Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. When authorizing bonds to be issued, the board of directors does not specify the a. total number of bonds authorized to be sold.

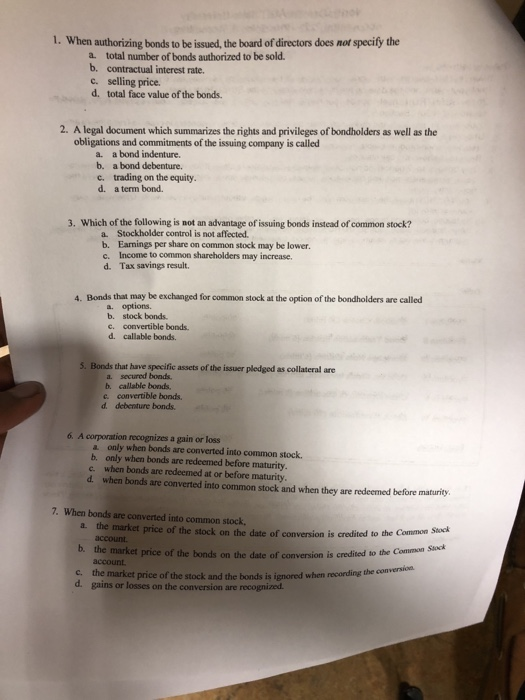

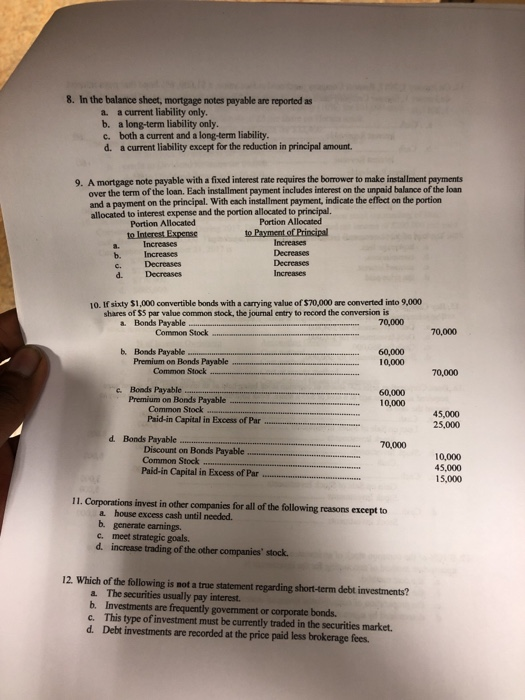

1. When authorizing bonds to be issued, the board of directors does not specify the a. total number of bonds authorized to be sold. b. contractual interest rate. c. selling price. d. total face value of the bonds. 2. A legal document which summarizes the rights and privileges of bondholders as well as the obligations and commitments of the issuing company is called a. a bond indenture. b. a bond debenture. c. trading on the equity. d. a term bond. 3. Which of the following is not an advantage of issuing bonds instead of common stock? a. Stockholder control is not affected. b. Earnings per share on common stock may be lower. c. Income to common shareholders may increase. d. Tax savings result. 4. Bonds that may be exchanged for common stock at the option of the bondholders are called a. options. b. stock bonds. c. convertible bonds. d. callable bonds. 5. Bonds that have specific assets of the issuer pledged as collateral are secured bonds. a. b. callable bonds. c. convertible bonds. d. debenture bonds. 6. A corporation recognizes a gain or loss a only when bonds are converted into common stock. b. only when bonds are redeemed before maturity. c. when bonds are redeemed at or before maturity. d. when bonds are converted into common stock and when they are redeemed before maturity. 7. When bonds are converted into common stock, a. the market price of the stock on the date of conversion is credited to the Common Stock account. b. the market price of the bonds on the date of conversion is credited to the Common Stock account. the market price of the stock and the bonds is ignored when recording the conversion d. gains or losses on the conversion are recognized. 8. In the balance sheet, mortgage notes payable are reported as a. a current liability only. b. a long-term liability only. c. both a current and a long-term liability. d. a current liability except for the reduction in principal amount. 9. A mortgage note payable with a fixed interest rate requires the borrower to make installment payments over the term of the loan. Each installment payment includes interest on the unpaid balance of the loan and a payment on the principal. With each installment payment, indicate the effect on the portion allocated to interest expense and the portion allocated to principal. Portion Allocated Portion Allocated to Interest Expense Increases to Payment of Principal Increases Increases Decreases Decreases Decreases Decreases Increases a. b. C. d. 10. If sixty $1,000 convertible bonds with a carrying value of $70,000 are converted into 9,000 shares of $5 par value common stock, the journal entry to record the conversion is a. Bonds Payable 70,000 Common Stock b. Bonds Payable Premium on Bonds Payable Common Stock c. Bonds Payable Premium on Bonds Payable Common Stock Paid-in Capital in Excess of Par d. Bonds Payable Discount on Bonds Payable Common Stock Paid-in Capital in Excess of Par 60,000 10,000 b. generate earnings. c. meet strategic goals. d. increase trading of the other companies' stock. 60,000 10,000 70,000 11. Corporations invest in other companies for all of the following reasons except to a house excess cash until needed. 12. Which of the following is not a true statement regarding short-term debt investments? a. The securities usually pay interest. b. Investments are frequently government or corporate bonds. c. This type of investment must be currently traded in the securities market. d. Debt investments are recorded at the price paid less brokerage fees. 70,000 70,000 45,000 25,000 10,000 45,000 15,000

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started