Answered step by step

Verified Expert Solution

Question

1 Approved Answer

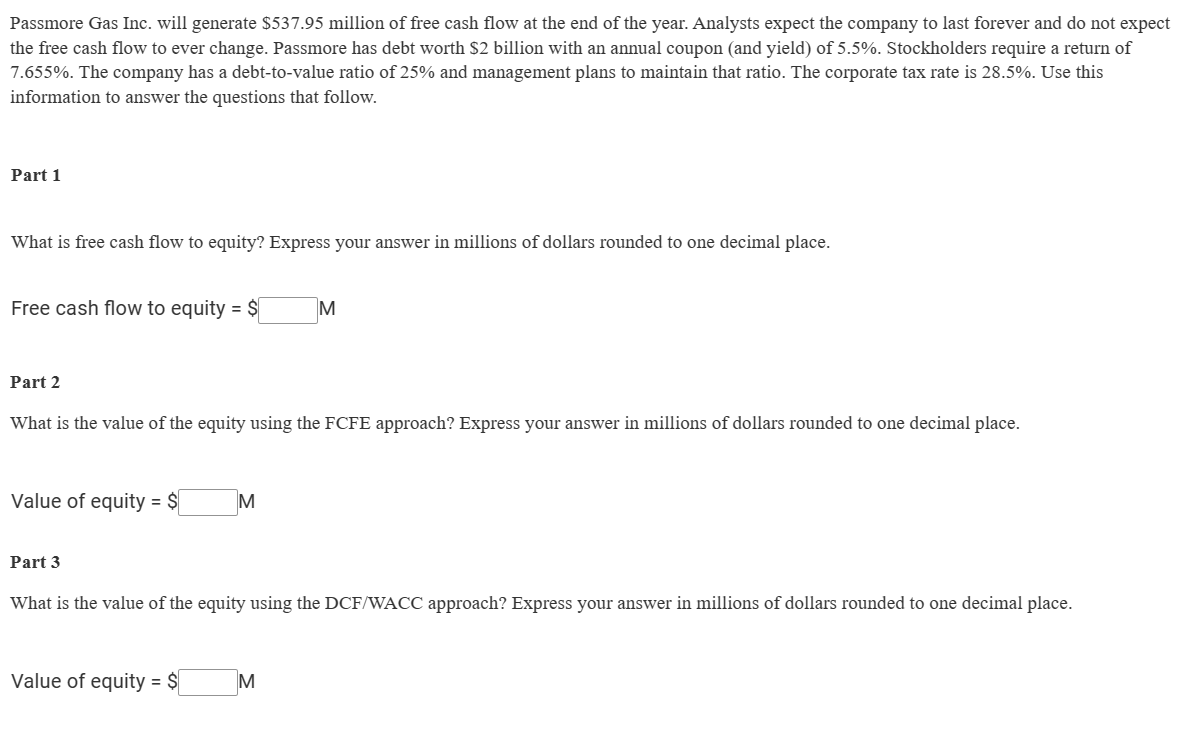

Passmore Gas Inc. will generate $ 5 3 7 . 9 5 million of free cash flow at the end of the year. Analysts expect

Passmore Gas Inc. will generate $ million of free cash flow at the end of the year. Analysts expect the company to last forever and do not expect

the free cash flow to ever change. Passmore has debt worth $ billion with an annual coupon and yield of Stockholders require a return of

The company has a debttovalue ratio of and management plans to maintain that ratio. The corporate tax rate is Use this

information to answer the questions that follow.

Part

What is free cash flow to equity? Express your answer in millions of dollars rounded to one decimal place.

Free cash flow to equity $

Part

What is the value of the equity using the FCFE approach? Express your answer in millions of dollars rounded to one decimal place.

Value of equity $

Part

What is the value of the equity using the DCFWACC approach? Express your answer in millions of dollars rounded to one decimal place.

Value of equity $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started