1. When the cost-of-goods-sold method is used to record inventory at net realizable value: a. there is a direct reduction in the selling price

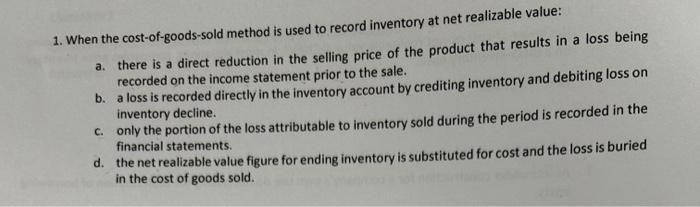

1. When the cost-of-goods-sold method is used to record inventory at net realizable value: a. there is a direct reduction in the selling price of the product that results in a loss being recorded on the income statement prior to the sale. b. a loss is recorded directly in the inventory account by crediting inventory and debiting loss on inventory decline. c. only the portion of the loss attributable to inventory sold during the period is recorded in the financial statements. d. the net realizable value figure for ending inventory is substituted for cost and the loss is buried in the cost of goods sold.

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The correct answer is c only the portion of the los...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started