Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Which of the following is not true? A. An auditor of a public company should conduct the audit in accordance with both ASB standards

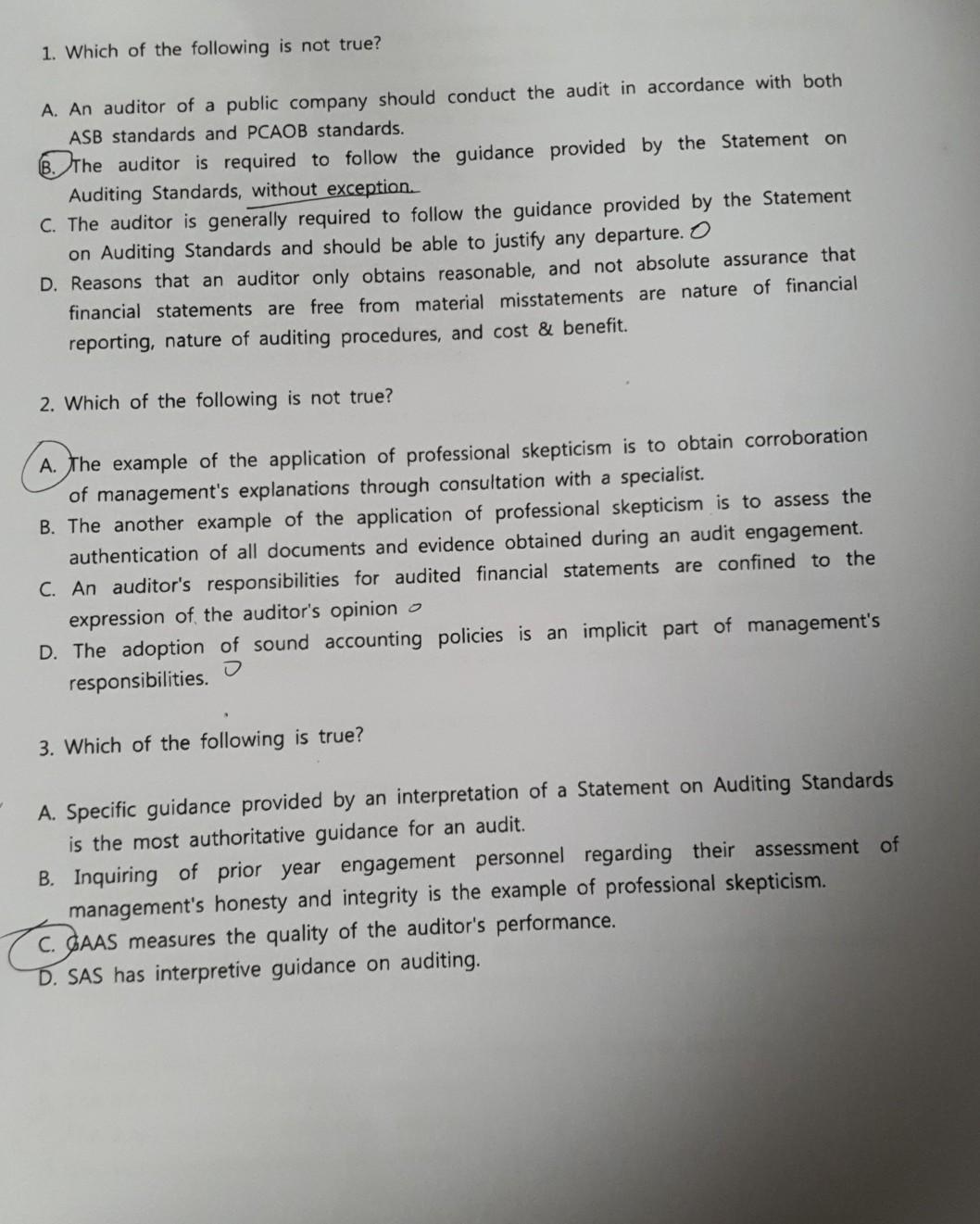

1. Which of the following is not true? A. An auditor of a public company should conduct the audit in accordance with both ASB standards and PCAOB standards. The auditor is required to follow the guidance provided by the Statement on Auditing Standards, without exception. C. The auditor is generally required to follow the guidance provided by the Statement on Auditing Standards and should be able to justify any departure. O D. Reasons that an auditor only obtains reasonable, and not absolute assurance that financial statements are free from material misstatements are nature of financial reporting, nature of auditing procedures, and cost & benefit. 2. Which of the following is not true? A. The example of the application of professional skepticism is to obtain corroboration of management's explanations through consultation with a specialist. B. The another example of the application of professional skepticism is to assess the authentication of all documents and evidence obtained during an audit engagement. C. An auditor's responsibilities for audited financial statements are confined to the expression of the auditor's opinion o D. The adoption of sound accounting policies is an implicit part of management's J responsibilities. 3. Which of the following is true? A. Specific guidance provided by an interpretation of a Statement on Auditing Standards is the most authoritative guidance for an audit. B. Inquiring of prior year engagement personnel regarding their assessment of management's honesty and integrity is the example of professional skepticism. C GAAS measures the quality of the auditor's performance. D. SAS has interpretive guidance on auditing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started