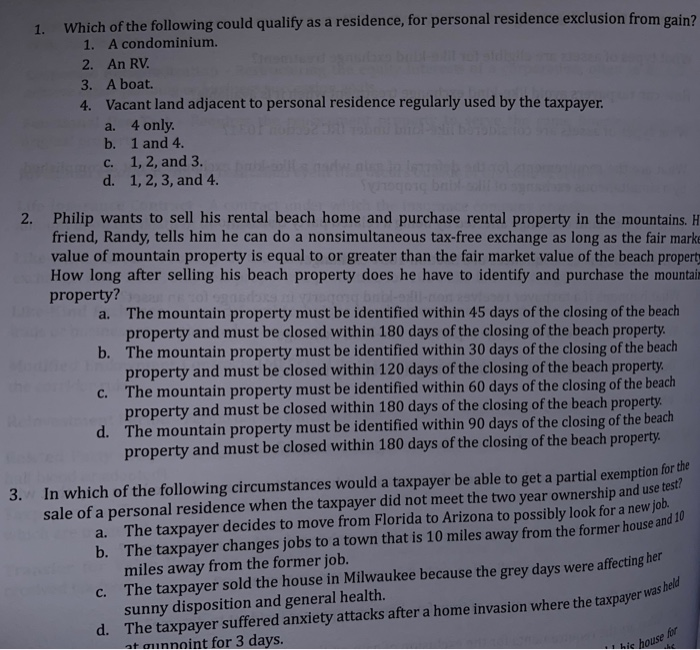

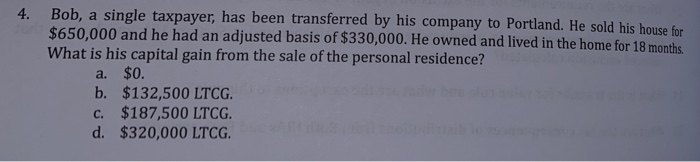

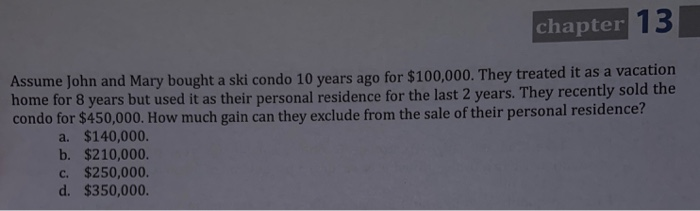

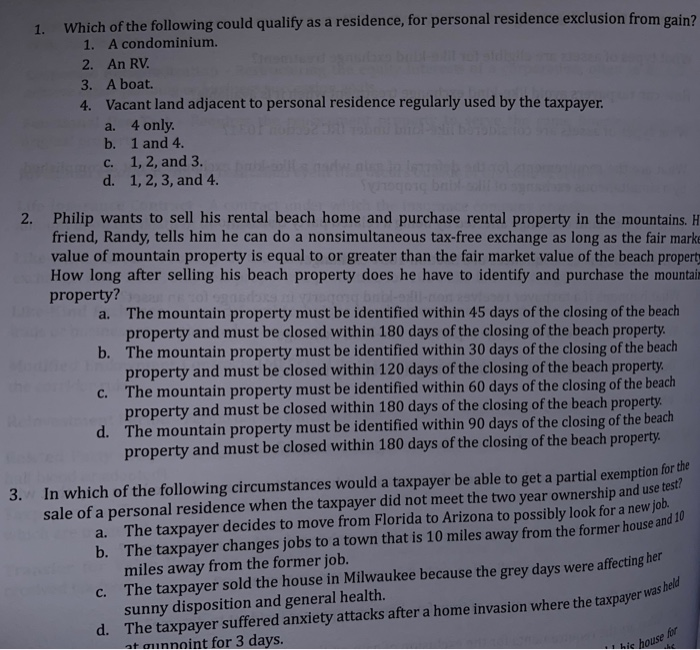

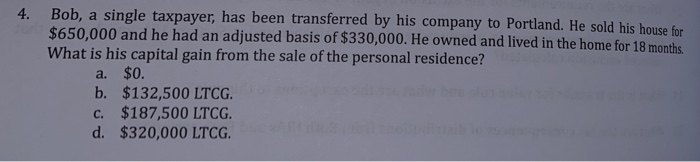

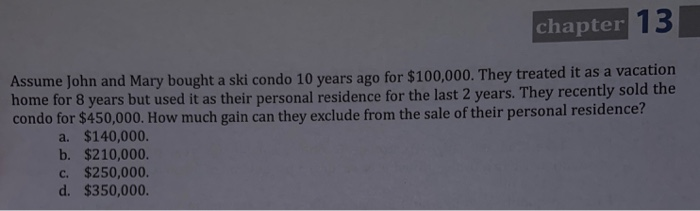

1. Which of the following could qualify as a residence, for personal residence exclusion from gain? 1. A condominium. 2. An RV. 3. A boat. 4. Vacant land adjacent to personal residence regularly used by the taxpayer. a. 4 only. b. 1 and 4. c. 1, 2, and 3. d. 1,2,3, and 4. 2. Philip wants to sell his rental beach home and purchase rental property in the mountains. H friend, Randy, tells him he can do a nonsimultaneous tax-free exchange as long as the fair marke value of mountain property is equal to or greater than the fair market value of the beach property How long after selling his beach property does he have to identify and purchase the mountain property? a. The mountain property must be identified within 45 days of the closing of the beach property and must be closed within 180 days of the closing of the beach property b. The mountain property must be identified within 30 days of the closing of the beach property and must be closed within 120 days of the closing of the beach property The mountain property must be identified within 60 days of the closing of the beach property and must be closed within 180 days of the closing of the beach property d. The mountain property must be identified within 90 days of the closing of the beach property and must be closed within 180 days of the closing of the beach property, 3. In which of the following circumstances would a taxpayer be able to get a partial exemption for sale of a personal residence when the taxpayer did not meet the two year ownership and use tes a. The taxpayer decides to move from Florida to Arizona to possibly look for a new jop b. The taxpayer changes jobs to a town that is 10 miles away from the former house and miles away from the former job. c. The taxpayer sold the house in Milwaukee because the grey days were affecting her sunny disposition and general health. d. The taxpayer suffered anxiety attacks after a home invasion where the taxpayer atunnoint for 3 days. ne taxpayer was held Lic house for 4. Bob, a single taxpayer, has been transferred by his company to Portland. He sold his house for $650,000 and he had an adjusted basis of $330,000. He owned and lived in the home for 18 months What is his capital gain from the sale of the personal residence? a. $0. b. $132,500 LTCG. c. $187,500 LTCG. d. $320,000 LTCG. chapter 13 Assume John and Mary bought a ski condo 10 years ago for $100,000. They treated it as a vacation home for 8 years but used it as their personal residence for the last 2 years. They recently sold the condo for $450,000. How much gain can they exclude from the sale of their personal residence? a. $140,000. b. $210,000. c. $250,000. d. $350,000