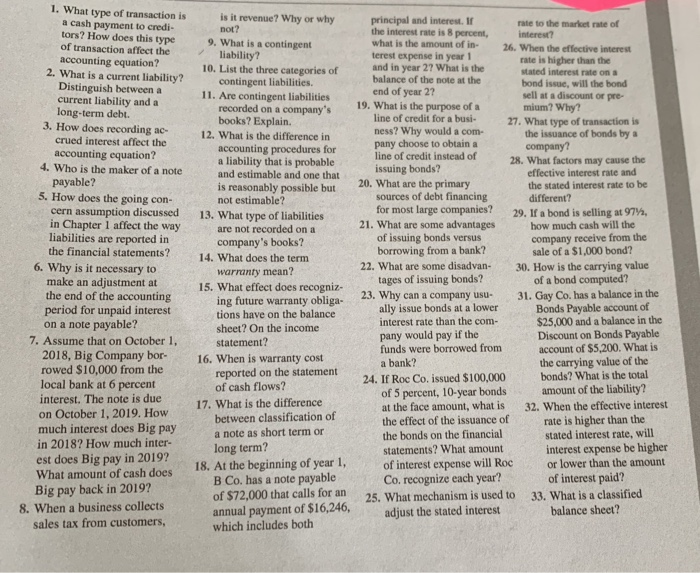

1. What type of transaction is a cash payment to credi- tors? How does this type of transaction affect the accounting equation? 2. What is a current liability? Distinguish between a current liability and a long-term debt. 3. How does recording ac crued interest affect the accounting equation? 4. Who is the maker of a note payable? 5. How does the going con- cern assumption discussed in Chapter 1 affect the way liabilities are reported in the financial statements? 6. Why is it necessary to make an adjustment at the end of the accounting period for unpaid interest on a note payable? 7. Assume that on October 1, 2018, Big Company bor- rowed $10,000 from the local bank at 6 percent interest. The note is due on October 1, 2019. How much interest does Big pay in 2018? How much inter- est does Big pay in 2019? What amount of cash does Big pay back in 2019? 8. When a business collects sales tax from customers, is it revenue? Why or why principal and interest. If not? rate to the market rate of the interest rate is 8 percent, interest? 9. What is a contingent what is the amount of in- 26. When the effective interest liability? terest expense in year 1 rate is higher than the 10. List the three categories of and in year 2? What is the stated interest rate on a contingent liabilities. balance of the note at the bond issue, will the bond 11. Are contingent liabilities end of year 2? sell at a discount or pre- recorded on a company's 19. What is the purpose of a mium? Why? books? Explain. line of credit for a busi 27. What type of transaction is 12. What is the difference in ness? Why would a com- the issuance of bonds by a accounting procedures for pany choose to obtain a company? a liability that is probable line of credit instead of 28. What factors may cause the and estimable and one that issuing bonds? effective interest rate and is reasonably possible but 20. What are the primary the stated interest rate to be not estimable? sources of debt financing different? 13. What type of liabilities for most large companies? 29. If a bond is selling at 97%, are not recorded on a 21. What are some advantages how much cash will the company's books? of issuing bonds versus company receive from the borrowing from a bank? 14. What does the term sale of a $1.000 bond? warranty mean? 22. What are some disadvan- 30. How is the carrying value 15. What effect does recogniz- tages of issuing bonds? of a bond computed? ing future warranty obliga- 23. Why can a company usu- 31. Gay Co. has a balance in the tions have on the balance ally issue bonds at a lower Bonds Payable account of sheet? On the income interest rate than the com $25,000 and a balance in the pany would pay if the Discount on Bonds Payable statement? funds were borrowed from account of $5,200. What is 16. When is warranty cost a bank? the carrying value of the reported on the statement 24. If Roc Co. issued $100,000 bonds? What is the total of cash flows? of 5 percent, 10-year bonds amount of the liability? 17. What is the difference at the face amount, what is 32. When the effective interest between classification of the effect of the issuance of rate is higher than the a note as short term or the bonds on the financial stated interest rate, will long term? statements? What amount interest expense be higher 18. At the beginning of year 1, of interest expense will Roc or lower than the amount B Co. has a note payable Co. recognize each year? of interest paid? of $72,000 that calls for an 25. What mechanism is used to 33. What is a classified annual payment of $16,246, balance sheet? which includes both