1) Which of the 4 methods create the greatest tax savings in the first year, (2) will you answer in (1) always be the same, and (3) explain your answer in (2).

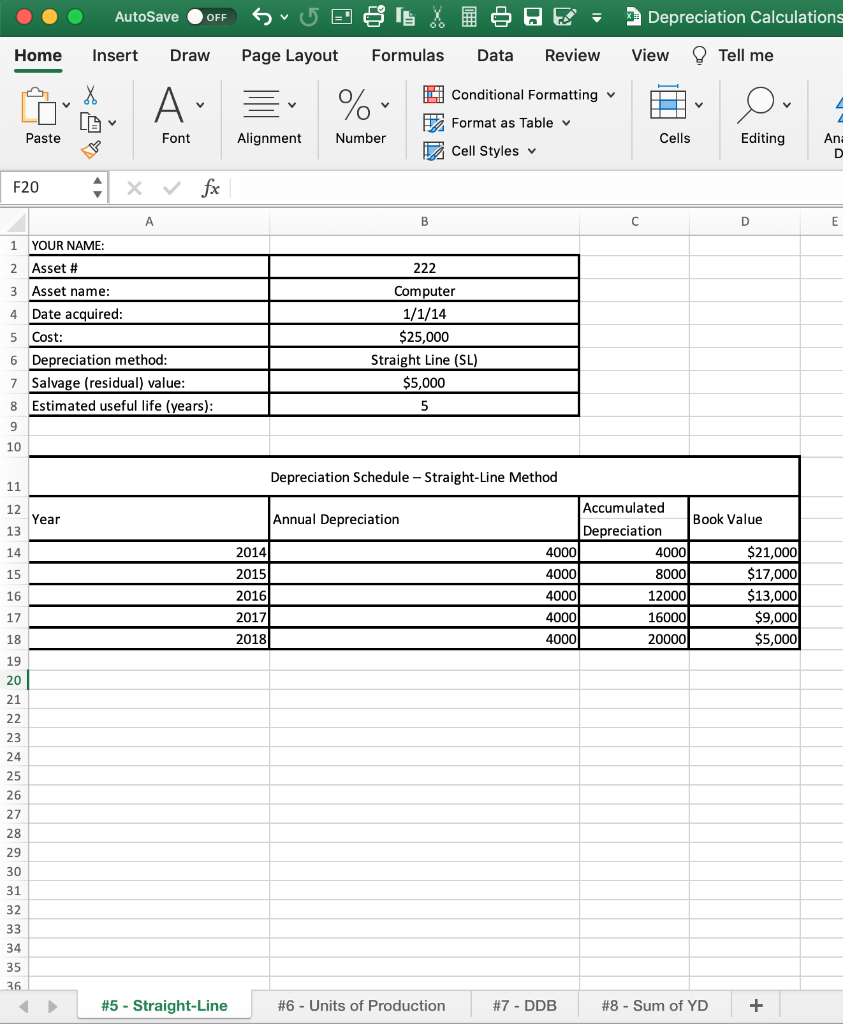

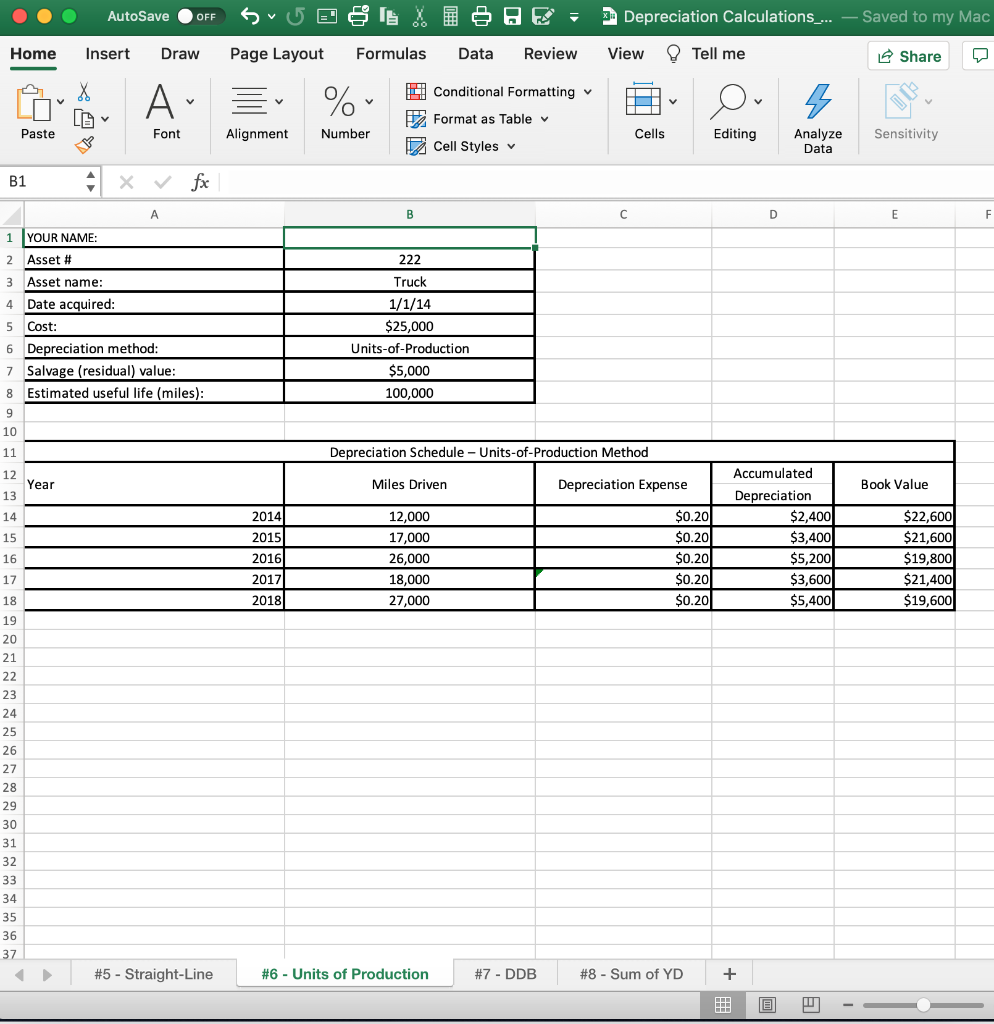

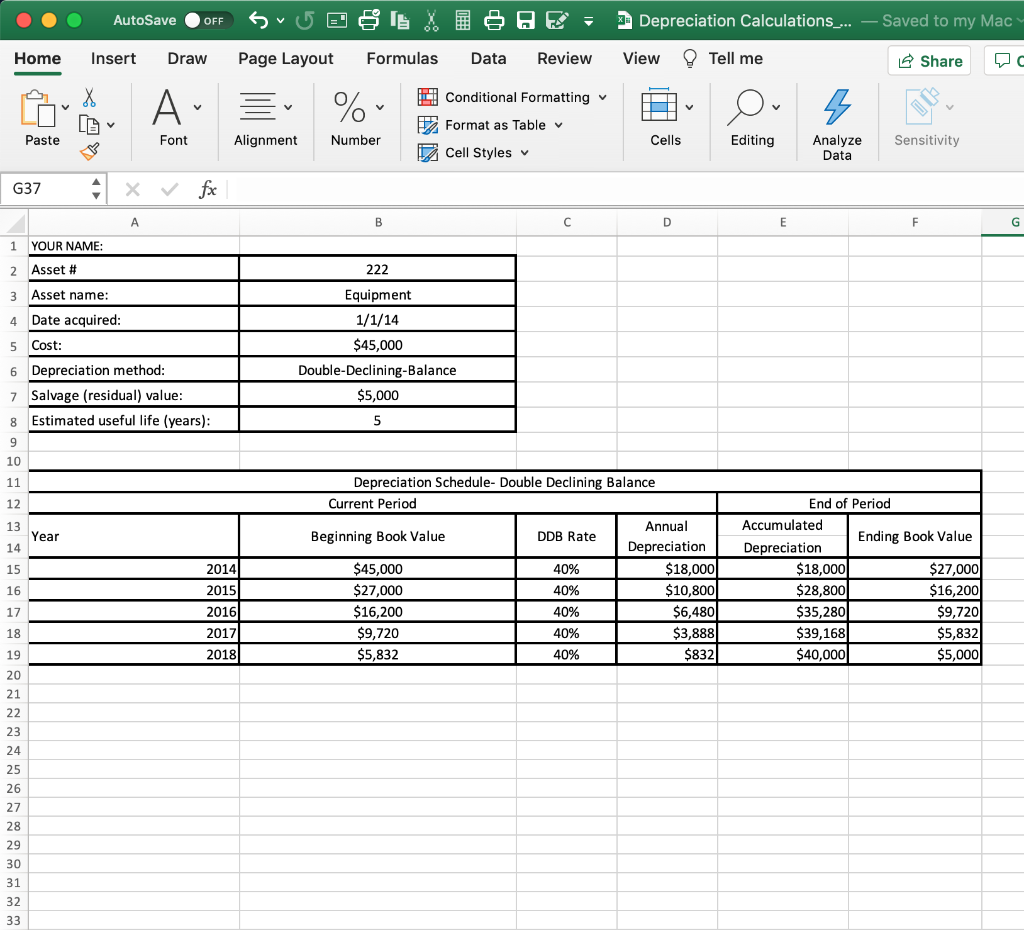

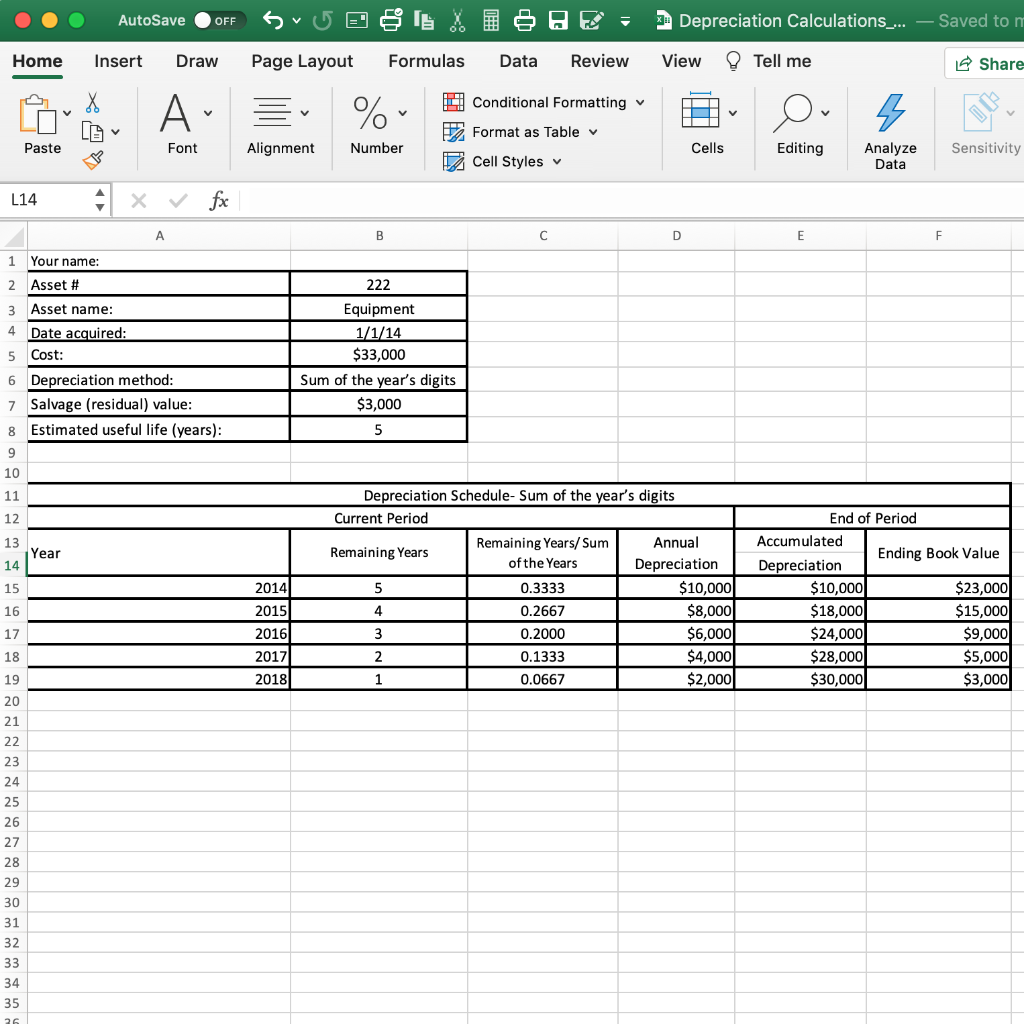

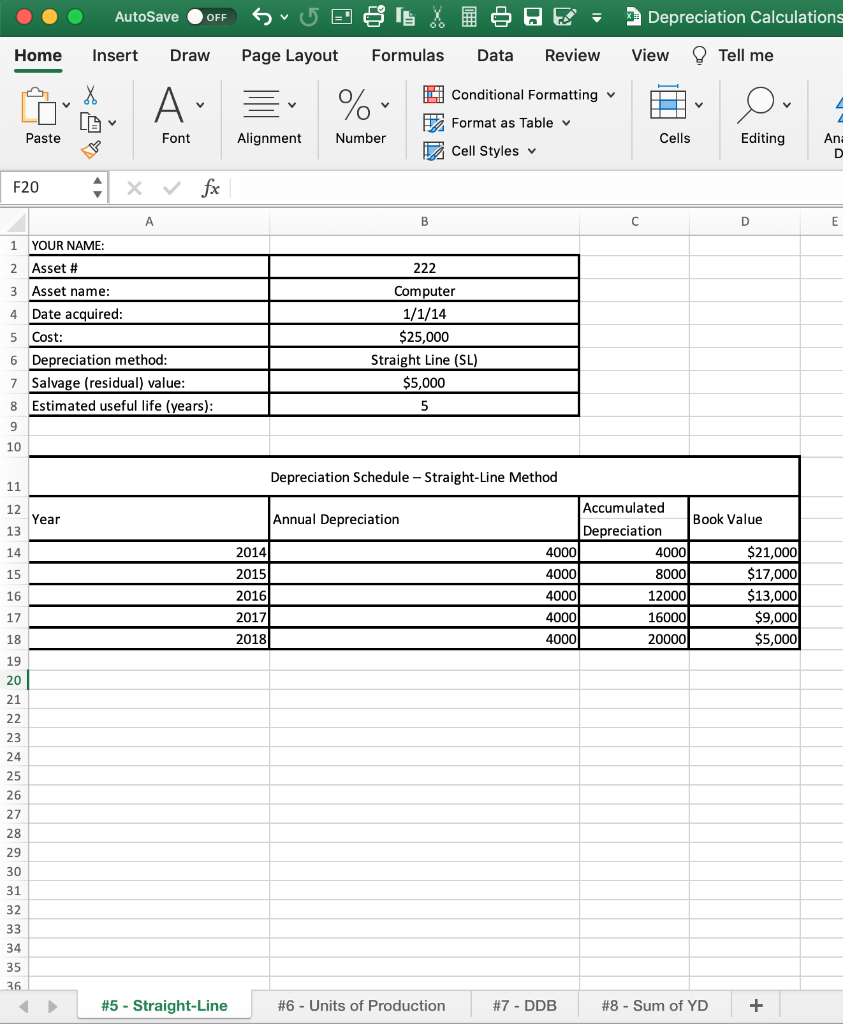

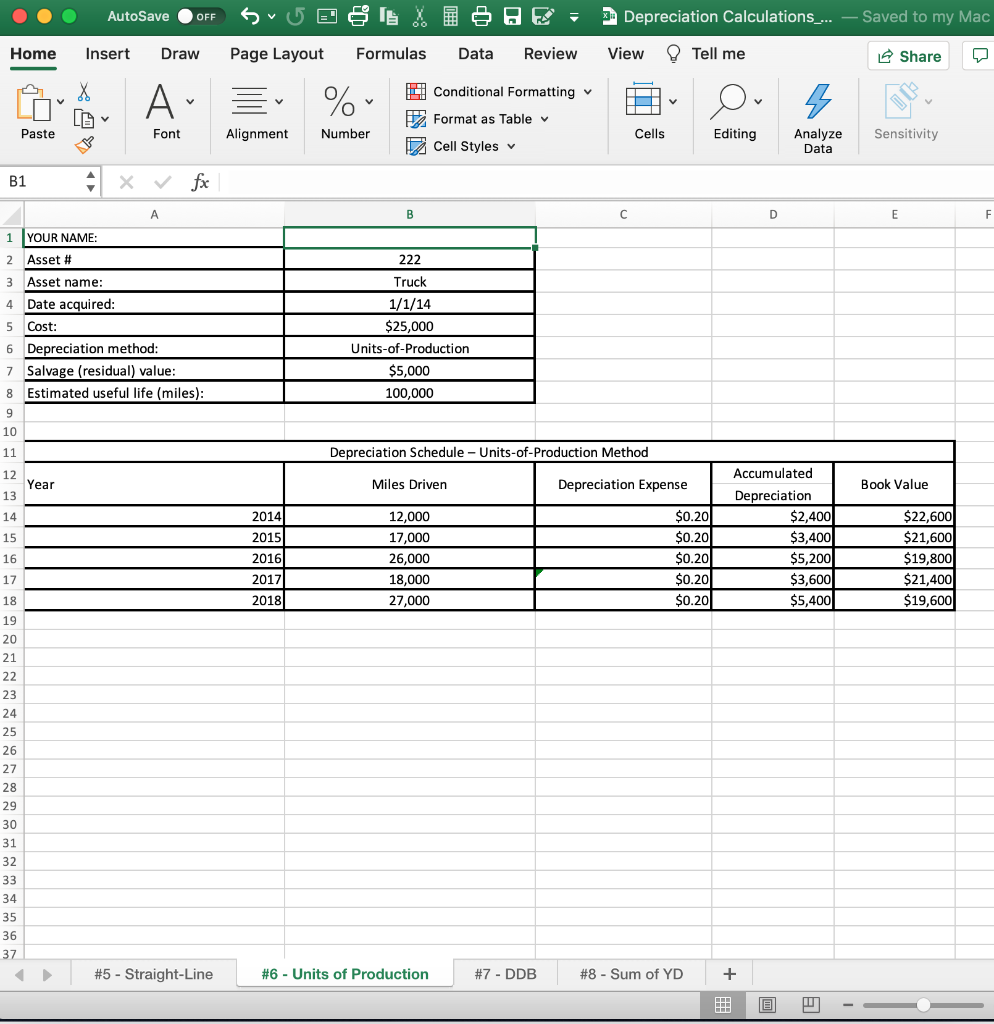

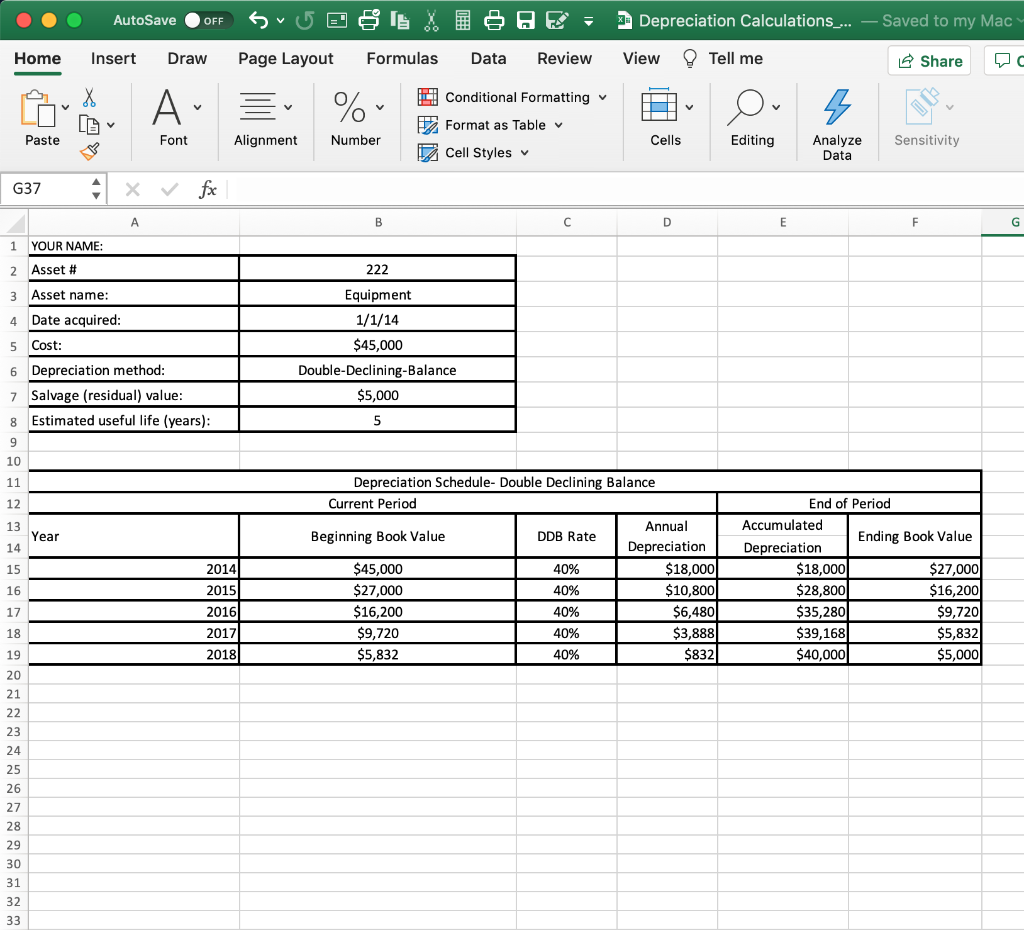

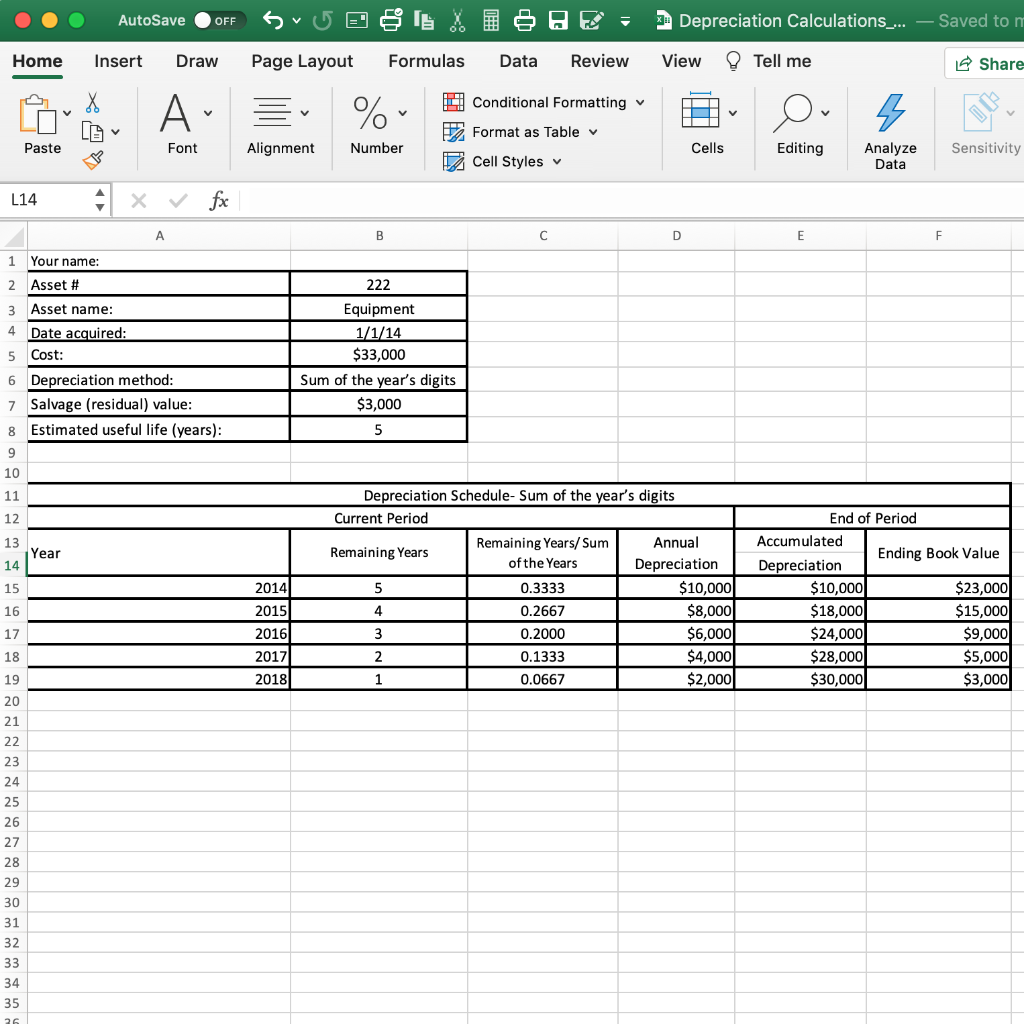

AutoSave OFF Depreciation Calculations Home Insert Draw Page Layout Formulas Data Review View Tell me A. % L Conditional Formatting Format as Table Cell Styles Paste Font Alignment Number Cells Editing Ang D F20 fx A B D E 1 YOUR NAME: 222 4 2 Asset # 3 Asset name: Date acquired: 5 Cost: 6 Depreciation method: 7 Salvage (residual) value: 8 Estimated useful life (years): Computer 1/1/14 $25,000 Straight Line (SL) $5,000 5 9 10 Depreciation Schedule - Straight-Line Method 11 12 Year Annual Depreciation 13 14 15 16 2014 2015 2016 2017 2018 Accumulated Book Value Depreciation 4000 4000 $21,000 4000 8000 $17,000 40001 12000 $13,000 4000 16000 $9,000 4000 20000 $5,000 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 #5 - Straight-Line #6 - Units of Production #7 - DDB #8 - Sum of YD + AutoSave OFF Depreciation Calculations ... Saved to my Mac Home Insert Draw Page Layout Formulas Data Review View Tell me Share X A. % V Conditional Formatting Format as Table Cell Styles O 5 Paste Font Alignment Number Cells Editing Analyze Data Sensitivity B1 fx A B D E F 1 YOUR NAME: 2 Asset # 3 Asset name: 4 Date acquired: 5 Cost: 6 Depreciation method: 7 Salvage (residual) value: 8 Estimated useful life (miles): 9 10 11 222 Truck 1/1/14 $25,000 Units-of-Production $5,000 100,000 Depreciation Schedule - Units-of-Production Method 12 Year Miles Driven Depreciation Expense Book Value 13 14 15 2014 2015 2016 2017 2018 16 17 12,000 17,000 26,000 18,000 27,000 Accumulated Depreciation $2,400 $3,400 $5,200 $3,600 $5,400 $0.20 $0.200 $0.20 $0.20 $0.20 $22,600 $21,600 $19,800 $21,4001 $19,600 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 #5 - Straight-Line #6 - Units of Production #7 - DDB #8 - Sum of YD + AutoSave OFF Depreciation Calculations_... - Saved to my Mac Home Insert Draw Page Layout Formulas Data Review View Tell me Share T A % V 3 Conditional Formatting Format as Table Cell Styles Paste Font Alignment Number Cells Editing Analyze Data Sensitivity G37 fx B D E F G 1 YOUR NAME: 2 Asset # 222 3 Asset name: 4 Date acquired: 5 Cost: Equipment 1/1/14 $45,000 Double-Declining-Balance $5,000 6 Depreciation method: 7 Salvage (residual) value: 8 Estimated useful life (years): 9 5 10 11 12 13 Year 14 15 Depreciation Schedule- Double Declining Balance Current Period Annual Beginning Book Value DDB Rate Depreciation $45,000 40% $18,000 $27,000 40% $10,800 $16,200 40% $6,480 $9,720 40% $3,888 $5,832 40% $832 End of Period Accumulated Ending Book Value Depreciation $18,000 $27,000 $28,8001 $16,200 $35,280 $9,720 $39,168 $5,832 $40,000 $5,000 2014 2015| 2016) 2017 2018) 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 AutoSave OFF Depreciation Calculations_... Saved to n Home Insert Draw Page Layout Formulas Data Review View Tell me Share Conditional Formatting X LA A . % 5 Format as Table Paste Font Alignment Number Cells Editing Analyze Data Sensitivity Cell Styles L14 fx A B D F F 1 Your name: 2 Asset # 222 3 Asset name: 4 Date acquired: 5 Cost: 6 Depreciation method: 7 Salvage (residual) value: 8 Estimated useful life (years): 9 Equipment 1/1/14 $33,000 Sum of the year's digits $3,000 5 10 11 12 13 Year 14 15 Depreciation Schedule-Sum of the year's digits Current Period Remaining Years/ Sum Annual Remaining Years of the Years Depreciation 5 0.3333 $10,000 4 0.2667 $8,000 3 0.2000 $6,000 2 0.1333 $4,0001 1 0.0667 $2,000 End of Period Accumulated Ending Book Value Depreciation $10,000 $23,000 $18,000 $15,000 $24,000 $9,000 $28,000 $5,000 $30,000 $3,000 2014 2015) 2016 2017 2018) 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 26