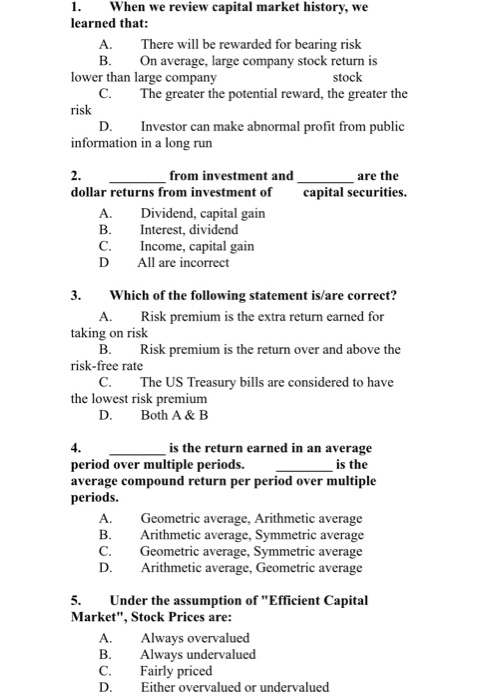

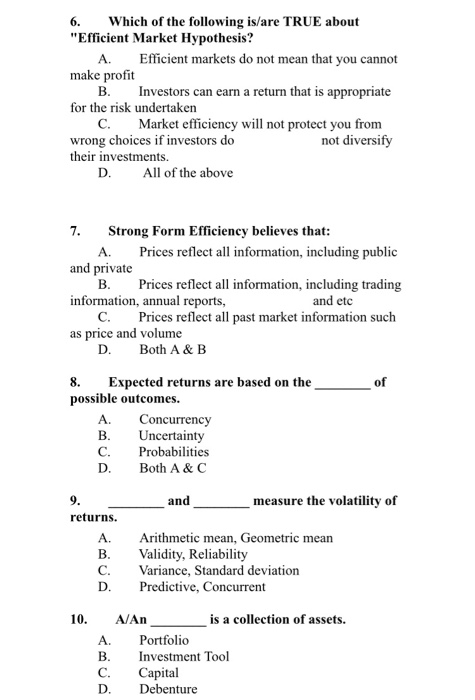

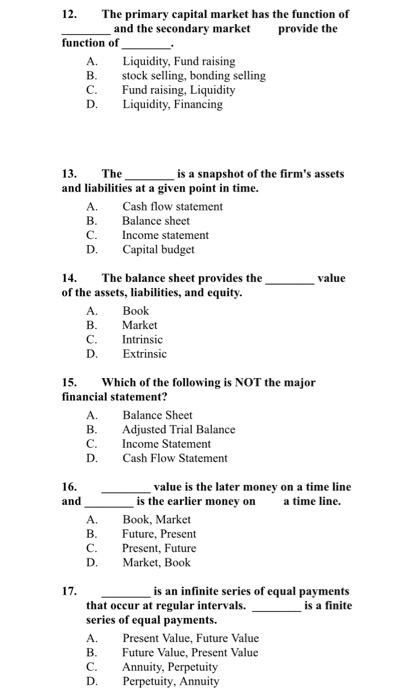

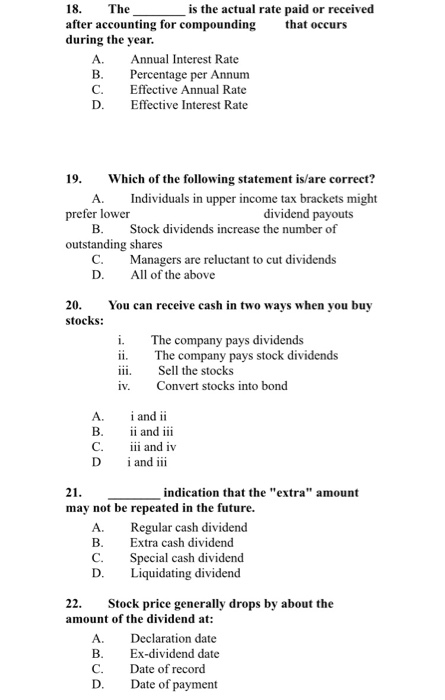

1. When we review capital market history, we learned that: A. There will be rewarded for bearing risk On average, large company stock return is . lower than large company stock The greater the potential reward, the greater the C. risk D. Investor can make abnormal profit from public information in a long run 2. from investment and are the dollar returns from investment of capital securities. Dividend, capital gain Interest, dividend A. . C. Income, capital gain All are incorrect 3. Which of the following statement is/are correct? Risk premium is the extra return earned for A. taking on risk . C Risk premium is the return over and above the risk-free rate C. The US Treasury bills are considered to have the lowest risk premium Both A& B D. is the return earned in an average is the 4. period over multiple periods. average compound return per period over multiple periods Geometric average, Arithmetic average Arithmetic average, Symmetric average Geometric average, Symmetric average Arithmetic average, Geometric average A. B. C. D. 5. Under the assumption of "Efficient Capital Market", Stock Prices are: A. Always overvalued Always undervalued Fairly priced Either overvalued or undervalued B. C. D. A Which of the following is/are TRUE about "Efficient Market Hypothesis? 6. Efficient markets do not mean that you cannot A. make profit . Investors can earn a return that is appropriate for the risk undertaken Market efficiency will not protect you from not diversify C. wrong choices if investors do their investments All of the above D. Strong Form Efficiency believes that: 7. Prices reflect all information, including public A. and private . information, annual reports, C. Prices reflect all past market information such price and volume D. Prices reflect all information, including trading and etc as Both A & B Expected returns are based on the possible outcomes 8. A. Concurrency Uncertainty Probabilities Both A& C B. C. D. 9. measure the volatility of and returns Arithmetic mean, Geometric mean Validity, Reliability Variance, Standard deviation Predictive, Concurrent A. B. C. D. is a collection of assets 10. A/An A. Portfolio B. Investment Tool C. Capital Debenture D. 12 The primary capital market has the function of and the secondary market provide the function of Liquidity, Fund raising stock selling, bonding selling Fund raising, Liquidity Liquidity, Financing A. B. C. D. 13. The is a snapshot of the firm's assets and liabilities at a given point in time. Cash flow statement A. B. Balance sheet C. Income statement Capital budget D. The balance sheet provides the of the assets, liabilities, and equity 14. value A. Book B. Market C. Intrinsic D. Extrinsic Which of the following is NOT the major 15. financial statement? Balance Sheet A. Adjusted Trial Balance Income Statement B. C. D. Cash Flow Statement 16. value is the later money on a time line is the earlier money a time line. and on A. Book, Market Future, Present Present, Future Market, Book B. C. D. 17 that occur at regular intervals series of equal payments is an infinite series of equal payments is a finite A. Present Value, Future Value Future Value, Present Value Annuity, Perpetuity Perpetuity, Annuity B. C. D. 18. The is the actual rate paid or received after accounting for compounding during the year. that occurs Annual Interest Rate A. B. Percentage per Annum Effective Annual Rate C. D. Effective Interest Rate 19 Which of the following statement is/are correct? Individuals in upper income tax brackets might dividend payouts Stock dividends increase the number of A. prefer lower B. outstanding shares Managers are reluctant to cut dividends All of the above C. D. 20 stocks You can receive cash in two ways when you buy The company pays dividends The company pays stock dividends Sell the stocks Convert stocks into bond i ii iv i and ii A. i and iii ii and iv iand ii B. C. 21. indication that the "extra" amount may not be repeated in the future. Regular cash dividend Extra cash dividend A. B. C. Special cash dividend Liquidating dividend D. 22. Stock price generally drops by about the amount of the dividend at: Declaration date A. B. Ex-dividend date Date of record C. Date of payment D