Question

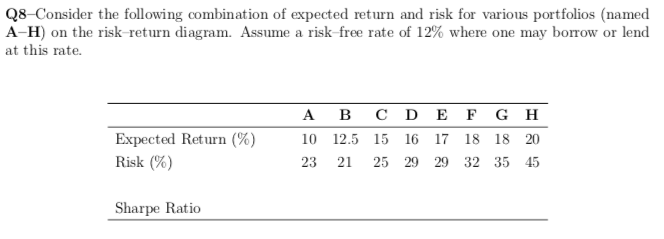

1. Which of the above portfolios has the highest Sharpe ratio? (Must express in percentage) 2. Suppose an investor can lend/borrow at the riskfree rate.

1. Which of the above portfolios has the highest Sharpe ratio? (Must express in percentage)

2. Suppose an investor can lend/borrow at the riskfree rate. Assume the investor can tolerate at most 25% risk in any constructed portfolio. What is the best strategy for the investor? Must show work. Hint: You may want to treat this a problem in efficient frontier in the presence of a riskfree asset!

3. What is the maximum attainable expected return under the optimal strategy?

Please answer all THREE questions! Upvotes will be given for correct answers and work!

Q8-Consider the following combination of expected return and risk for various portfolios (named A-H) on the risk-return diagram. Assume a risk-free rate of 12% where one may borrow or lend at this rate. Expected Return (%) Risk (%) A B C D E F G H 10 12.5 15 16 17 18 18 20 23 21 25 29 29 32 35 45 Sharpe RatioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started