Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Which of the following is FALSE about bond credit ratings and credit ratings are like consumer credit scores, they indicate the level of default

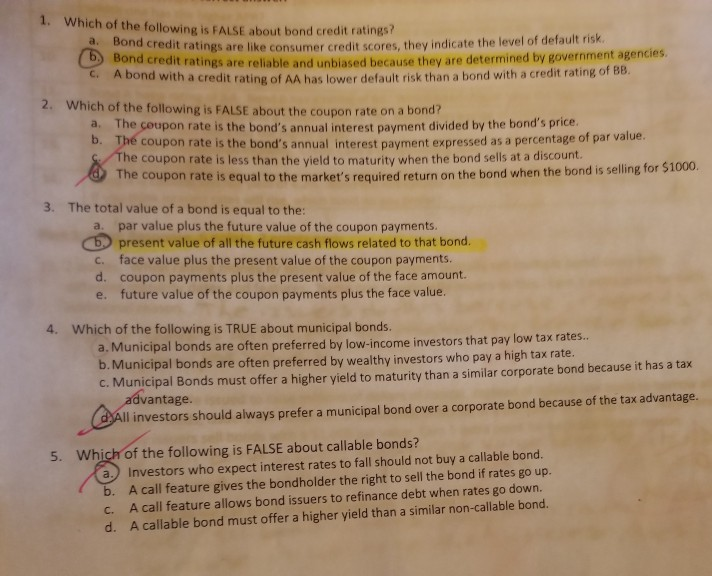

1. Which of the following is FALSE about bond credit ratings and credit ratings are like consumer credit scores, they indicate the level of default risk. edit ratings are reliable and unbiased because they are determined by government agencies A bond with a credit rating of AA hac inwer default risk than a bond with a credit rating of 10 2. Which of the following is FALSE about the coupon rate on a bond? a. The coupon rate is the bond's annual interest payment divided by the bond's price. D. The coupon rate is the band's annual interest payment expressed as a percentage of par value, s. The coupon rate is less than the vield to maturity when the bond sells at a discount. The coupon rate is equal to the market's required return on the bond when the bond is selling for $1000, 3. The total value of a bond is equal to the a. par value plus the future value of the coupon payments O present value of all the future cash flows related to that bond. c. face value plus the present value of the coupon payments. d. coupon payments plus the present value of the face amount e. future value of the coupon payments plus the face value. 4. Which of the following is TRUE about municipal bonds. a. Municipal bonds are often preferred by low-income investors that pay low tax rates.. b. Municipal bonds are often preferred by wealthy investors who pay a high tax rate. c. Municipal Bonds must offer a higher yield to maturity than a similar corporate bond because it has a tax advantage. d. All investors should always prefer a municipal bond over a corporate bond because of the tax advantage 5. Which of the following is FALSE about callable bonds? a. Investors who expect interest rates to fall should not buy a callable bond. b. A call feature gives the bondholder the right to sell the bond if rates go up. C. A call feature allows bond issuers to refinance debt when rates go down d. A callable bond must offer a higher yield than a similar non-callable bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started