Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Which definition best describes indirect costs? a. Indirect costs are those costs which are not controlled directly by a manager. b. Indirect costs

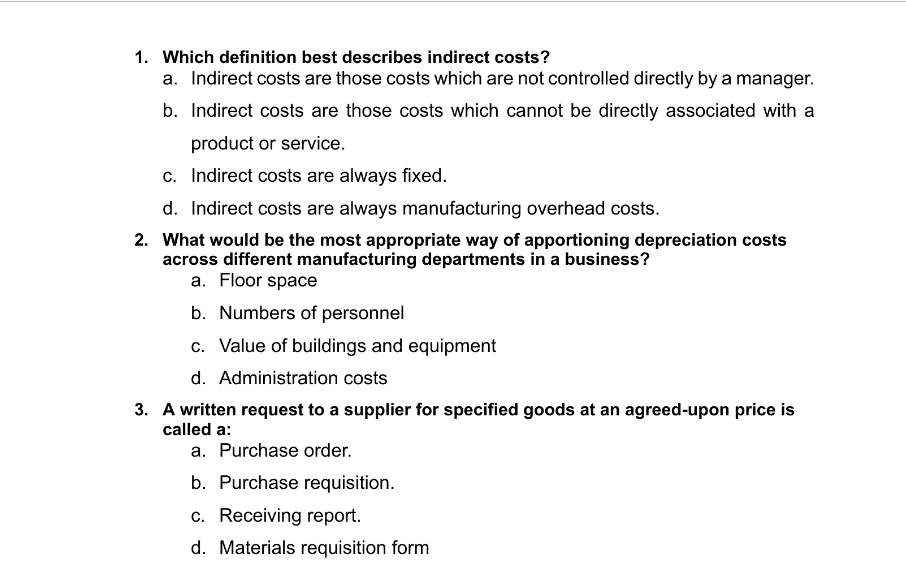

1. Which definition best describes indirect costs? a. Indirect costs are those costs which are not controlled directly by a manager. b. Indirect costs are those costs which cannot be directly associated with a product or service. c. Indirect costs are always fixed. d. Indirect costs are always manufacturing overhead costs. 2. What would be the most appropriate way of apportioning depreciation costs across different manufacturing departments in a business? a. Floor space b. Numbers of personnel c. Value of buildings and equipment d. Administration costs 3. A written request to a supplier for specified goods at an agreed-upon price is called a: a. Purchase order. b. Purchase requisition. c. Receiving report. d. Materials requisition form 1. Which definition best describes indirect costs? a. Indirect costs are those costs which are not controlled directly by a manager. b. Indirect costs are those costs which cannot be directly associated with a product or service. c. Indirect costs are always fixed. d. Indirect costs are always manufacturing overhead costs. 2. What would be the most appropriate way of apportioning depreciation costs across different manufacturing departments in a business? a. Floor space b. Numbers of personnel c. Value of buildings and equipment d. Administration costs 3. A written request to a supplier for specified goods at an agreed-upon price is called a: a. Purchase order. b. Purchase requisition. c. Receiving report. d. Materials requisition form

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Which definition best describes indirec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started