Answered step by step

Verified Expert Solution

Question

1 Approved Answer

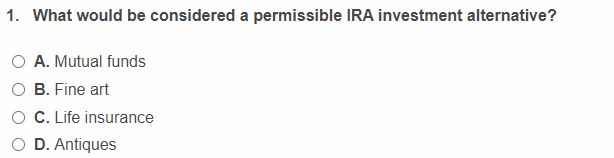

1. What would be considered a permissible IRA investment alternative? A. Mutual funds B. Fine art C. Life insurance D. Antiques Which of the following

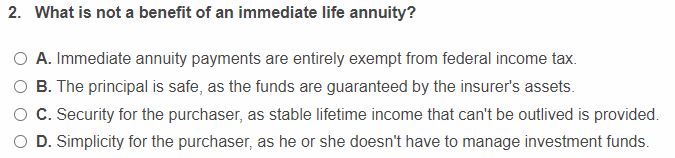

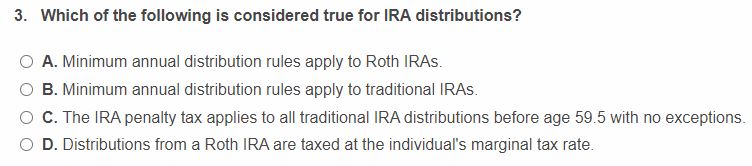

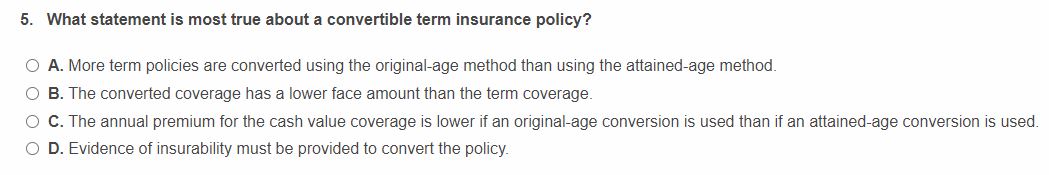

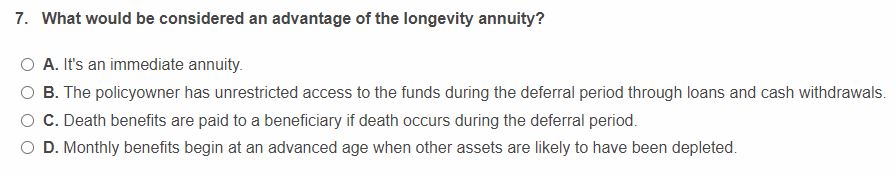

1. What would be considered a permissible IRA investment alternative? A. Mutual funds B. Fine art C. Life insurance D. Antiques Which of the following is considered true for IRA distributions? A. Minimum annual distribution rules apply to Roth IRAs. B. Minimum annual distribution rules apply to traditional IRAs. C. The IRA penalty tax applies to all traditional IRA distributions before age 59.5 with no exceptions. D. Distributions from a Roth IRA are taxed at the individual's marginal tax rate. 2. What is not a benefit of an immediate life annuity? A. Immediate annuity payments are entirely exempt from federal income tax. B. The principal is safe, as the funds are guaranteed by the insurer's assets. C. Security for the purchaser, as stable lifetime income that can't be outlived is provided. D. Simplicity for the purchaser, as he or she doesn't have to manage investment funds. 5. What statement is most true about a convertible term insurance policy? A. More term policies are converted using the original-age method than using the attained-age method. B. The converted coverage has a lower face amount than the term coverage. C. The annual premium for the cash value coverage is lower if an original-age conversion is used than if an attained-age conversion is used. D. Evidence of insurability must be provided to convert the policy. 7. What would be considered an advantage of the longevity annuity? A. It's an immediate annuity. B. The policyowner has unrestricted access to the funds during the deferral period through loans and cash withdrawals C. Death benefits are paid to a beneficiary if death occurs during the deferral period. D. Monthly benefits begin at an advanced age when other assets are likely to have been depleted

1. What would be considered a permissible IRA investment alternative? A. Mutual funds B. Fine art C. Life insurance D. Antiques Which of the following is considered true for IRA distributions? A. Minimum annual distribution rules apply to Roth IRAs. B. Minimum annual distribution rules apply to traditional IRAs. C. The IRA penalty tax applies to all traditional IRA distributions before age 59.5 with no exceptions. D. Distributions from a Roth IRA are taxed at the individual's marginal tax rate. 2. What is not a benefit of an immediate life annuity? A. Immediate annuity payments are entirely exempt from federal income tax. B. The principal is safe, as the funds are guaranteed by the insurer's assets. C. Security for the purchaser, as stable lifetime income that can't be outlived is provided. D. Simplicity for the purchaser, as he or she doesn't have to manage investment funds. 5. What statement is most true about a convertible term insurance policy? A. More term policies are converted using the original-age method than using the attained-age method. B. The converted coverage has a lower face amount than the term coverage. C. The annual premium for the cash value coverage is lower if an original-age conversion is used than if an attained-age conversion is used. D. Evidence of insurability must be provided to convert the policy. 7. What would be considered an advantage of the longevity annuity? A. It's an immediate annuity. B. The policyowner has unrestricted access to the funds during the deferral period through loans and cash withdrawals C. Death benefits are paid to a beneficiary if death occurs during the deferral period. D. Monthly benefits begin at an advanced age when other assets are likely to have been depleted Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started