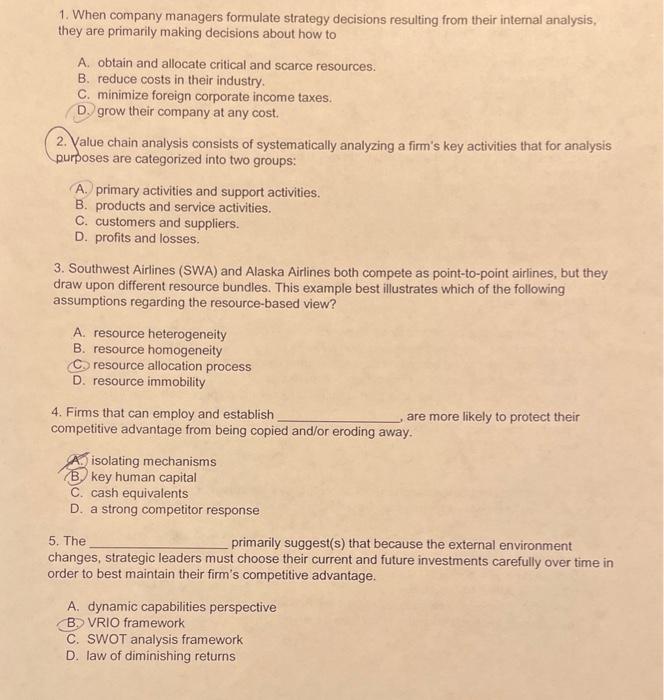

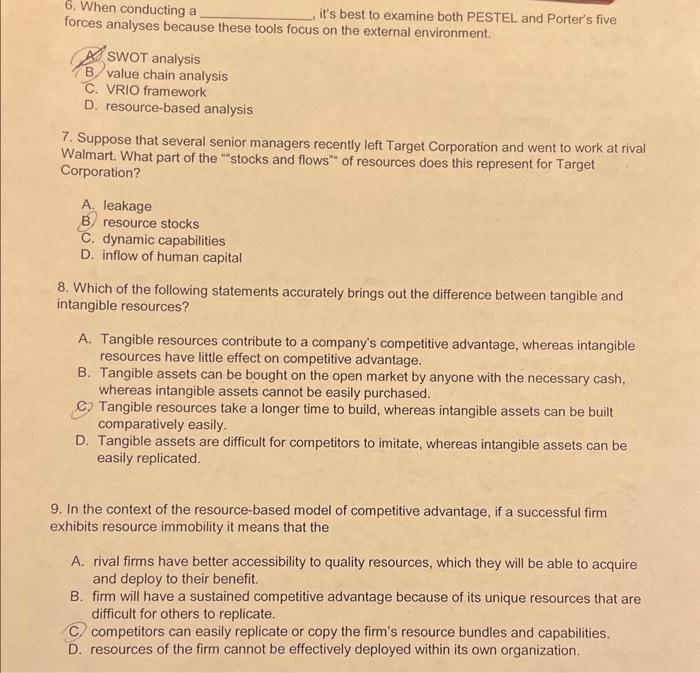

1. When company managers formulate strategy decisions resulting from their internal analysis, they are primarily making decisions about how to A. obtain and allocate critical and scarce resources. B. reduce costs in their industry. C. minimize foreign corporate income taxes. D. grow their company at any cost. 2. Value chain analysis consists of systematically analyzing a firm's key activities that for analysis purposes are categorized into two groups: A. primary activities and support activities. B. products and service activities. C. customers and suppliers. D. profits and losses. 3. Southwest Airlines (SWA) and Alaska Airlines both compete as point-to-point airlines, but they draw upon different resource bundles. This example best illustrates which of the following assumptions regarding the resource-based view? A. resource heterogeneity B. resource homogeneity C. resource allocation process D. resource immobility 4. Firms that can employ and establish , are more likely to protect their competitive advantage from being copied and/or eroding away. A. isolating mechanisms B. key human capital C. cash equivalents D. a strong competitor response 5. The primarily suggest(s) that because the external environment changes, strategic leaders must choose their current and future investments carefully over time in order to best maintain their firm's competitive advantage. A. dynamic capabilities perspective B. VRIO framework C. SWOT analysis framework D. law of diminishing returns 6. When conducting a it's best to examine both PESTEL and Porter's five forces analyses because these tools focus on the external environment. A. SWOT analysis B. value chain analysis C. VRIO framework D. resource-based analysis 7. Suppose that several senior managers recently left Target Corporation and went to work at rival Walmart. What part of the ""stocks and flows" of resources does this represent for Target Corporation? A. leakage B. resource stocks C. dynamic capabilities D. inflow of human capital 8. Which of the following statements accurately brings out the difference between tangible and intangible resources? A. Tangible resources contribute to a company's competitive advantage, whereas intangible resources have little effect on competitive advantage. B. Tangible assets can be bought on the open market by anyone with the necessary cash, whereas intangible assets cannot be easily purchased. C. Tangible resources take a longer time to build, whereas intangible assets can be built comparatively easily. D. Tangible assets are difficult for competitors to imitate, whereas intangible assets can be easily replicated. 9. In the context of the resource-based model of competitive advantage, if a successful firm exhibits resource immobility it means that the A. rival firms have better accessibility to quality resources, which they will be able to acquire and deploy to their benefit. B. firm will have a sustained competitive advantage because of its unique resources that are difficult for others to replicate. C. competitors can easily replicate or copy the firm's resource bundles and capabilities. D. resources of the firm cannot be effectively deployed within its own organization