Answered step by step

Verified Expert Solution

Question

1 Approved Answer

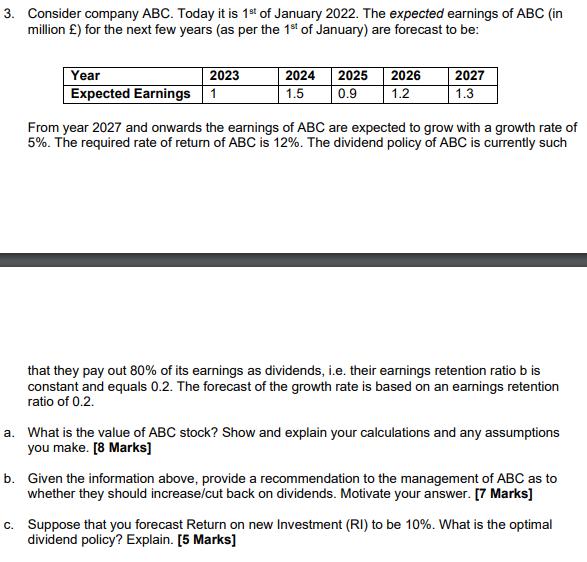

3. Consider company ABC. Today it is 1st of January 2022. The expected earnings of ABC (in million ) for the next few years

3. Consider company ABC. Today it is 1st of January 2022. The expected earnings of ABC (in million ) for the next few years (as per the 1st of January) are forecast to be: Year 2023 2024 2025 2026 2027 Expected Earnings 1 1.5 0.9 1.2 1.3 From year 2027 and onwards the earnings of ABC are expected to grow with a growth rate of 5%. The required rate of return of ABC is 12%. The dividend policy of ABC is currently such that they pay out 80% of its earnings as dividends, i.e. their earnings retention ratio b is constant and equals 0.2. The forecast of the growth rate is based on an earnings retention ratio of 0.2. a. What is the value of ABC stock? Show and explain your calculations and any assumptions you make. [8 Marks] b. Given the information above, provide a recommendation to the management of ABC as to whether they should increase/cut back on dividends. Motivate your answer. [7 Marks] c. Suppose that you forecast Return on new Investment (RI) to be 10%. What is the optimal dividend policy? Explain. [5 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets tackle the given problem step by step Question a Calculate the value of ABC stock We are given the expected earnings and the dividend payout ratio and we need to calculate the value of the stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started