Question

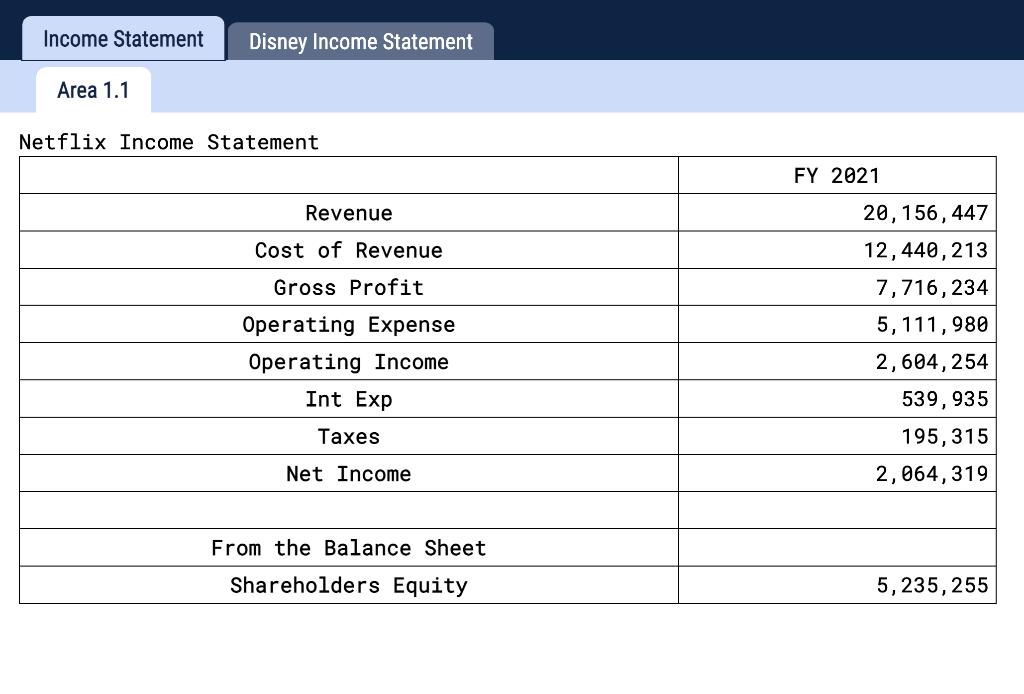

1. Which company has a higher times interest earned ratio? 2. Which company has a lower return on equity? 3. Which company has the better

1. Which company has a higher times interest earned ratio?

2. Which company has a lower return on equity?

3. Which company has the better ROE?

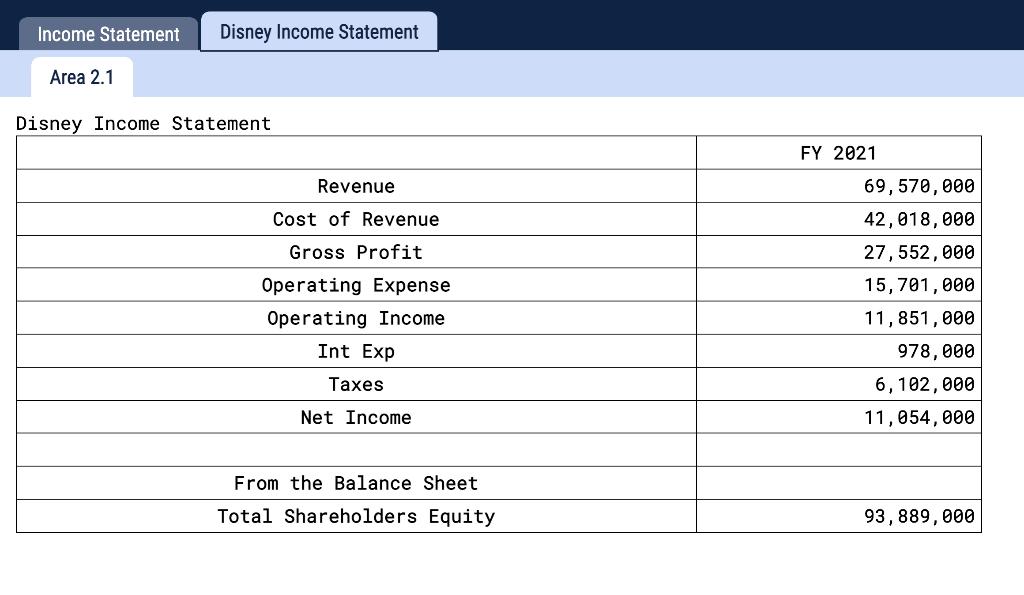

Income Statement Disney Income Statement Area 2.1 Disney Income Statement Revenue Cost of Revenue Gross Profit Operating Expense Operating Income Int Exp Taxes Net Income From the Balance Sheet Total Shareholders Equity FY 2021 69,570,000 42,018,000 27,552,000 15,701,000 11,851,000 978,000 6,102,000 11,054,000 93,889,000

Step by Step Solution

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Times interest earned ratio is the ratio of earnings before interest and tax and interest expens...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis Using Financial Accounting Information

Authors: Charles H Gibson

12th Edition

1439080607, 978-1439080603

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App