Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. When the perpetual inventory system is used, the inventory sold is shown on the income statement as a. cost of goods sold b.

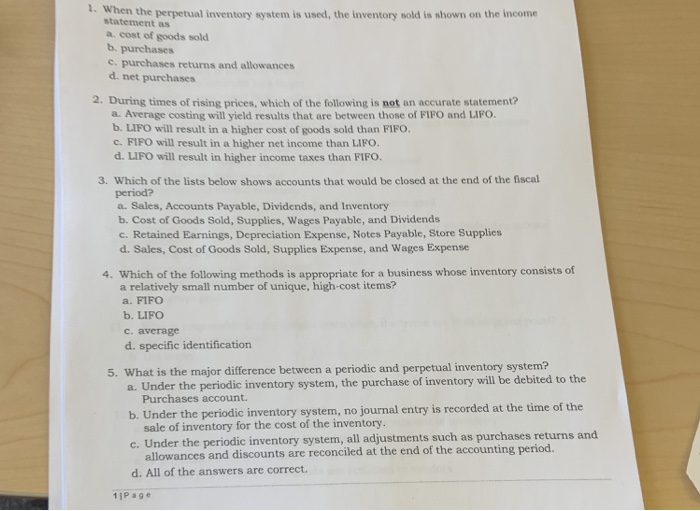

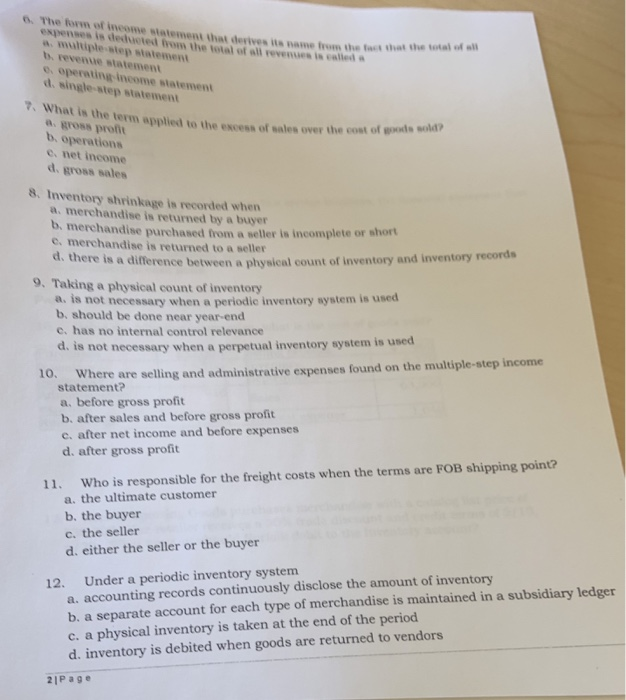

1. When the perpetual inventory system is used, the inventory sold is shown on the income statement as a. cost of goods sold b. purchases c. purchases returns and allowances d. net purchases 2. During times of rising prices, which of the following is not an accurate statement? a. Average costing will yield results that are between those of FIFO and LIFO. b. LIFO will result in a higher cost of goods sold than FIFO. c. FIFO will result in a higher net income than LIFO. d. LIFO will result in higher income taxes than FIFO. 3. Which of the lists below shows accounts that would be closed at the end of the fiscal period? a. Sales, Accounts Payable, Dividends, and Inventory. b. Cost of Goods Sold, Supplies, Wages Payable, and Dividends c. Retained Earnings, Depreciation Expense, Notes Payable, Store Supplies d. Sales, Cost of Goods Sold, Supplies Expense, and Wages Expense 4. Which of the following methods is appropriate for a business whose inventory consists of a relatively small number of unique, high-cost items? a. FIFO b. LIFO c. average d. specific identification 5. What is the major difference between a periodic and perpetual inventory system? a. Under the periodic inventory system, the purchase of inventory will be debited to the Purchases account. b. Under the periodic inventory system, no journal entry is recorded at the time of the sale of inventory for the cost of the inventory. c. Under the periodic inventory system, all adjustments such as purchases returns and allowances and discounts are reconciled at the end of the accounting period. d. All of the answers are correct. 1| Page 6. The form of income statement that derives its name from the fact that the total of all expenses is deducted from the total of all revenues is called a a. multiple-step statement b. revenue statement e. operating income statement d. single-step statement 7. What is the term applied to the excess of sales over the cost of goods sold? a. gross profit b. operations e. net income d. gross sales 8. Inventory shrinkage is recorded when a. merchandise is returned by a buyer b. merchandise purchased from a seller is incomplete or short c. merchandise is returned to a seller d. there is a difference between a physical count of inventory and inventory records 9. Taking a physical count of inventory a. is not necessary when a periodic inventory system is used b. should be done near year-end c. has no internal control relevance d. is not necessary when a perpetual inventory system is used 10. Where are selling and administrative expenses found on the multiple-step income statement? a. before gross profit b. after sales and before gross profit c. after net income and before expenses d. after gross profit 11. Who is responsible for the freight costs when the terms are FOB shipping point? a. the ultimate customer b. the buyer c. the seller d. either the seller or the buyer 12. Under a periodic inventory system a. accounting records continuously disclose the amount of inventory b. a separate account for each type of merchandise is maintained in a subsidiary ledger c. a physical inventory is taken at the end of the period d. inventory is debited when goods are returned to vendors 21 Page

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

54 Ans Sol 55 Ans Sol Area of the region Tis 0000086 T is an equilateral triangle wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started