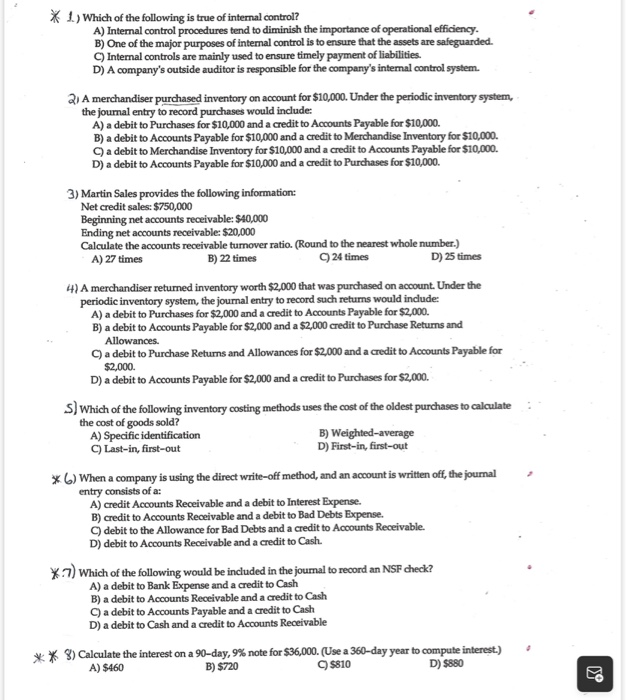

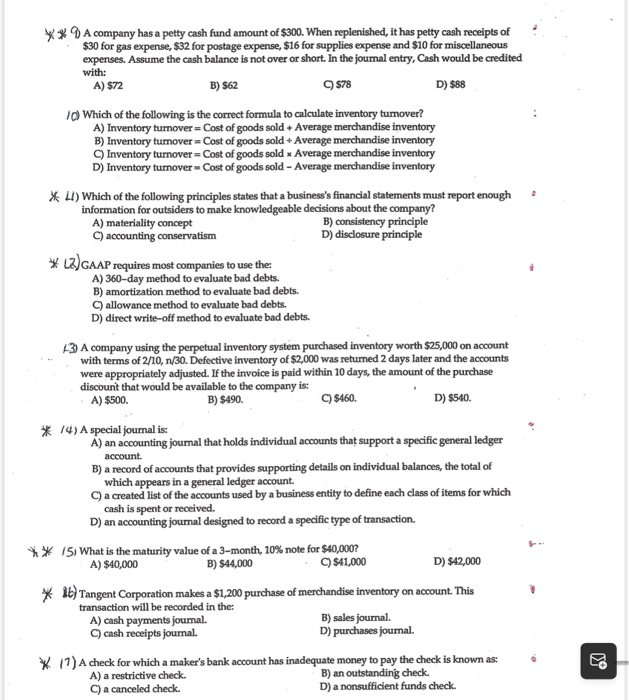

* 1) Which of the following is true of internal control? A) Internal control procedures tend to diminish the importance of operational efficiency. B) One of the major purposes of internal control is to ensure that the assets are safeguarded C) Internal controls are mainly used to ensure timely payment of liabilities. D) A company's outside auditor is responsible for the company's intemal control system 21 A merchandiser purchased inventory on account for $10,000. Under the periodic inventory system, the journal entry to record purchases would include: A) a debit to Purchases for $10,000 and a credit to Accounts Payable for $10,000. B) a debit to Accounts Payable for $10,000 and a credit to Merchandise Inventory for $10,000 a debit to Merchandise Inventory for $10,000 and a credit to Accounts Payable for $10,000. D) a debit to Accounts Payable for $10,000 and a credit to Purchases for $10,000. 3) Martin Sales provides the following information: Net credit sales: $750,000 Beginning net accounts receivable: $40,000 Ending net accounts receivable: $20,000 Calculate the accounts receivable turnover ratio. (Round to the nearest whole number.) A) 27 times B) 22 times 24 times D) 25 times 4) A merchandiser returned inventory worth $2,000 that was purchased on account. Under the periodic inventory system, the journal entry to record such returns would include: A) a debit to Purchases for $2,000 and a credit to Accounts Payable for $2,000. B) a debit to Accounts Payable for $2,000 and a $2,000 credit to Purchase Returns and Allowances. a debit to Purchase Returns and Allowances for $2,000 and a credit to Accounts Payable for $2,000 D) a debit to Accounts Payable for $2,000 and a credit to Purchases for $2,000. S) Which of the following inventory costing methods uses the cost of the oldest purchases to calculate the cost of goods sold? A) Specific identification B) Weighted average C) Last-in, first-out D) First-in, first-out * 6) When a company is using the direct write-off method, and an account is written off, the joumal entry consists of a A) credit Accounts Receivable and a debit to Interest Expense. B) credit to Accounts Receivable and a debit to Bad Debts Expense. C) debit to the Allowance for Bad Debts and a credit to Accounts Receivable. D) debit to Accounts Receivable and a credit to Cash. *.7) Which of the following would be included in the journal to record an NSF check? A) a debit to Bank Expense and a credit to Cash B) a debit to Accounts Receivable and a credit to Cash a debit to Accounts Payable and a credit to Cash D) a debit to Cash and a credit to Accounts Receivable ** 8) Calculate the interest on a 90-day, 9% note for $36,000. (Use a 360-day year to compute interest.) A) $460 $810 D) $880 B) $720 B) $62 . ** A company has a petty cash fund amount of $300. When replenished, it has petty cash receipts of $30 for gas expense, $32 for postage expense, $16 for supplies expense and $10 for miscellaneous expenses. Assume the cash balance is not over or short. In the journal entry, Cash would be credited with: A) $72 878 D) $88 1) Which of the following is the correct formula to calculate inventory turnover? A) Inventory turnover = Cost of goods sold + Average merchandise inventory B) Inventory tumover - Cost of goods sold + Average merchandise inventory Inventory turnover = Cost of goods sold * Average merchandise inventory D) Inventory turnover - Cost of goods sold - Average merchandise inventory * L) Which of the following principles states that a business's financial statements must report enough information for outsiders to make knowledgeable decisions about the company? A) materiality concept B) consistency principle C) accounting conservatism D) disclosure principle * LZ) GAAP requires most companies to use the A) 360-day method to evaluate bad debts. B) amortization method to evaluate bad debts. allowance method to evaluate bad debts. D) direct write-off method to evaluate bad debts. 3) A company using the perpetual inventory system purchased inventory worth $25,000 on account with terms of 2/10, 1/30. Defective inventory of $2,000 was returned 2 days later and the accounts were appropriately adjusted. If the invoice is paid within 10 days, the amount of the purchase discount that would be available to the company is: A) $500 B) $490. $460 D) $540 * 14) A special journal is A) an accounting journal that holds individual accounts that support a specific general ledger account B) a record of accounts that provides supporting details on individual balances, the total of which appears in a general ledger account C) a created list of the accounts used by a business entity to define each class of items for which cash is spent or received. D) an accounting journal designed to record a specific type of transaction. ** 15. What is the maturity value of a 3-month, 10% note for $40,000? A) $40,000 B) $44,000 $41,000 D) $42,000 * lt) Tangent Corporation makes a $1,200 purchase of merchandise inventory on account. This transaction will be recorded in the: A) cash payments joumal. B) sales journal. C) cash receipts journal. D) purchases journal. * 17) A check for which a maker's bank account has inadequate money to pay the check is known as: A) a restrictive check. B) an outstanding check C) a canceled check D) a nonsufficient funds check