WSM could provide yarn at less than the price Elite was paying their English supplier before duty and transportation costs. Yam costs were about 35% of sales. Furthermore, WSM had more than sufficient yarn capacity to supply Elite's needs. By combining product lines, sales effort and expanding the sale of Elite's products beyond Canada, Dunlop felt sales 11 could be increased considerably. The plant had estimated capacity to support over $25 million in sales. Some savings could also be realized by centralizing administration and bookkeeping Type here to search O 16 2:42 PM ~ (7 41 ) ENG 2021-04-10 23Quizzes - Strategic Management. X | B Designer Classic Carpets - Strate. *Homework Help - Q&A from On " Designer Cla C. @ File | file:///C:/Users/Nischay/Downloads/Designer%20Classic%20Carpets.pdf a N E Designer Classic Carpets.pdf 10 / 12 100% + CASE I Designer Classics Carpet Manufacturing Lid. 11 While net book value for the company was negative. Dunlop felt he would have to offer something for its equity. He was informed that about 100 of the employees had each in- vested $3 000 when they had purchased the company in 1978. In addition, the bank would expect an equity infusion. On another front, Dunlop had been having discussions with his major U.S. wholesaler/ agent about an exchange of ownership. Dunlop explained: My major wholesaler in the U.S. accounts for about 35-40 of our sales. Because they're so important to DCC, we've been talking about an exchange of shares. Although we haven't got- ten to specifics, they have very few hard assets, basically an office, a few sales people and a phone, we would probably give 4% of DCC for 25% of their operation. It's a small business 8 and the owner takes a large salary, but I'm more interested in cementing the relationship than making a big return on my investment. Dunlop also wanted to set up an importing company, probably in Seattle, Washington, in order to bring in hand tufted carpets from Thailand. DCC already did a small amount of im- porting of hand tufted carpets. Rather than lose a sale to a price sensitive customer who was willing to accept longer delivery terms. DCC sales representatives would offer the import op- tion. The order would be placed through Dunco International, another company owned by Dunlop Holdings, with a supplier in Thailand. Geographic growth was also being pursued. DCC had two European agents, and had just hired a full time representative based in England. Much of this offshore business was for major commercial development projects. For example, through a European dealer DCC had 9 just been asked to bid on a major hotel/commercial complex in the Middle East. DCC's inter- national competitiveness was influenced by strong local competition, the 14% tariff and cur- ency fluctuations. This latter factor was currently in DCC's favour. 10 11 Type here to search O ~ (7 41) ) ENG 2:42 PM 2021-04-10 23Quizzes - Strategic Management. x | @ Designer Classic Carpets -.Strate. *Homework Help - Q&A from On 5. Designer C. @ File | file:///C:/Users/Nischay/Downloads/Designer%20Classic%20Carpets.pdf a N E Designer Classic Carpets.pdf 11 / 12 100% + 12 Business Policy: A Canadian Casebook EXHIBIT 1 DCC Financial Summary ($000s) Designer Classics Carpet WSM 1983 1984 1985 1986 1986 Gross Sales 1 140 2 430 3 721 $ 200 Less deductions" 380 595 810 Net Sales 2 050 3 12 4 390 Cost of Goods Sold Labour 160 435 530 700 Material 610 677 792 142 9 Overhead -variable 206 331 507 680 - fixed 219 408 500 Gross Margin 164 388 889 1 368 Selling Expense" 226 150 285 580 Unusual item 75 Administrative Expense 159 346 497 650 Income Before Tax (209) (108) 108 63 Excluding unusual item 138 Assets Accounts receivable 769 1 036 51 10 Inventories 412 707 Prepaid expenses 86 117 Total Current Assets 268 1862 73 Machinery & Equipment (net) 349 363 183 Trademarks 10 Total Assets 591 1 380 617 2 234 256 Liabilities & Equity Bank loans 139 298 39 Accounts payable 688 801 67 Payable to affiliates 49 11 ODC export loans 157 423 Shareholder loan 11 10 I-t principal due 51 68 Total Current Liabilities 1 046 1 648 106 Long-term Debt 310 235 139 Equity & Retained Earnings 261 352 10 Total 591 1 380 1 617 2 234 256 Number of Employees 45 50 85 130 "Unusual item: upfront payment to U.S. sales representative who delivered no sales. 12 Commissions to agents, duties, freight, etc. included as selling expense in 1983 deducted from sales 1984 onward. t r .1.. .. . 1--does L..id ant (40) lace danraciation /?) Type here to search O ~ (7 41) ) ENG 2:43 PM 2021-04-10 23Quizzes - Strategic Management. x | @ Designer Classic Carpets -.Strate. *Homework Help - Q&A from On 5. Designer Cla a N C. @ File | file:///C:/Users/Nischay/Downloads/Designer%20Classic%20Carpets.pdf E Designer Classic Carpets.pdf 12 / 12 100% + CASE I Designer Classics Carpet Manufacturing Lid. 13 EXHIBIT 2 DCC Tufted Carpet: Production Steps Sample Customer Quote Dyeing - Tufting - Finishing Acceptance Colour Check Batch Dyeing Yarn Spinning Customer Approval Winding Marking Tufting Hand, Machine, Overtuft Finishing Latexing Mending Carving. Shearing. 10 Binding Wrapping Shipping EXHIBIT 3 DCC Remake Charges as a Percentage of Sales 11 % of Sales 12 12 2:43 PM ~ (7 41) ) ENG 2021-04-10 23 Type here to search O