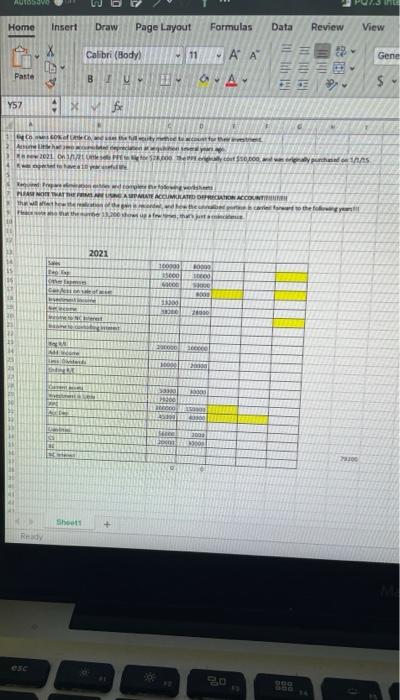

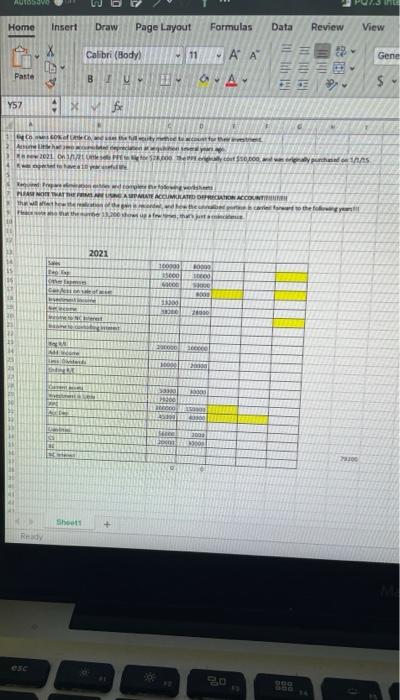

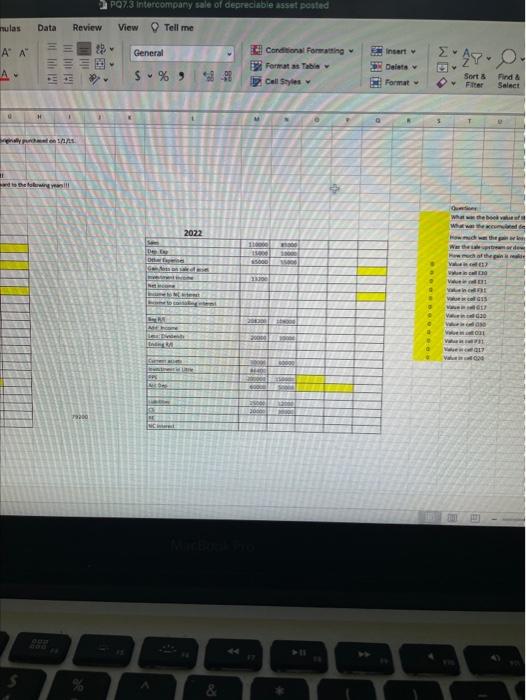

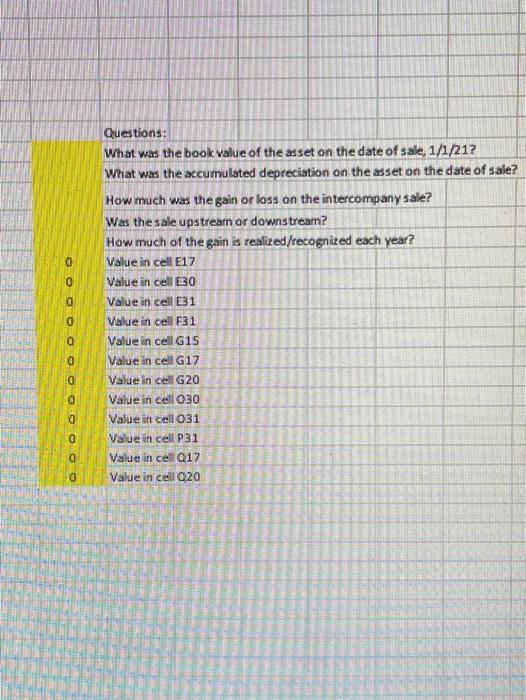

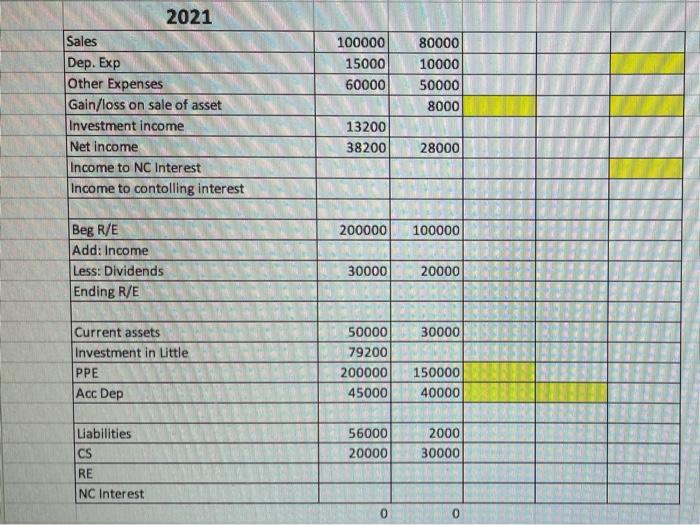

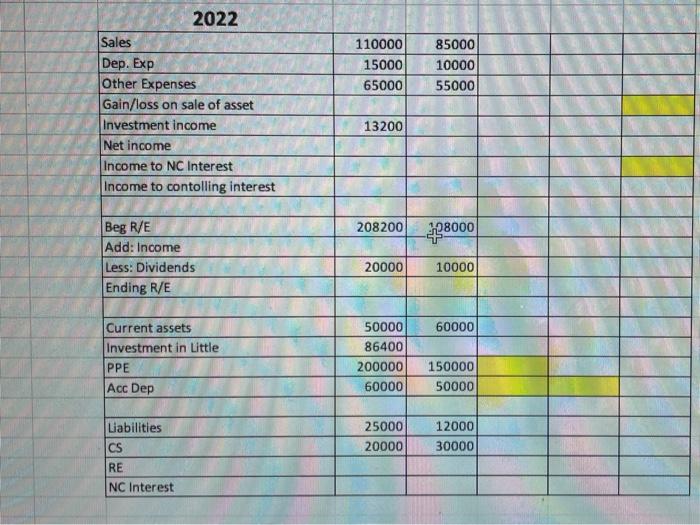

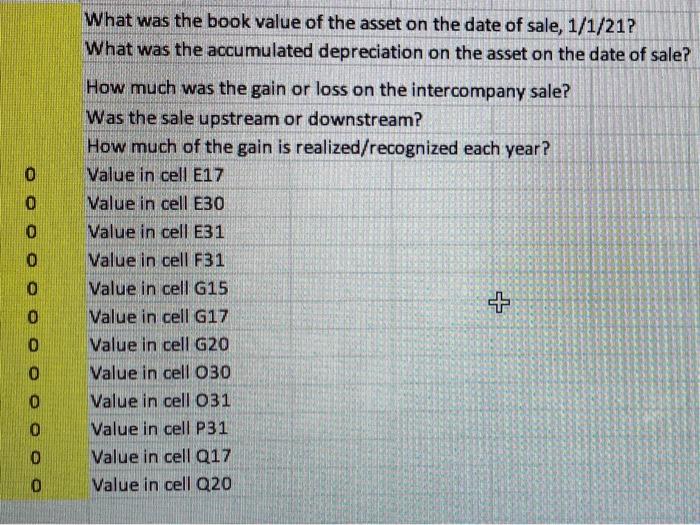

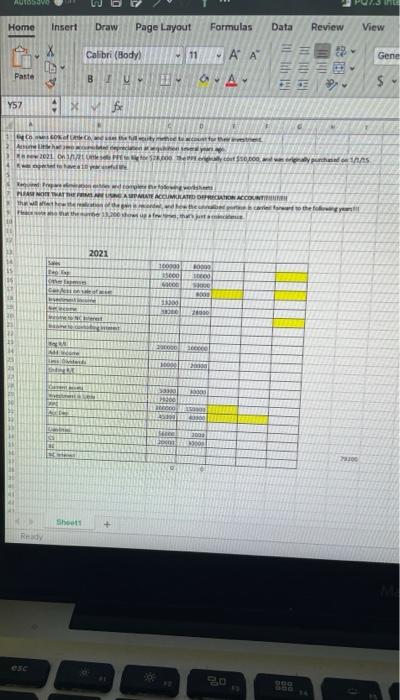

1. what was the book value on the asset on the date of sale

2. what was the accumulated depreciation of that asset on the date of sale?

3. how much was the gain or loss on the intercompany sale of the asset?

4. Was the sale upstream or downstream?

5. How much of the gain is recognized each year?

6. What is the Value of the Following Cells?

-E17

-E30

-E31

-F31

-G15

-G17

-G20

-O30

-031

-P31

-Q17

-Q20

Information for questions in pictures

Thank you!

AUTO Une Home Insert Draw Page Layout Formulas Data Review View == Calibri (Body 11 Gene PA A OA Paste $ BTU H $ Y57 for Other Onion they for purchas have to um: tra PASTATTUNG wo PEATE ACCURATED DEPRECIATO ACCOUNT delete crown to the fan that 2021 100000 5000 GO 0000 10000 on 08 33200 2000 200 el 10000 0000 1.800 2009 000 TE Shoot Ready 20 PQ7.3 Intercompany sale of depreciable asset posted mulas Data Review View Tell me ' " General Insert Conditional Formatting Formatas Tabla Call Sales , 2:48. 0 D Delta A $% % Format Sort & Fitter Find a Select H 5 awal What the Ww 2022 De 5000 01 RE VacGIS WOLF 030 We 2000 20000 Vah 1 V20 0000 79200 0 O g Questions: What was the book value of the asset on the date of sale, 1/1/217 What was the accumulated depreciation on the asset on the date of sale? How much was the gain or loss on the intercompany sale? Was the sale upstream or downstream? How much of the gain is realized/recognized each year? Value in cell E17 Value in cell E30 Value in cell E31 Value in cell F31 Value in cell G15 Value in cell G17 Value in cell G20 Value in cell 030 Value in cell 031 Value in cell P31 Value in cell 017 Value in cell 020 0 0 0 0 Q 0 100000 15000 60000 2021 Sales Dep. Exp Other Expenses Gain/loss on sale of asset Investment income Net income Income to NC Interest Income to contolling interest 80000 10000 50000 8000 13200 38200 28000 200000 100000 Beg R/E Add: Income Less: Dividends Ending R/E 30000 20000 30000 Current assets Investment in Little PPE Acc Dep 50000 79200 200000 45000 150000 40000 56000 20000 2000 30000 Liabilities CS RE NC Interest 0 0 110000 15000 65000 85000 10000 55000 2022 Sales Dep. Exp Other Expenses Gain/loss on sale of asset Investment income Net income Income to NC Interest Income to contolling interest 13200 208200 -2428000 Beg R/E Add: Income Less: Dividends Ending R/E 20000 10000 60000 Current assets Investment in Little PPE Acc Dep 50000 86400 200000 60000 150000 50000 25000 20000 12000 30000 Liabilities CS RE NC Interest 0 0 0 What was the book value of the asset on the date of sale, 1/1/21? What was the accumulated depreciation on the asset on the date of sale? How much was the gain or loss on the intercompany sale? Was the sale upstream or downstream? How much of the gain is realized/recognized each year? Value in cell E17 Value in cell E30 Value in cell E31 Value in cell F31 Value in cell G15 + Value in cell G17 Value in cell G20 Value in cell 030 Value in cell 031 Value in cell P31 Value in cell 017 Value in cell 020 0 0 0 0 0 0 0 0 AUTO Une Home Insert Draw Page Layout Formulas Data Review View == Calibri (Body 11 Gene PA A OA Paste $ BTU H $ Y57 for Other Onion they for purchas have to um: tra PASTATTUNG wo PEATE ACCURATED DEPRECIATO ACCOUNT delete crown to the fan that 2021 100000 5000 GO 0000 10000 on 08 33200 2000 200 el 10000 0000 1.800 2009 000 TE Shoot Ready 20 PQ7.3 Intercompany sale of depreciable asset posted mulas Data Review View Tell me ' " General Insert Conditional Formatting Formatas Tabla Call Sales , 2:48. 0 D Delta A $% % Format Sort & Fitter Find a Select H 5 awal What the Ww 2022 De 5000 01 RE VacGIS WOLF 030 We 2000 20000 Vah 1 V20 0000 79200 0 O g Questions: What was the book value of the asset on the date of sale, 1/1/217 What was the accumulated depreciation on the asset on the date of sale? How much was the gain or loss on the intercompany sale? Was the sale upstream or downstream? How much of the gain is realized/recognized each year? Value in cell E17 Value in cell E30 Value in cell E31 Value in cell F31 Value in cell G15 Value in cell G17 Value in cell G20 Value in cell 030 Value in cell 031 Value in cell P31 Value in cell 017 Value in cell 020 0 0 0 0 Q 0 100000 15000 60000 2021 Sales Dep. Exp Other Expenses Gain/loss on sale of asset Investment income Net income Income to NC Interest Income to contolling interest 80000 10000 50000 8000 13200 38200 28000 200000 100000 Beg R/E Add: Income Less: Dividends Ending R/E 30000 20000 30000 Current assets Investment in Little PPE Acc Dep 50000 79200 200000 45000 150000 40000 56000 20000 2000 30000 Liabilities CS RE NC Interest 0 0 110000 15000 65000 85000 10000 55000 2022 Sales Dep. Exp Other Expenses Gain/loss on sale of asset Investment income Net income Income to NC Interest Income to contolling interest 13200 208200 -2428000 Beg R/E Add: Income Less: Dividends Ending R/E 20000 10000 60000 Current assets Investment in Little PPE Acc Dep 50000 86400 200000 60000 150000 50000 25000 20000 12000 30000 Liabilities CS RE NC Interest 0 0 0 What was the book value of the asset on the date of sale, 1/1/21? What was the accumulated depreciation on the asset on the date of sale? How much was the gain or loss on the intercompany sale? Was the sale upstream or downstream? How much of the gain is realized/recognized each year? Value in cell E17 Value in cell E30 Value in cell E31 Value in cell F31 Value in cell G15 + Value in cell G17 Value in cell G20 Value in cell 030 Value in cell 031 Value in cell P31 Value in cell 017 Value in cell 020 0 0 0 0 0 0 0 0