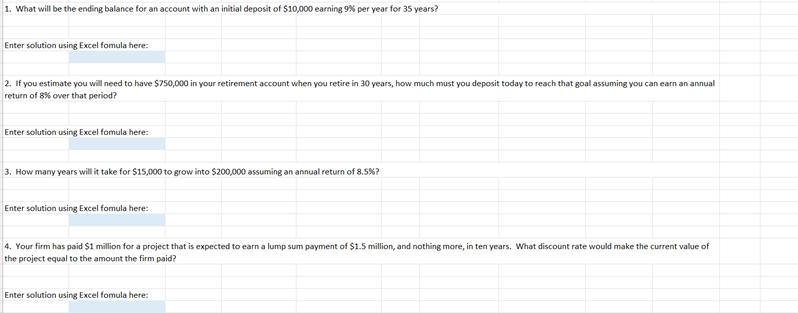

1. What will be the ending balance for an account with an initial deposit of $10,000 earning 9% per year for 35 years? Enter

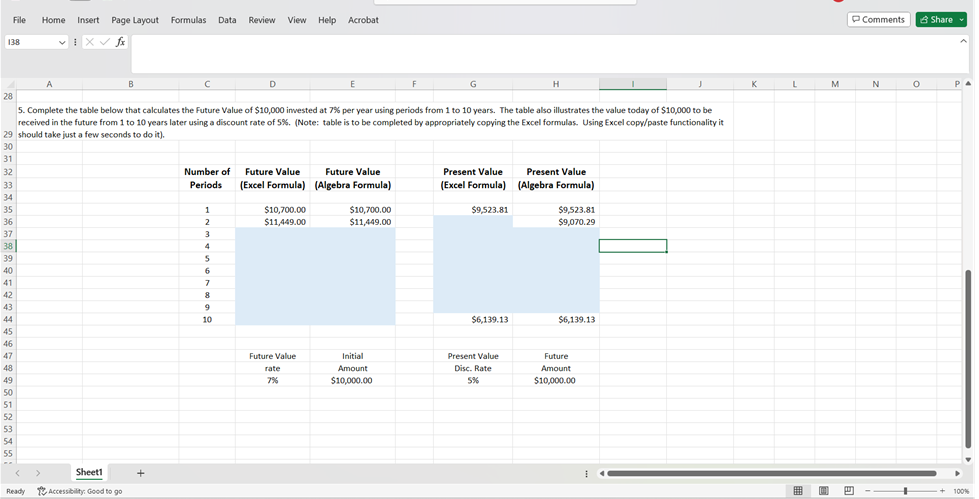

1. What will be the ending balance for an account with an initial deposit of $10,000 earning 9% per year for 35 years? Enter solution using Excel fomula here: 2. If you estimate you will need to have $750,000 in your retirement account when you retire in 30 years, how much must you deposit today to reach that goal assuming you can earn an annual return of 8% over that period? Enter solution using Excel fomula here: 3. How many years will it take for $15,000 to grow into $200,000 assuming an annual return of 8.5%? Enter solution using Excel fomula here: 4. Your firm has paid $1 million for a project that is expected to earn a lump sum payment of $1.5 million, and nothing more, in ten years. What discount rate would make the current value of the project equal to the amount the firm paid? Enter solution using Excel fomula here: File Home Insert Page Layout Formulas Data Review View Help Acrobat 138 XVfx A B D G H 28 5. Complete the table below that calculates the Future Value of $10,000 invested at 7% per year using periods from 1 to 10 years. The table also illustrates the value today of $10,000 to be received in the future from 1 to 10 years later using a discount rate of 5%. (Note: table is to be completed by appropriately copying the Excel formulas. Using Excel copy/paste functionality it 29 should take just a few seconds to do it). 30 31 32 33 Number of Periods Future Value (Excel Formula) (Algebra Formula) Future Value Present Value Present Value (Excel Formula) (Algebra Formula) 34 35 1 36 2 $10,700.00 $11,449.00 $10,700.00 $11,449.00 $9,523.81 $9,523.81 $9,070.29 37 3 38 4 39 5 40 6 41 7 42 8 43 9 44 10 $6,139.13 $6,139.13 45 46 47 48 49 50 51 52 53 54 55 Ready Sheet1 Accessibility: Good to go Future Value rate 7% Initial Amount Present Value Future Disc. Rate $10,000.00 5% Amount $10,000.00 Comments Share K L M N 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started