Question

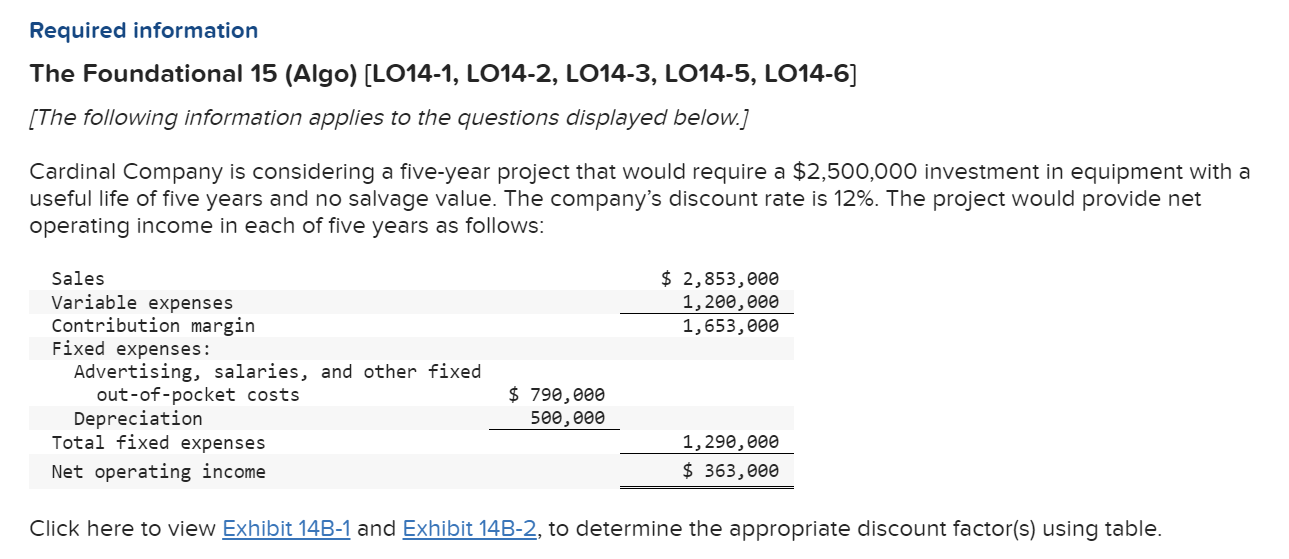

1. Which item(s) in the income statement shown above will not affect cash flows? (You may select more than one answer. Single click the box

1. Which item(s) in the income statement shown above will not affect cash flows? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.)

check all that apply

- Sales

- Variable expenses

- Advertising, salaries, and other fixed out-of-pocket costs expenses

- Depreciation expense

2. What are the projects annual net cash inflows?

3. What is the present value of the projects annual net cash inflows? (Round your final answer to the nearest whole dollar amount.)

4. What is the projects net present value? (Round final answer to the nearest whole dollar amount.)

5. What is the profitability index for this project? (Round your answer to 2 decimal places.)

6. What is the projects internal rate of return?

7. What is the projects payback period? (Round your answer to 2 decimal places.)

8. What is the projects simple rate of return for each of the five years? (Round your answer to 2 decimal places.)

9. If the companys discount rate was 14% instead of 12%, would you expect the project's net present value to be higher, lower, or the same?

10. If the equipment had a salvage value of $300,000 at the end of five years, would you expect the projects payback period to be higher, lower, or the same?

Required information The Foundational 15 (Algo) [LO14-1, LO14-2, LO14-3, LO14-5, LO14-6] [The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,500,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 12%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started