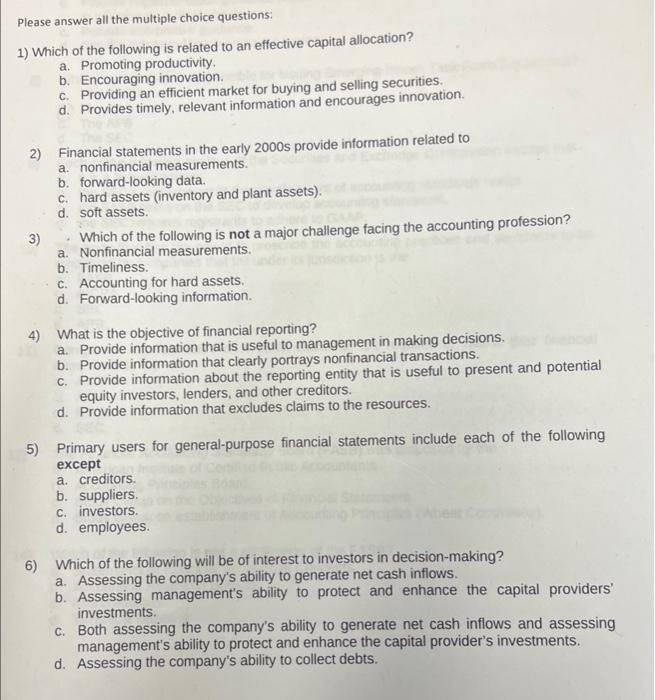

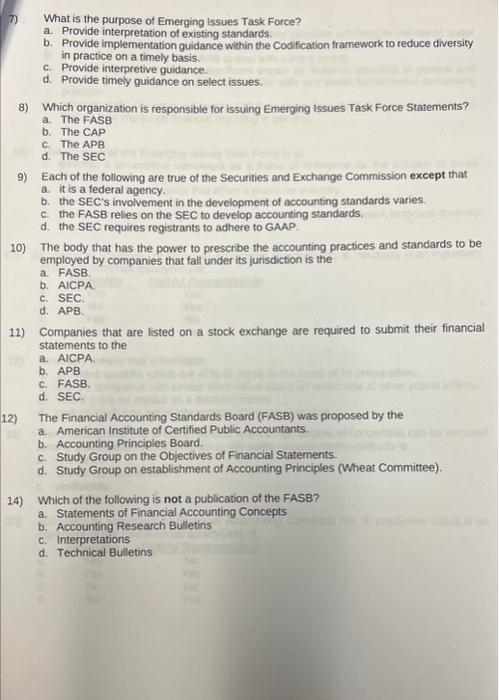

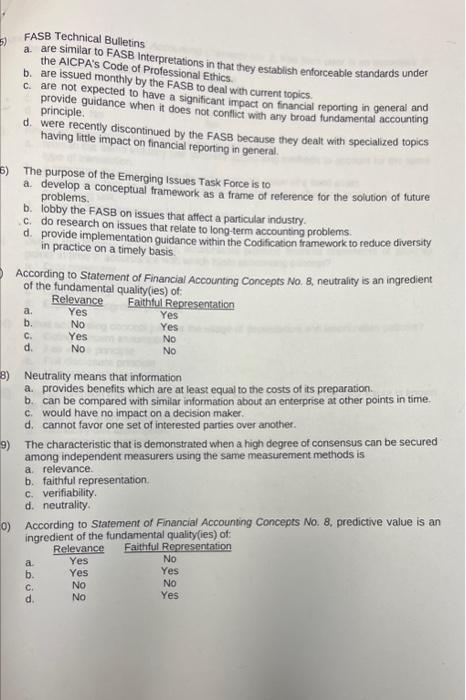

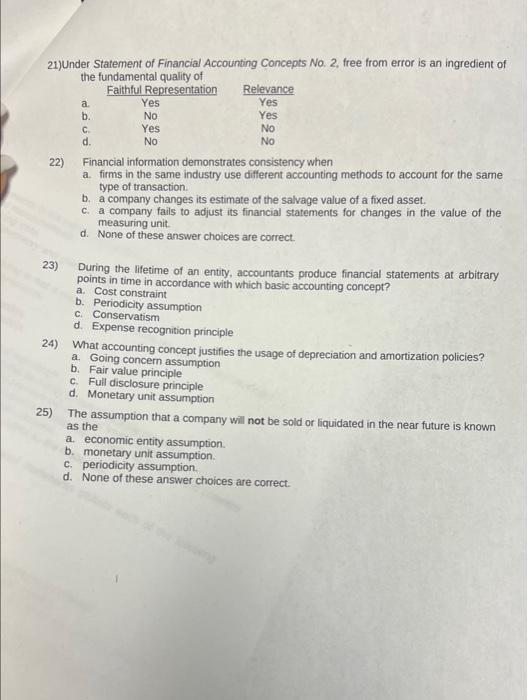

1) Which of the following is related to an effective capital allocation? a. Promoting productivity. b. Encouraging innovation. c. Providing an efficient market for buying and selling securities. d. Provides timely, relevant information and encourages innovation. 2) Financial statements in the early 2000 s provide information related to a. nonfinancial measurements. b. forward-looking data. c. hard assets (inventory and plant assets). d. soft assets. 3) Which of the following is not a major challenge facing the accounting profession? a. Nonfinancial measurements. b. Timeliness. c. Accounting for hard assets. d. Forward-looking information. 4) What is the objective of financial reporting? a. Provide information that is useful to management in making decisions, b. Provide information that clearly portrays nonfinancial transactions. c. Provide information about the reporting entity that is useful to present and potential equity investors, lenders, and other creditors. d. Provide information that excludes claims to the resources. 5) Primary users for general-purpose financial statements include each of the following except a. creditors. b. suppliers. c. investors. d. employees. 6) Which of the following will be of interest to investors in decision-making? a. Assessing the company's ability to generate net cash inflows. b. Assessing management's ability to protect and enhance the capital providers' investments. c. Both assessing the company's ability to generate net cash inflows and assessing management's ability to protect and enhance the capital provider's investments. d. Assessing the company's ability to collect debts. 7) What is the purpose of Emerging Issues Task Force? a. Provide interpretation of existing standards. b. Provide implementation guidance within the Codification framework to reduce diversity in practice on a timely basis. c. Provide interpretive guidance. d. Provide timely guidance on select issues. 8) Which organization is responsible for issuing Emerging Issues Task Force Statements? a. The FASB b. The CAP c. The APB d. The SEC 9) Each of the following are true of the Securities and Exchange Commission except that a. it is a federal agency. b. the SEC's involvement in the development of accounting standards varies. c. the FASB relies on the SEC to develop accounting standards. d. the SEC requires registrants to adhere to GAAP. 10) The body that has the power to prescribe the accounting practices and standards to be employed by companies that fall under its jurisdiction is the a. FASB. b. AICPA. c. SEC. d. APB. 11) Companies that are listed on a stock exchange are required to submit their financial statements to the a. AICPA. b. APB c. FASB. d. SEC. 12) The Financial Accounting Standards Board (FASB) was proposed by the a. American Institute of Certified Public Accountants. b. Accounting Principles Board. c. Study Group on the Objectives of Financial Statements. d. Study Group on establishment of Accounting Principles (Wheat Committee). 14) Which of the following is not a publication of the FASB? a. Statements of Financial Accounting Concepts b. Accounting Research Bulletins c. Interpretations d. Technical Bulletins 5) FASB Technical Bulletins a. are similar to FASB Interpretations in that they establish enforceable standards under the AICPA's Code of Professional Ethics. b. are issued monthly by the FASB to deal wth current topics. c. are not expected to have a significant impact on financial reporting in general and provide guidance when it does not conflict with any broad fundamental accounting principle. d. Were recently discontinued by the FASB because they dealt with specialized topics having little impact on financial reporting in general. 5) The purpose of the Emerging Issues Task Force is to a. develop a conceptual framework as a frame of reference for the solution of future problems. b. lobby the FASB on issues that affect a particular industry. c. do research on issues that relate to long-term accounting problems. d. provide implementation guidance within the Codification framework to reduce diversity in practice on a timely basis. According to Statement of Financial Accounting Concepts No. 8, neutrality is an ingredient of the fundamental cualitufinel int 8) Neutrality means that information a. provides benefits which are at least equal to the costs of its preparation. b. can be compared with similar information about an enterprise at other points in time. c. would have no impact on a decision maker. d. cannot favor one set of interested parties over another. 9) The characteristic that is demonstrated when a high degree of consensus can be secured among independent measurers using the same measurement methods is a. relevance. b. faithful representation. c. verifiability. d. neutrality. 21)Under Statement of Financial Accounting Concepts No. 2, free from error is an ingredient of the fundamental aualitv of 22) Financial information demonstrates consistency when a. firms in the same industry use different accounting methods to account for the same type of transaction. b. a company changes its estimate of the salvage value of a fixed asset. c. a company fails to adjust its financial statements for changes in the value of the measuring unit. d. None of these answer choices are correct. 23) During the lifetime of an entity, accountants produce financial statements at arbitrary points in time in accordance with which basic accounting concept? a. Cost constraint b. Periodicity assumption c. Conservatism d. Expense recognition principle 24) What accounting concept justifies the usage of depreciation and amortization policies? a. Going concern assumption b. Fair value principle c. Full disclosure principle d. Monetary unit assumption 25) The assumption that a company will not be sold or liquidated in the near future is known as the a. economic entity assumption. b. monetary unit assumption. c. periodicity assumption. d. None of these answer choices are correct